Exploring Craneware And 2 Other Top High Growth Tech Stocks In The UK

The market in the United Kingdom has climbed 1.1% in the last 7 days and is up 6.9% over the last 12 months, with earnings forecasted to grow by 14% annually. In this favorable environment, identifying high-growth tech stocks like Craneware and two others can be crucial for investors looking to capitalize on robust market conditions.

Top 10 High Growth Tech Companies In The United Kingdom

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

STV Group | 13.15% | 46.78% | ★★★★★☆ |

Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

YouGov | 14.29% | 29.79% | ★★★★★☆ |

Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

Redcentric | 4.89% | 63.79% | ★★★★★☆ |

Windar Photonics | 67.08% | 130.82% | ★★★★★☆ |

LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Craneware

Simply Wall St Growth Rating: ★★★★☆☆

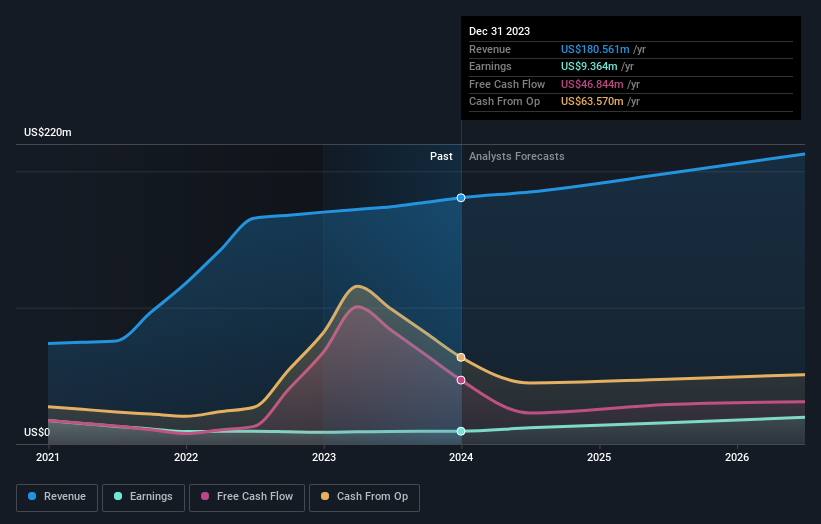

Overview: Craneware plc, with a market cap of £803.93 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: Craneware plc generates revenue primarily through its healthcare software segment, which contributed $189.27 million. The company focuses on developing and licensing software solutions tailored for the U.S. healthcare industry.

Craneware, a key player in the UK's tech scene, demonstrates robust growth with a 26.8% surge in earnings over the past year, surpassing its industry's average by nearly 10%. This performance is underpinned by strategic investments in R&D and partnerships that enhance its offerings, notably its collaboration with Microsoft to integrate AI and cloud technologies. The company's commitment to innovation is evident from its R&D spending trends which align closely with revenue growth—investing heavily to stay ahead in competitive healthcare technology markets. Recent share repurchases totaling £5 million underscore confidence in their strategy and future prospects despite facing slower forecasted revenue growth at 8.2% annually compared to the market’s faster pace.

Click to explore a detailed breakdown of our findings in Craneware's health report.

Evaluate Craneware's historical performance by accessing our past performance report.

GB Group

Simply Wall St Growth Rating: ★★★★☆☆

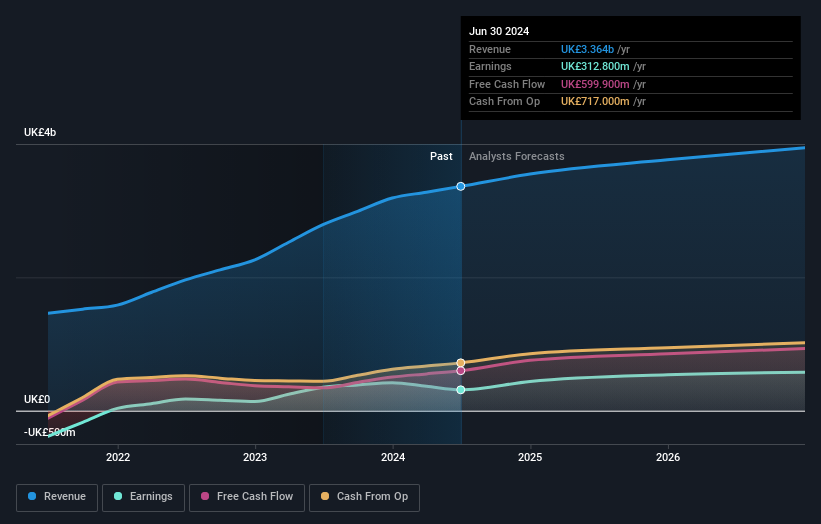

Overview: GB Group plc, along with its subsidiaries, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and internationally with a market cap of £806.76 million.

Operations: GB Group plc generates revenue through three main segments: Fraud (£40.20 million), Identity (£156.06 million), and Location (£81.07 million). The company operates primarily in the United Kingdom, the United States, Australia, and internationally.

GB Group, amidst a challenging tech landscape, is navigating with strategic agility. The company's revenue is set to grow at 6.8% annually, outpacing the UK market average of 3.7%, reflecting a robust adaptation to market demands despite its current unprofitability. Significantly, earnings are projected to skyrocket by approximately 92.9% annually over the next three years, positioning GB Group for a strong rebound into profitability. This growth trajectory is supported by substantial R&D investments that align closely with these ambitious revenue targets, ensuring continuous innovation and competitive edge in identity verification technologies. Recently, at their AGM on July 23, GB Group declared a dividend of 4.20 pence per share which underscores their confidence in financial health and commitment to shareholder returns. Coupled with positive free cash flow dynamics and an anticipated low Return on Equity of around 3.4% in three years' time, these factors collectively suggest that while GB Group faces hurdles typical for high-growth sectors like software technology—such as achieving profitability—their strategic focus on R&D and above-market growth forecasts demonstrate potential for significant future advancements within the tech industry.

Click here and access our complete health analysis report to understand the dynamics of GB Group.

Assess GB Group's past performance with our detailed historical performance reports.

Informa

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally with a market cap of £11.23 billion.

Operations: Informa generates revenue primarily through its four segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company operates across the UK, Continental Europe, the US, China, and other international markets with a market cap of £11.23 billion.

Informa, navigating the dynamic tech landscape, has shown a promising growth trajectory with earnings expected to surge by 21.6% annually. This growth is underpinned by robust R&D investments, crucial for fostering innovation and maintaining competitive advantage in its sector. Despite a challenging past marked by a significant one-off loss of £213.5 million, Informa's strategic initiatives like the recent share repurchase of £338.9 million underscore its commitment to enhancing shareholder value. These efforts are complemented by an active conference schedule, highlighting its industry engagement and potential for future growth in emerging tech domains.

Dive into the specifics of Informa here with our thorough health report.

Gain insights into Informa's past trends and performance with our Past report.

Turning Ideas Into Actions

Delve into our full catalog of 46 UK High Growth Tech and AI Stocks here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:CRW AIM:GBG and LSE:INF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]