Why the market will head higher into year-end

The market will head higher into year-end for the following reasons: technicals, fundamentals, interest rates, and sentiment. Of course, we will see shakeouts, pullbacks, and minor corrections along the way, but I have trouble seeing this secular bull market ending anytime soon — especially when most people are prepared for it and actually looking for it to end.

Technicals

The big institutions control the market. I’ve been stressing for many years that people should learn how to read the technicals and follow what the big funds are doing. So far this year, the S&P 500 has not seen ONE week of distribution (heavy institutional selling). We’ve seen some normal pullbacks, but they have occurred on light volume telling me that the institutions are holding on to their shares and continue to support this market at key levels.

By no means am I encouraging people to be complacent. I am simply saying that market tops don’t happen until we see consistent heavy volume selling over 3-6 weeks by the large institutions. Until that happens, keep it simple and stick with the trend. In other words, don’t focus on what you THINK the market should be doing, focus on what it is ACTUALLY doing.

Fundamentals

Earnings are definitely slowing but that doesn’t mean the economy is entering a recession. According to FactSet, the S&P 500 is projected to report back-to-back quarters of year-over-year earnings declines for the first time since 2016. It’s possible that we will see a scenario similar to 2016 where we had an earnings recession but we didn’t see a recession in the overall economy. If we see a positive resolution in the China trade talks, one would expect to see an uptick in earnings.

Many people point out that this 10-year economic expansion has gone on for too long and should end any day now. Please keep in mind that the economy was never in an explosive growth stage. We have simply been growing GDP at 1.5%-2.5% per year and this slow and steady pace can continue for a while. If we see more consistent readings of 3% or higher, this can definitely justify acceleration in the stock market. Again, all these macro theories don’t matter as long as the institutions continue to support the market.

Interest Rates

Many people underestimate how much influence the Federal Reserve has on the stock market. Let’s look at recent examples: 1) The main reason for the decline in Q4 2018 was when Fed Chair Jerome Powell said he would raise interest rates three times in 2019. 2) The market’s strong recovery began in January when Powell reversed course and said he would be “patient” on rate hikes. 3) On May 1, the market was expecting Powell to hint at a rate cut, but when he didn’t, we ended up seeing an ugly decline in May of -6.6%. 4) In the most recent June meeting, the market interpreted Powell’s statement as being more accommodative and we ended up seeing the best June since 1955.

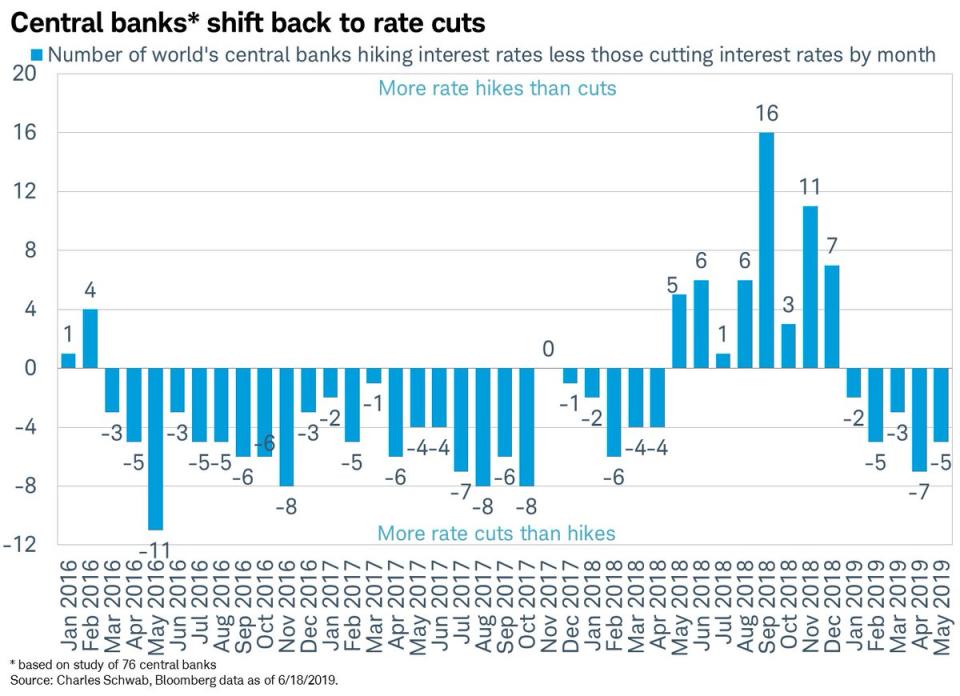

The Fed’s hint at an interest rate cut in their next July meeting has sparked a heated debate among market participants. It’s possible that the Fed is doing this because many parts of the world are already in a recession. One might argue that it’s not the Fed’s job to worry about other countries, but we are in a global economy and all the Feds have been globally coordinated for a long time. The only way we might not see a cut in July is if the S&P 500 continues to scream higher. If this happens, the Fed might hold off, causing a decline in the market and then an eventual cut in their September meeting. If you don’t think the Fed’s decision is mainly based on the price action of the stock market then you clearly have not been paying attention the past several years. Either way, the old expression “Don’t Fight the Fed” comes into play, especially when the global central banks are back in an easing cycle.

Sentiment

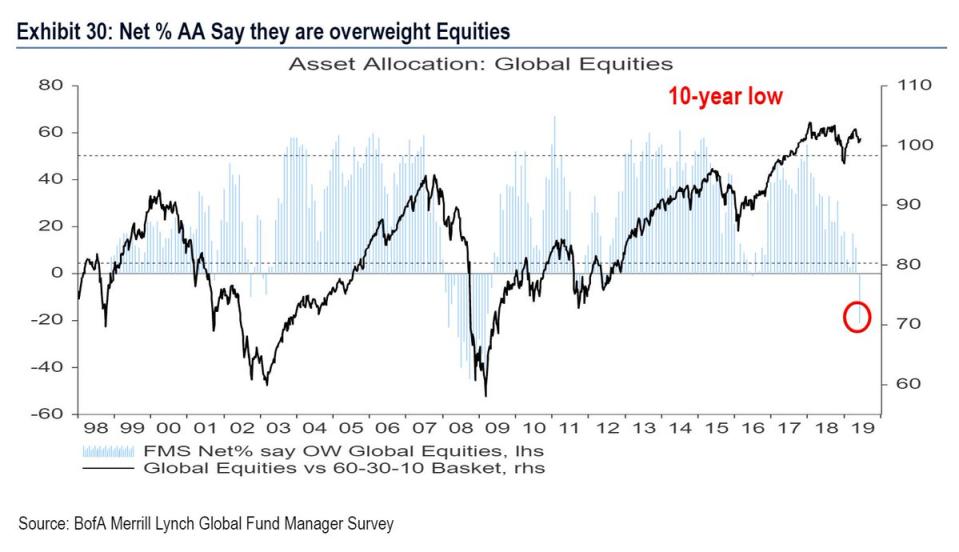

The main concept to understand about sentiment is that the market tends to fool the majority. Right now, sentiment is very poor and this continues to be one of the most hated bull markets. The recent BAML Global Fund Manager Survey shows the largest jump in cash since the 2011 debt ceiling crisis, the lowest allocation of equities to bonds since May 2009, and a record decline in global growth expectations (insert chart - see attached). Also, the AAII survey is showing a 3-year low in bullish sentiment.

It’s amazing how sentiment can be so poor with the market so close to all-time highs. I think the bigger question is WHY are people so bearish? My guess is people: 1) Have not participated in this rally because anyone making money is not complaining. 2) Keep blaming the Fed and complain that this will end badly. 3) Listen to the news too much (which tends to be negative) rather than paying attention to price action which is very strong and 4) Over-think things by being macro economists and focusing on what could go wrong.

The two main factors that drive the stock market are earnings and interest rates. Earnings are definitely slowing but are still growing at a steady pace overall. Interest rates are low and justify higher valuations. We are currently consolidating the gains we had since the beginning of the year. We are likely to continue consolidating over the near-term, but this consolidation will resolve itself to the upside, especially if we get positive news on a China trade deal. Many people continue to hate this market and stay under-invested, but keep in mind the market tends to fool the majority. As long as the big institutions continue to support this market, I will continue to stick to this strong uptrend. Bottom line: Don’t fight the Fed and don’t fight the big institutions!

I can be reached at: [email protected]

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained on this site constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned on this site. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.