Top Swedish Growth Companies With High Insider Ownership October 2024

As global markets react to China's robust stimulus measures and European indices rebound on hopes for interest rate cuts, Sweden's economic landscape is also showing signs of resilience. In this environment, identifying growth companies with high insider ownership can be particularly appealing to investors seeking alignment between management and shareholder interests. A good stock in this context often exhibits strong growth potential coupled with significant insider ownership, indicating confidence from those closest to the company's operations. This combination can be a compelling indicator of long-term value creation in today's market conditions.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 24.8% |

Truecaller (OM:TRUE B) | 29.6% | 21.6% |

Fortnox (OM:FNOX) | 21.1% | 22.2% |

Biovica International (OM:BIOVIC B) | 17.6% | 78.5% |

Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

BioArctic (OM:BIOA B) | 34% | 98.4% |

Yubico (OM:YUBICO) | 37.5% | 42.3% |

KebNi (OM:KEBNI B) | 37.8% | 86.1% |

InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

OrganoClick (OM:ORGC) | 23.1% | 109.0% |

We'll examine a selection from our screener results.

NIBE Industrier

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NIBE Industrier AB (publ) develops, manufactures, markets, and sells energy-efficient solutions for indoor climate comfort and intelligent heating control across the Nordic countries, Europe, North America, and internationally with a market cap of SEK112.21 billion.

Operations: The company generates revenue from three main segments: SEK5.33 billion from Stoves, SEK13.48 billion from Element, and SEK35.22 billion from Climate Solutions.

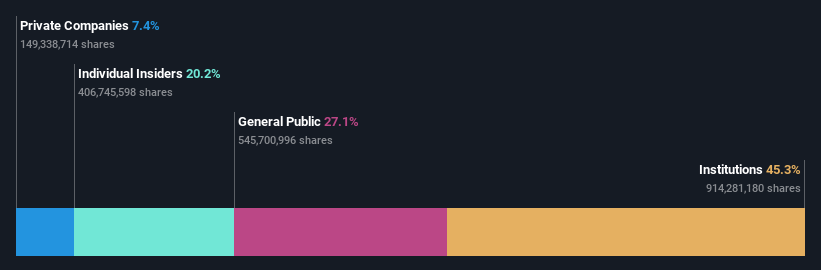

Insider Ownership: 20.2%

Earnings Growth Forecast: 42.5% p.a.

NIBE Industrier, a growth company with high insider ownership in Sweden, is forecasted to have significant annual earnings growth at 42.5%, outpacing the Swedish market's 15.1%. However, its revenue growth of 6.8% per year lags behind the desired 20% benchmark and recent financials show declining profit margins and net income. Despite these challenges, NIBE's strong insider ownership aligns management interests with shareholders, potentially fostering long-term value creation.

Take a closer look at NIBE Industrier's potential here in our earnings growth report.

Upon reviewing our latest valuation report, NIBE Industrier's share price might be too optimistic.

AB Sagax

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company operating in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market cap of SEK101.97 billion.

Operations: AB Sagax generates revenue primarily through real estate rentals, amounting to SEK 4.63 billion.

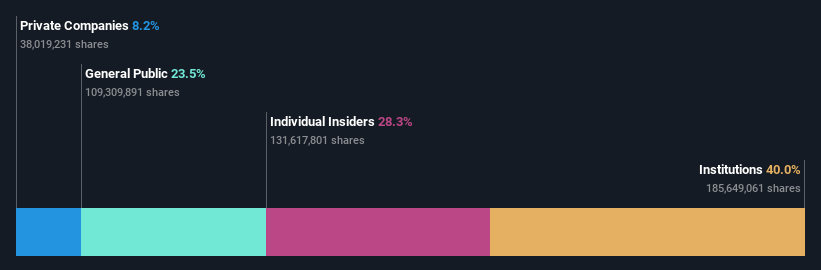

Insider Ownership: 28.6%

Earnings Growth Forecast: 29.1% p.a.

AB Sagax exhibits strong growth potential with forecasted annual earnings growth of 29.1%, significantly outpacing the Swedish market's 15.1%. Recent financials show robust performance, with second-quarter sales rising to SEK 1.20 billion and net income surging to SEK 978 million from SEK 53 million a year ago. However, shareholders have faced dilution in the past year, and debt coverage by operating cash flow remains inadequate. High insider ownership aligns management interests with those of shareholders, enhancing long-term value prospects.

Click to explore a detailed breakdown of our findings in AB Sagax's earnings growth report.

Our valuation report unveils the possibility AB Sagax's shares may be trading at a premium.

Sectra

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) offers medical IT and cybersecurity solutions in Sweden, the United Kingdom, the Netherlands, and other parts of Europe with a market cap of SEK54.68 billion.

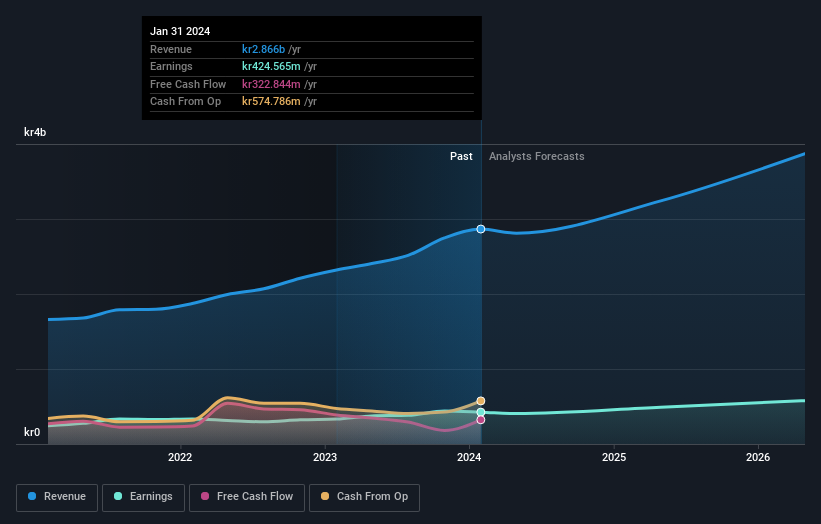

Operations: Sectra's revenue segments include Imaging IT Solutions at SEK2.67 billion, Secure Communications at SEK388.55 million, and Business Innovation at SEK90.77 million.

Insider Ownership: 30.3%

Earnings Growth Forecast: 21.2% p.a.

Sectra AB shows promising growth with first-quarter sales rising to SEK 736.75 million from SEK 601.71 million a year ago, and net income improving to SEK 80.4 million from SEK 61.56 million. Earnings per share also increased to SEK 0.42 from SEK 0.32 last year, reflecting solid financial health. Forecasted annual earnings growth of over 21% outpaces the Swedish market average of 15%. High insider ownership aligns management interests with shareholders, bolstering confidence in long-term prospects.

Make It Happen

Gain an insight into the universe of 92 Fast Growing Swedish Companies With High Insider Ownership by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:NIBE B OM:SAGA A and OM:SECT B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]