3 ASX Dividend Stocks Offering Up To 9.1% Yield

The Australian market has shown robust performance, climbing 1.4% in the last week and achieving a 10% increase over the past year, with earnings projected to grow by 13% annually. In this environment, dividend stocks that offer high yields can be particularly appealing for investors looking for both income and potential growth.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Lindsay Australia (ASX:LAU) | 6.56% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 5.28% | ★★★★★☆ |

Collins Foods (ASX:CKF) | 3.11% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 7.32% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.25% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.12% | ★★★★★☆ |

Fortescue (ASX:FMG) | 9.16% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.92% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.59% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.12% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

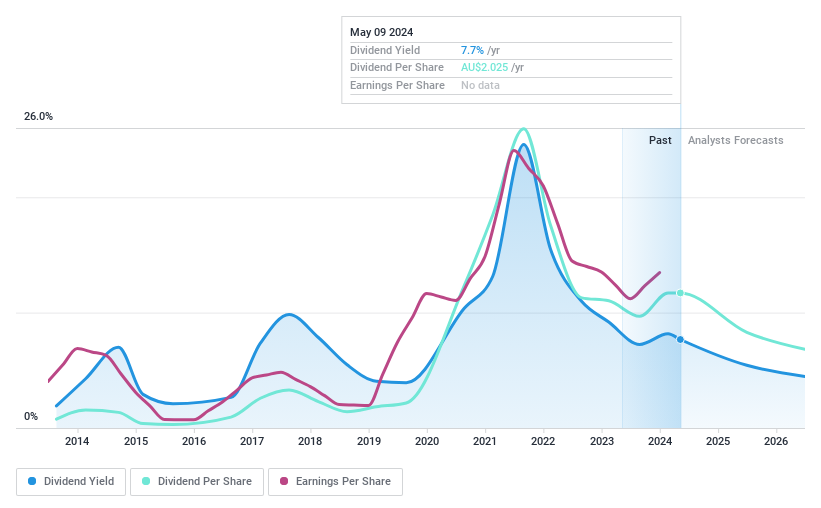

Fortescue

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fortescue Ltd is an Australian company specializing in the exploration, development, production, processing, and sale of iron ore, operating both domestically and internationally with a market capitalization of approximately A$66.41 billion.

Operations: Fortescue Ltd generates revenue primarily through its Metals segment, which accounted for A$18.47 billion, with an additional A$79 million from its Energy operations.

Dividend Yield: 9.2%

Fortescue's dividends, yielding 9.16%, rank in the top 25% in Australia, though its dividend history has been unstable over the past decade with significant fluctuations and an average annual drop of over 20%. Despite this, both earnings and cash flows reasonably cover the payouts, with payout ratios at 74.2% and 73.1%, respectively. However, earnings are projected to decline by an average of 19.2% annually over the next three years, posing a risk to future dividend sustainability.

Take a closer look at Fortescue's potential here in our dividend report.

Our valuation report unveils the possibility Fortescue's shares may be trading at a discount.

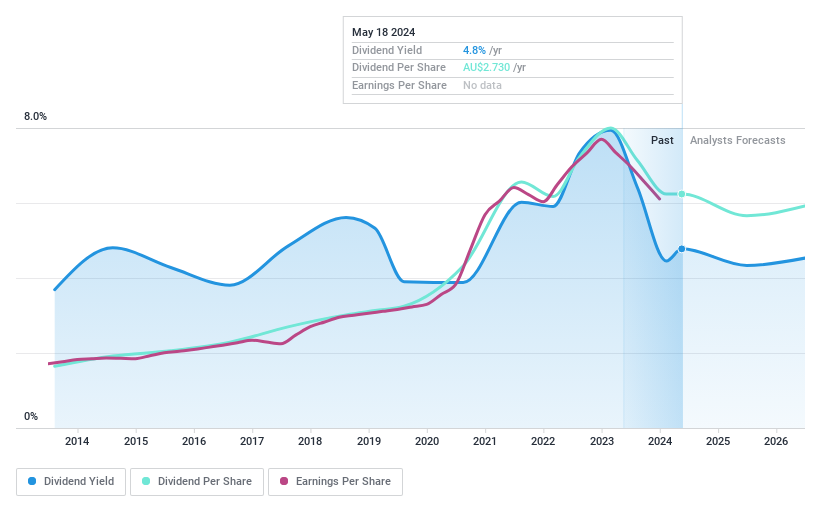

JB Hi-Fi

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JB Hi-Fi Limited operates a retail chain that sells home consumer products, with a market capitalization of approximately A$7.04 billion.

Operations: JB Hi-Fi Limited generates revenue through three primary segments: The Good Guys (TGG) at A$2.66 billion, JB Hi-Fi Australia (JB Aust) at A$6.57 billion, and JB Hi-Fi New Zealand (JB NZ) at A$0.28 billion.

Dividend Yield: 4.2%

JB Hi-Fi's dividend yield of 4.24% is modest compared to Australia's top dividend payers. The company has a mixed track record with volatile dividends over the past decade, although recent years show an increase in payouts. Its dividends are reasonably covered by earnings and cash flows, with payout ratios at 65% and 46.7%, respectively. However, JB Hi-Fi faces challenges with declining earnings forecasted at an average of -1.4% annually over the next three years, potentially impacting future dividend reliability.

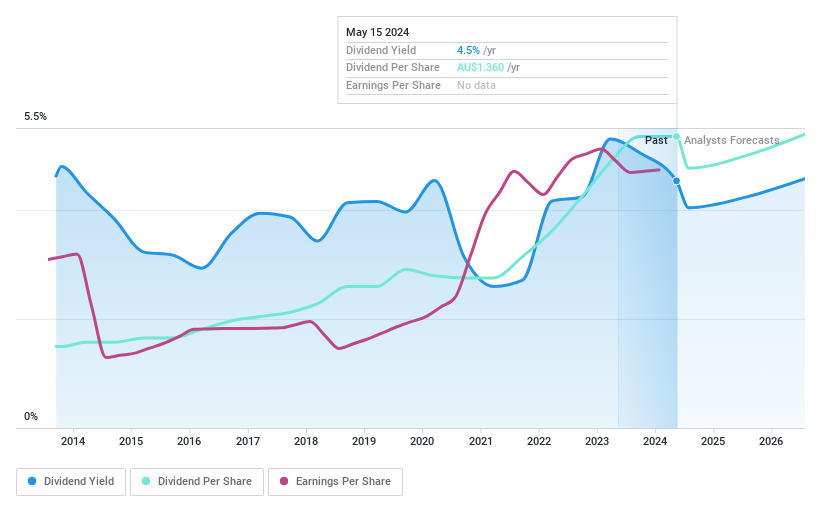

Premier Investments

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Premier Investments Limited is a specialty retail company that manages fashion chains across Australia, New Zealand, Asia, and Europe, with a market capitalization of approximately A$4.73 billion.

Operations: Premier Investments Limited generates revenue primarily through its retail operations, which amounted to A$1.63 billion.

Dividend Yield: 4.6%

Premier Investments offers a stable dividend yield of 4.59%, underpinned by a decade of consistent growth in dividend payments. The company's dividends are well-supported by earnings and cash flows, with payout ratios standing at 71.5% and 55% respectively, indicating sustainability. However, its yield trails the top quartile of Australian dividend stocks, which averages around 6.44%. Despite trading at a significant discount to estimated fair value, earnings are expected to grow modestly at 3.63% annually.

Seize The Opportunity

Delve into our full catalog of 27 Top ASX Dividend Stocks here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:FMG ASX:JBH and ASX:PMV.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]