As the U.S. stock market navigates through mixed economic signals, with inflation and job data surprising investors, the focus remains on identifying companies that can thrive in such an environment. Growth companies with high insider ownership often demonstrate a strong alignment between management and shareholder interests, potentially offering resilience amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.2% |

Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

Hims & Hers Health (NYSE:HIMS) | 13.7% | 41.3% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

We'll examine a selection from our screener results.

Pangaea Logistics Solutions

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pangaea Logistics Solutions, Ltd. offers seaborne dry bulk logistics and transportation services globally to industrial customers, with a market cap of $321.75 million.

Operations: The company generates revenue of $503.74 million from its transportation and shipping segment.

Insider Ownership: 26.4%

Pangaea Logistics Solutions demonstrates potential as a growth company with significant insider ownership. Recent earnings show improved profitability, with net income rising to US$15.36 million for the first half of 2024. Analysts forecast substantial annual profit growth at 23%, outpacing the broader US market. The company's strategic merger discussions and recent shelf registration filing indicate active expansion efforts, although its dividend history remains unstable. Trading significantly below fair value estimates suggests potential upside in stock price appreciation.

LGI Homes

Simply Wall St Growth Rating: ★★★★★☆

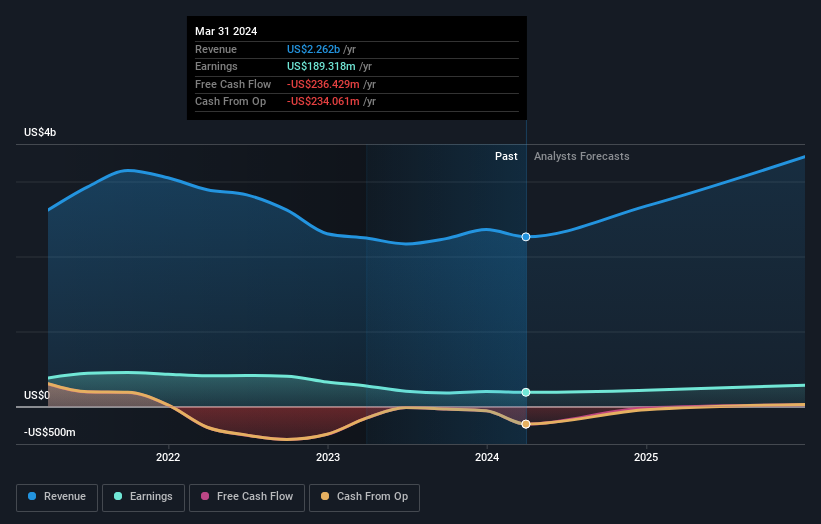

Overview: LGI Homes, Inc. designs, constructs, and sells homes with a market capitalization of approximately $2.61 billion (NasdaqGS:LGIH).

Operations: The company's primary revenue segment is its Homebuilding Business, which generated $2.22 billion.

Insider Ownership: 12.3%

LGI Homes exhibits characteristics of a growth company with substantial insider ownership. Analysts anticipate significant earnings and revenue growth at 20.7% annually, surpassing the US market average. The company's price-to-earnings ratio of 13.3x suggests it is valued below the broader market, potentially offering investment value. Recent developments include the grand opening of Beverly, a new community in Washington, and an updated guidance projecting up to 7,200 home closings for 2024 despite challenges in debt coverage by operating cash flow.

Take a closer look at LGI Homes' potential here in our earnings growth report.

Our valuation report unveils the possibility LGI Homes' shares may be trading at a premium.

Full Truck Alliance

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Full Truck Alliance Co. Ltd. operates a digital freight platform in China that connects shippers with truckers for various shipment needs, with a market cap of approximately $10.20 billion.

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to CN¥9.70 billion.

Insider Ownership: 10.4%

Full Truck Alliance has shown robust growth, with recent earnings rising significantly. The company reported second-quarter sales of CNY 2.76 billion, up from CNY 2.06 billion a year ago, and net income increased to CNY 823.13 million from CNY 605.54 million. Analysts forecast annual earnings growth of nearly 30%, outpacing the US market average of 15.3%. Despite low return on equity forecasts and an unstable dividend track record, it trades below estimated fair value by a significant margin.

Unlock comprehensive insights into our analysis of Full Truck Alliance stock in this growth report.

Our valuation report here indicates Full Truck Alliance may be undervalued.

Where To Now?

Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 184 companies by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:PANL NasdaqGS:LGIH and NYSE:YMM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]