2016 wasn't the disaster for hedge funds everyone thought it was going to be

There was one trend that was constant among hedge funds this year — and that was to criticize them.

There’s going to be a “washout in hedge funds,” hedge fund manager Daniel Loeb of Third Point LLC wrote in his first quarter investor letter. There’s a “lack of talent,” Steve Cohen of family-office Point72 Asset Management declared at the Milken Conference in May. And those fees that they charge are “unbelievable,” Warren Buffett said at Berkshire Hathaway’s shareholder meeting.

Some of these statements have proven to be true in 2016. But this year hasn’t been a complete disaster for the industry — at least, not for the ones left standing.

“If all you do is read the news you would think that hedge funds have lost half their assets. The reality is the industry is at an all-time high,” said Don Steinbrugge, managing partner of the Richmond, Virginia-based Agecroft Partners, a marketing and consulting firm for the hedge fund industry.

According to HFR, hedge fund industry assets are at an all-time record high, with total capital hitting $2.979 trillion the third quarter.

“The hedge fund industry is at all time high from an asset standpoint. From an industry standpoint, it’s doing a lot better than what most people think,” Steinbrugge said. “A lot of criticism relative to hedge fund industry is being addressed.”

In the first three quarters of 2016, the number of hedge fund liquidations hit 782, which is on pace for the highest number of closures since the financial crisis, according to data from HFR. In that time, the total number of hedge funds dropped to 9,925, dipping below 10,000 funds for the first time since 2014. During the first nine months of the year, there were only 576 new hedge fund launches, a decline of over 200 from the 785 launches over the same period the year prior. Fees also declined, with the average management fee dropping to 1.49%, and the average incentive fee dipping to 17.5%.

Difficult to benchmark

A quick glance at performance for the industry shows that the numbers aren’t great compared to the broader market.

The HFRI Fund Weighted Composite Index – an equal-weighted index of hedge funds —was last up 4.54% through the end of November, while the S&P 500, a commonly used benchmark to compare performance, gained 7.2% in that same time period. The S&P is up more than 10% this year.

The reality is hedge funds should be thought of as a fee structure as opposed to an asset class. With nearly 10,000 hedge funds employing a variety of very different strategies (long/short, credit, risk arbitrage, macro, etc.), they’re difficult to benchmark.

“One of the big problems with performance is most [funds] aren’t very good. And the indices are made up of thousands of managers and most aren’t very good, so the indices aren’t going to do well,” Steinbrugge said.

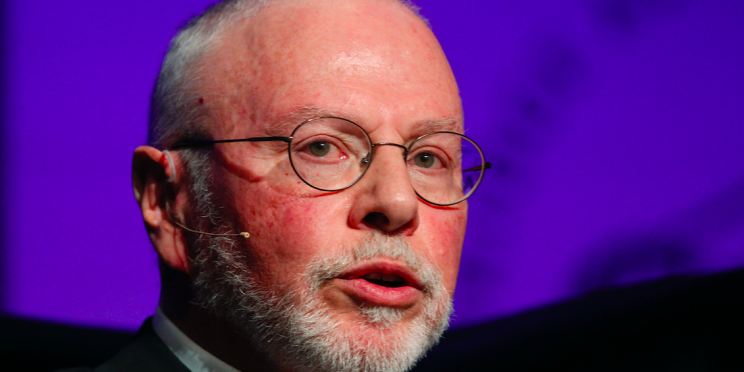

Hedge fund billionaire Paul Singer, the founder of Elliott Management, summed this up nicely in his third quarter letter.

“Among the thousands of existing hedge funds, there is a tremendous variety in terms of adeptness, professionalism, organizational appropriateness for the task at hand, robustness of strategic approach, volatility and other elements of quality and ability to contribute to investors’ goals Because of the number of hedge funds and the wide range of characteristics and categories, as well as their flexibility and fluidity of approaches and risk-management strategies, hedge funds are particularly difficult to benchmark and even categorize,” Singer wrote. Since Elliott Management’s inception nearly 40 years ago, Singer has only experienced two down years.

‘Healthy dynamic’ for survivors

One hedge fund manager, who will remain anonymous, described the redemptions and closures seen in 2016 as a “healthy dynamic” for the survivors.

“There’s too many hedge funds, too many doing the same thing, looking at the world in a very similar way, with similar backgrounds,” the fund manager said. “A lot of those funds are the ones that have fewer assets now.”

One way of putting it is “hedge fund schadenfreude,” meaning those funds that did well will see the benefit as assets are recirculated. That same fund manager noted that we’re going to be seeing a rejiggering in the industry around assets and fees as well as strategy.

Fees under pressure

Under-performance tends to reignite the age-old debate in the industry about the fees. Typically, fund managers are paid through a compensation structure commonly known as the “2 and 20,” which means they charge investors 2% of total assets under management and 20% of any profits. The fees can vary from fund to fund, with some charging less and others charging more.

“Most investors aren’t paying 2-and-20. They’re paying a lot less than that,” Steinbrugge said, noting that some funds offer a significant discount for large mandates.

The HFR report found that the average management fee dropped to 1.49% and the average incentive fee declined to 17.5%. Fees were mixed on new fund launches, the report noted.

Steinbruggge predicts that some funds might tier their stated fee structure so that large investors will pay a lower fee. Of course, not everyone will lower their fees. Some funds are worth it, while others are not. Steinbrugge estimated that only 10% of hedge funds are worth the fees they charge.

“That might sounds pretty negative, but when I look at mutual funds, I think 5% of them justify their fees.”

Dispersion in returns

The year started off very negative for the hedge fund industry due to major selloffs in both the equity and credit markets. Many funds posted dismal numbers in the first six weeks of the year.

“Since then, it’s been all about market exposure. The equity market did really well. The fixed income market did well. Credit spreads tightened significantly,” Steinbrugge said.

Steinbrugge noted that distressed debt will prove to be the No. 1 strategy for 2016. According to HSBC, the average distressed fund it tracks posted an average return of 11.94% through mid-December. In addition to an increased demand for distressed debt as a strategy, there’s been a big move to strategies with market exposure, Steinbrugge said. He also noted there’s been demand for commodity trading advisers (CTAs) and direct-lending.

One standout was Jason Mudrick’s $1.4 billion Distressed Opportunity Fund posting a 35% gain through December 15, according to data from HSBC. Last year, Mudrick was among the bottom performers posting decline of more than 25%, the HSBC data shows. Mudrick’s annualized return since inception in 2009 has been 8.89%, the data shows.

There was significant dispersion in returns among hedge fund managers and within the same strategies. If you just glance at the top performers versus the bottom performers, the range of returns is very wide. Some funds are up double-digits, while others are down double-digits.

Other top 20 best-performers for 2016 such as Elm Ridge Capital Partners, Dorset Energy, ECF Value Fund International, Firebird Republics Fund and Firebird New Russia Fund, Quantedge Global Fund, and Wexford Offshore Catalyst Fund were all among the bottom 20 performers in 2015, according to HSBC.

As they say, past performance is not indicative of future performance.

—

Julia La Roche is a finance reporter at Yahoo Finance.

Read more: