3 Swedish Growth Stocks With Significant Insider Ownership

As global markets navigate the complexities of geopolitical tensions and economic shifts, Sweden's stock market remains a focal point for investors seeking stability amidst uncertainty. In this environment, growth companies with significant insider ownership can offer unique insights into potential opportunities, as insiders often have a deeper understanding of their company's prospects and challenges.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 24.8% |

Truecaller (OM:TRUE B) | 29.6% | 21.6% |

Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

Biovica International (OM:BIOVIC B) | 18.3% | 78.5% |

BioArctic (OM:BIOA B) | 34% | 98.4% |

KebNi (OM:KEBNI B) | 36.3% | 86.1% |

Yubico (OM:YUBICO) | 37.5% | 42.2% |

InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

C-Rad (OM:CRAD B) | 16.1% | 33.9% |

OrganoClick (OM:ORGC) | 23.1% | 109.0% |

Below we spotlight a couple of our favorites from our exclusive screener.

Rusta

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market cap of SEK12.67 billion.

Operations: The company's revenue segments are comprised of SEK6.43 billion from Sweden, SEK2.39 billion from Norway, and SEK2.41 billion from other markets.

Insider Ownership: 10.2%

Return On Equity Forecast: 32% (2027 estimate)

Rusta's earnings are projected to grow significantly, outpacing the Swedish market with a 21.5% annual growth forecast. Despite trading well below its estimated fair value, Rusta continues to expand its store network aggressively, opening new locations in Sweden and Norway as part of a large expansion strategy. Recent financial results show improved performance with increased sales and net income year-over-year, supporting its growth trajectory without recent insider trading activity noted.

Truecaller

Simply Wall St Growth Rating: ★★★★★★

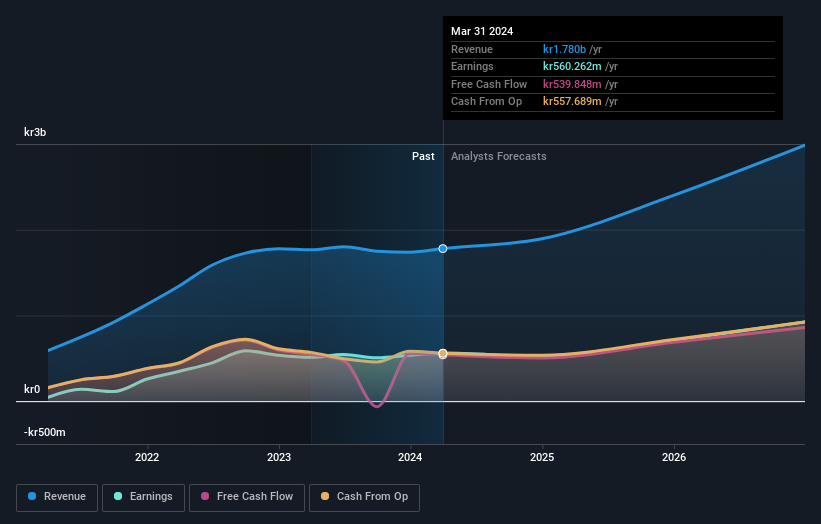

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK13.59 billion.

Operations: The company generates revenue primarily from its communications software segment, amounting to SEK1.72 billion.

Insider Ownership: 29.6%

Return On Equity Forecast: 42% (2027 estimate)

Truecaller is poised for significant growth, with earnings expected to rise by 21.6% annually, surpassing the Swedish market average. Trading at a substantial discount to its estimated fair value, it benefits from high insider ownership without recent substantial insider selling. Recent strategic partnerships and executive appointments bolster its position in key markets like India. Despite a dip in sales and net income recently reported, Truecaller's growth outlook remains strong due to innovative solutions like Verified Business Caller ID.

Click to explore a detailed breakdown of our findings in Truecaller's earnings growth report.

Our valuation report unveils the possibility Truecaller's shares may be trading at a discount.

Yubico

Simply Wall St Growth Rating: ★★★★★★

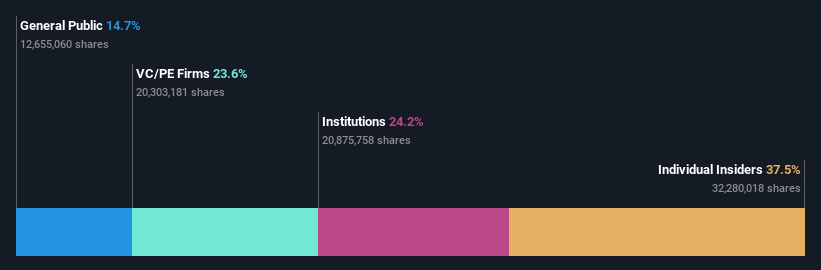

Overview: Yubico AB offers authentication solutions for computers, networks, and online services and has a market cap of approximately SEK23.04 billion.

Operations: The company's revenue is primarily derived from its Security Software & Services segment, which generated SEK2.09 billion.

Insider Ownership: 37.5%

Return On Equity Forecast: 29% (2027 estimate)

Yubico's growth trajectory is underpinned by robust earnings, forecast to grow significantly at 42.18% annually, outpacing the Swedish market. Despite recent profit margin contraction, its revenue growth remains strong at 20.5% per year. High insider ownership aligns interests with shareholders, while recent collaborations with PKO Bank Polski and the U.S. Air Force highlight its strategic expansion in secure authentication solutions. However, volatile share prices may present challenges for investors seeking stability.

Make It Happen

Click here to access our complete index of 78 Fast Growing Swedish Companies With High Insider Ownership.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:RUSTA OM:TRUE B and OM:YUBICO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]