12 Gene Editing Stocks With the Best Long-Term Potential

In this article, we will take a look at the 12 gene editing stocks with the best long-term potential. To see more such companies, go directly to 5 Gene Editing Stocks With the Best Long-Term Potential.

Gene editing stocks are gaining ground on the back of an upbeat tone in the industry, helped by a favorable regulatory environment, deals and positive results. Some of the notable gene editing stocks gained earlier this month include Editas Medicine, CRISPR Therapeutics, Intellia Therapeutics, and Beam Therapeutics.

Cantor Fitzgerald analyst Rick Bienkowski recently gave bullish comments for the overall gene editing space and named several companies that can profit in the near future. The analyst believes the industry, which has suffered over the past few months due to regulatory uncertainties, has several growth catalysts for the future.

"Breakthrough of the Century"

The gene editing market has now become mainstream and investors are taking interest in the space given the size and explosive opportunities in the market. The term “CRISPR” is widely used in investing circles now as the industry is teeming with companies with CRISPR-based technologies. One of the biggest hedge fund investors bullish on the industry is Cathie Wood. Wood has been investing in disruptive gene editing companies for several years now. In a report, Cathie Wood’s ARK said that it believes Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR) is “breakthrough of the century.” The firm believes the near-term applications of the CRISPR technology will be evident in the agriculture market where it could use to enhance food supply.

ARK estimates that CRISPR’s addressable market in the monogenic disease space is over $75 billion annually with nearly $2 trillion in latent demand from unaddressed populations.

Morgan Stanley in a report expressed similar views about the gene editing industry. One of the biggest factors that makes the industry attractive for investors is that it’s just getting started. The report highlighted that CRISPR received its first clinical approval in June 2016. In a matter of few years, several companies are using the technology to work on innovative solutions. In addition to agriculture, Morgan Stanley highlighted the technology’s capabilities to fix diseases by addressing the underlying causes using gene editing methodologies instead of just focusing on treating symptoms like traditional medicines.

According to ARK, CRISPR’s applications in different areas will create new investment opportunities. CAR-T is a case in point. CAR-T is a type of immunotherapy in which an individual’s cells are used to attack and kill cancerous cells while leaving healthy cells intact. According to ARK’s estimates, even if CAR-T’s applications remain limited to stage 3 and stage 4 metastatic cancers, the total addressable market of CAR-T could reach $40 billion annually. It the therapy begins to be applied to other stages of cancer, the market could reach a whopping $250 billion

Intellia Therapeutics, Inc. (NASDAQ:NTLA), an important company in the industry, recently shed some light on the progress it’s making on several of its projects during its Q4 earnings call. Intellia Therapeutics, Inc. (NASDAQ:NTLA) focuses on developing gene editing therapies using the CRISPR/Cas9 technology. Here’s what the company’s Chief Scientific Officer Laura Sepp-Lorenzino said during the call:

We’re entering the next stage of growth at Intellia as we advanced new platform capabilities to the clinic, such as in vivo gene insertions, our allogenic technology and base editing. For targeted in vivo gene insertion, we’re progressing both wholly-owned and partner programs leveraging our modular insertion platform. This includes NTLA-2001, our wholly-owned candidate for the treatment of AATD-associated lung disease, for which we plan to submit an IND or IND equivalent application in the second half of this year. In parallel, we’re advancing IND enabling activities for NTLA-2003, our third in vivo local candidate as a treatment for the liver manifestation of AATD. In collaboration with Regeneron, we’re also making important progress advancing our Factor IX insertion programs for people with hemophilia B.

Turning to our ex vivo pipeline, we’re advancing multiple programs, ours and those share with partners, utilizing our proprietary allergenic platform. These platform capabilities demonstrate the already broad opportunity of our robust research engine, but there is still more untapped potential and so we’re further pushing the boundaries of what therapeutic gene editing can do. We have made rapid and significant headway with the development of our proprietary DNA writing technology. Since the acquisition of Rewrite Therapeutics, we have implemented and expanded the platform leveraging Intellia’s genome editing toolbox and expertise, and demonstrated robust performance and versatility. We’re excited by the potential of our newest platform capability, offering us the potential to target diseases beyond those currently being explored in our pipeline.

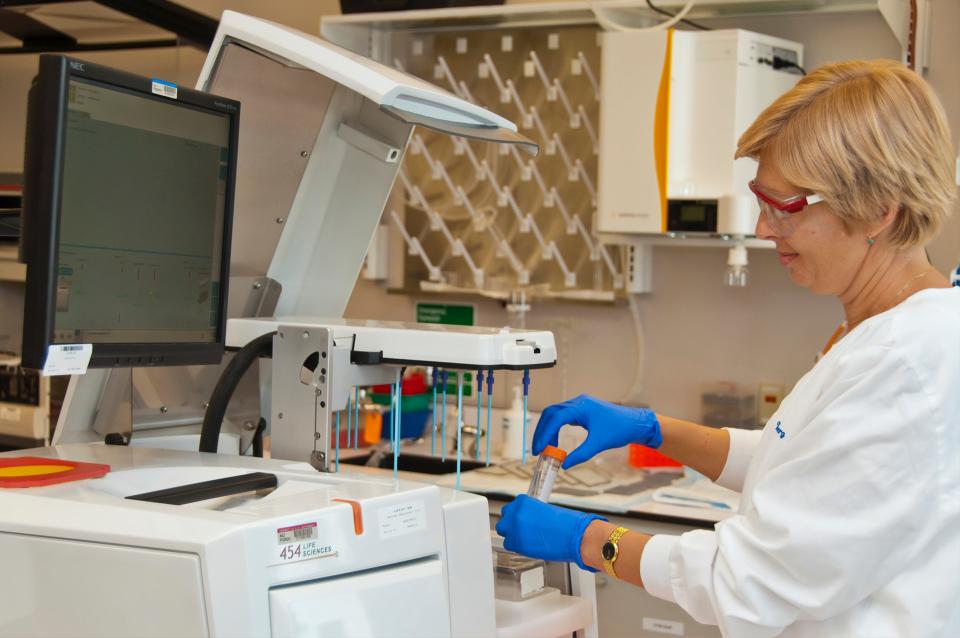

Photo by National Cancer Institute on Unsplash

Our Methodology

For this article we scanned Insider Monkey’s database of 943 hedge funds and picked 11 gene editing companies with the highest number of hedge fund investors. The idea was to pick gene editing companies which hedge funds are bullish on. These companies also have strong analyst ratings and price targets.

Gene Editing Stocks With the Best Long-Term Potential

12. Caribou Biosciences, Inc. (NASDAQ:CRBU)

Number of Hedge Fund Holders: 15

Caribou Biosciences, Inc. (NASDAQ:CRBU) is a clinical-stage biopharmaceutical company working on genome-edited allogeneic cell therapies for devastating human diseases. Caribou Biosciences, Inc. (NASDAQ:CRBU) jumped earlier this month after the FDA gave fast track designation to the company’s allogeneic CAR-T cell therapy CB-011 to treat relapsed or refractory multiple myeloma (r/r MM).

In March Caribou Biosciences, Inc. (NASDAQ:CRBU) posted its Q4 results. GAAP EPS in the period came in at -$0.44 beating estimates by $0.02. Revenue in the quarter jumped about 44.5% year over year to total $3.7 million, beating estimates by $0.63 million.

15 hedge funds tracked by Insider Monkey have stakes in Caribou Biosciences, Inc. (NASDAQ:CRBU).

11. Twist Bioscience Corporation (NASDAQ:TWST)

Number of Hedge Fund Holders: 17

Twist Bioscience Corporation (NASDAQ:TWST) focuses on developing and manufacturing synthetic DNA for a variety of applications, including gene therapy, drug discovery, and agricultural biotechnology.

A total of 17 hedge funds had stakes in Twist Bioscience Corporation (NASDAQ:TWST) as of the end of the fourth quarter of 2022. The most notable hedge fund stakeholder of Twist Bioscience Corporation (NASDAQ:TWST) was ARK Investment Management of Catherine D. Wood which owns a $156 million stake in the company.

Jackson Square Partners made the following comment about Twist Bioscience Corporation (NASDAQ:TWST) in its Q3 2022 investor letter:

“Twist Bioscience Corporation (NASDAQ:TWST): market leader in synthetic DNA manufacturing with its highly differentiated silicon platform; poised to unlock a multi-year outsourcing wave as new manufacturing processes and products dramatically improve the turnaround time, cost, and quality of silicon-based DNA manufacturing.”

10. Graphite Bio, Inc. (NASDAQ:GRPH)

Number of Hedge Fund Holders: 18

Graphite Bio, Inc. (NASDAQ:GRPH) ranks 10th in our list of the gene editing stocks with the best long-term potential.

Graphite Bio, Inc. (NASDAQ:GRPH) recently posted Q4 results. GAAP EPS in the period came in at -$0.44, beating estimates by $0.07. Graphite Bio, Inc. (NASDAQ:GRPH)’s cash, cash equivalents and investments in marketable securities totaled $283.6 million as of the end of December 2022.

18 hedge funds tracked by Insider Monkey had stakes in Graphite Bio, Inc. (NASDAQ:GRPH). The biggest stake in Graphite Bio, Inc. (NASDAQ:GRPH) was owned by Srini Akkaraju and Michael Dybbs’s Samsara BioCapital which owns an $28 million stake in the company.

9. Beam Therapeutics Inc. (NASDAQ:BEAM)

Number of Hedge Fund Holders: 18

Massachusetts-based gene therapy and gene editing company Beam Therapeutics Inc. (NASDAQ:BEAM) ranks 9th in our list of the gene editing stocks with the best long-term potential. Earlier this year, Cantor Fitzgerald analyst Rick Bienkowsi gave an Overweight rating to Beam Therapeutics Inc. (NASDAQ:BEAM) and gave a $62 price target on the stock. The analyst said Beam Therapeutics Inc. (NASDAQ:BEAM)’s base-editing technology allows it to develop “novel medicines that are highly differentiated from competing therapies.”

Out of the 943 hedge funds tracked by Insider Monkey, 18 hedge funds had stakes in Beam Therapeutics Inc. (NASDAQ:BEAM). The biggest stakeholder of Beam Therapeutics Inc. (NASDAQ:BEAM) was ARK Investment Management of Cathie Wood which had a $321 million stake.

8. Editas Medicine, Inc. (NASDAQ:EDIT)

Number of Hedge Fund Holders: 20

Massachusetts-based Editas Medicine, Inc. (NASDAQ:EDIT) is a clinical-stage biotechnology company which is developing therapies for rare diseases based on CRISPR gene editing technology.

Editas Medicine, Inc. (NASDAQ:EDIT) recently jumped as much as 17% after the company appointed a new chair and director to its board.

As of the end of the fourth quarter of 2022, 20 hedge funds tracked by Insider Monkey had stakes in Editas Medicine, Inc. (NASDAQ:EDIT). The total worth of these stakes was $84 million. The biggest hedge fund stakeholder of Editas Medicine, Inc. (NASDAQ:EDIT) was Michael Rockefeller and Karl Kroeker’s Woodline Partners million.

7. Pacific Biosciences of California, Inc. (NASDAQ:PACB)

Number of Hedge Fund Holders: 25

Pacific Biosciences of California, Inc. (NASDAQ:PACB) operates in the genome sequencing market. Last month, Pacific Biosciences of California, Inc. (NASDAQ:PACB) was upgraded by Cowen to Buy from Hold. The firm believes Pacific Biosciences of California, Inc. (NASDAQ:PACB)’s management is leading "a growth transformation story." Cowen survey of Pacific Biosciences of California, Inc. (NASDAQ:PACB)’s customers shows that they intend to purchase more products.

Cowen increased its price target on Pacific Biosciences of California, Inc. (NASDAQ:PACB) to $15 from $13.

Jackson Square Partners made the following comment about Pacific Biosciences of California, Inc. (NASDAQ:PACB) in its Q3 2022 investor letter:

“Pacific Biosciences of California, Inc. (NASDAQ:PACB): emerging player in genomic sequencing with its highly differentiated long-read technology; poised to unlock a multi-year share shift towards long-read sequencing as new products dramatically improve throughput and cost to competitively advantaged levels.”

6. CRISPR Therapeutics AG (NASDAQ:CRSP)

Number of Hedge Fund Holders: 28

CRISPR Therapeutics AG (NASDAQ:CRSP) is one of the most promising gene editing stocks according to both Wall Street analysts and hedge funds. Recently, CRISPR Therapeutics AG (NASDAQ:CRSP) jumped after Cantor Fitzgerald started covering the company with an Overweight rating and a $72 per share target. The firm expects the FDA to approve CRISPR Therapeutics AG (NASDAQ:CRSP)’s gene editing therapy, exa-cel.

A total of 28 hedge funds tracked by Insider Monkey had stakes in CRISPR Therapeutics AG (NASDAQ:CRSP) as of the end of the fourth quarter of 2022. The biggest hedge fund stakeholder of CRISPR Therapeutics AG (NASDAQ:CRSP) was Catherine D. Wood’s ARK Investment Management which owns a $318 million stake in the company.

Click to continue reading and see 5 Gene Editing Stocks With the Best Long-Term Potential.

Suggested articles:

Disclosure: None. 12 Gene Editing Stocks With the Best Long-Term Potential is originally published on Insider Monkey.