3 ASX Dividend Stocks Yielding Up To 6.9%

The Australian market has shown resilience, with the ASX200 rising 1.3% to close above 7970 points, buoyed by a strong performance across all sectors and a notable rally on Wall Street. As investors navigate these dynamic conditions, dividend stocks can offer a reliable income stream and potential for capital appreciation. In this article, we will explore three ASX-listed dividend stocks that are yielding up to 6.9%, highlighting their potential benefits in the current market environment.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Lindsay Australia (ASX:LAU) | 6.67% | ★★★★★☆ |

Collins Foods (ASX:CKF) | 3.14% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.41% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 7.37% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 6.97% | ★★★★★☆ |

MFF Capital Investments (ASX:MFF) | 3.62% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 3.56% | ★★★★★☆ |

Bapcor (ASX:BAP) | 4.24% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.53% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.06% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top ASX Dividend Stocks screener.

We'll examine a selection from our screener results.

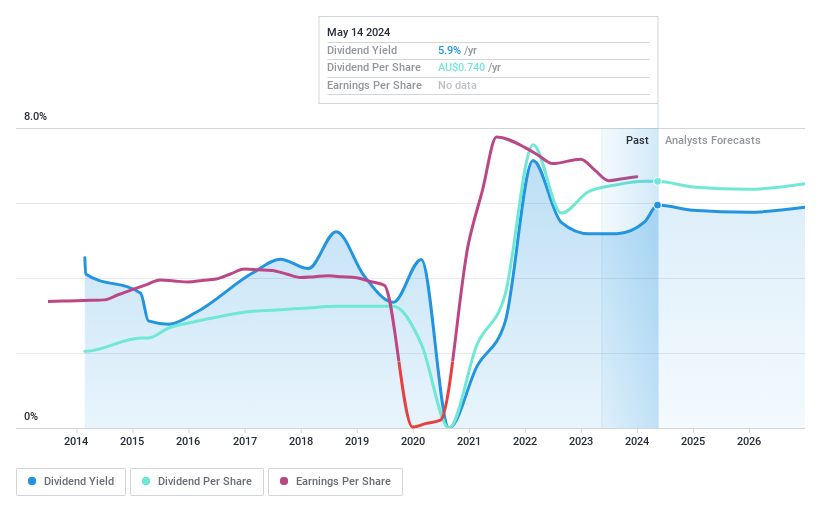

Eagers Automotive

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Eagers Automotive Limited, with a market cap of A$2.74 billion, owns and operates motor vehicle dealerships across Australia and New Zealand.

Operations: Eagers Automotive Limited generates revenue primarily from its Car Retailing segment, which accounted for A$9.85 billion, and also includes a Property segment contributing A$39.68 million.

Dividend Yield: 7.0%

Eagers Automotive has shown a volatile dividend history over the past 10 years, with payments covered by both earnings (66.8% payout ratio) and cash flows (55.9% cash payout ratio). The dividend yield is in the top 25% of Australian payers at 6.97%. However, earnings are forecast to decline by an average of 0.7% per year for the next three years, despite expected revenue growth of 5.52%. Recent buyback plans could impact future dividends positively or negatively depending on execution and market conditions.

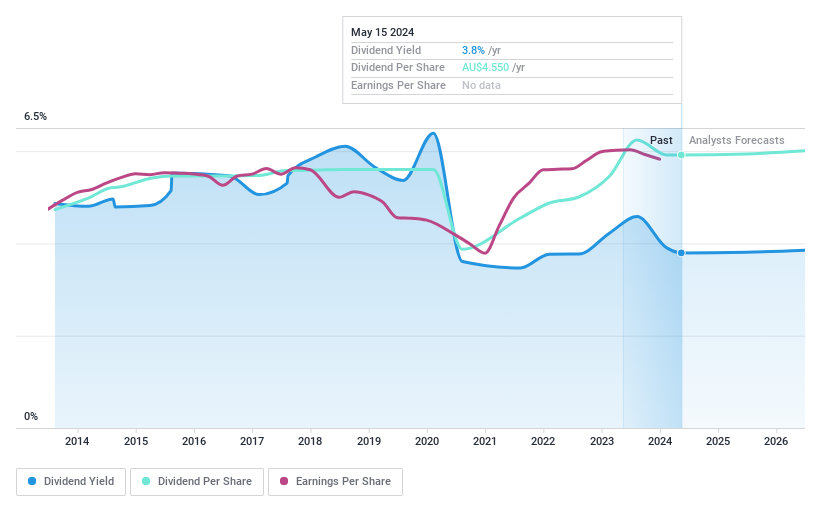

Commonwealth Bank of Australia

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Commonwealth Bank of Australia provides financial services in Australia, New Zealand, and internationally, with a market cap of A$230.96 billion.

Operations: Commonwealth Bank of Australia's revenue segments include Retail Banking Services (Incl. Bankwest) at A$12.47 billion, Business Banking at A$8.14 billion, New Zealand operations at A$2.86 billion, and Institutional Banking and Markets at A$2.51 billion.

Dividend Yield: 3.4%

Commonwealth Bank of Australia has a low allowance for bad loans (63%) and an unstable dividend track record. Its current dividend yield of 3.37% is below the top 25% in the Australian market. However, dividends are covered by earnings with a payout ratio of 82.1%, forecasted to remain sustainable at 78.8% in three years despite past volatility. Recent earnings showed a slight decline, with net income dropping to A$9.39 billion from A$9.99 billion last year, but announced dividends increased to A$2.50 per share for the six months ended June 30, 2024.

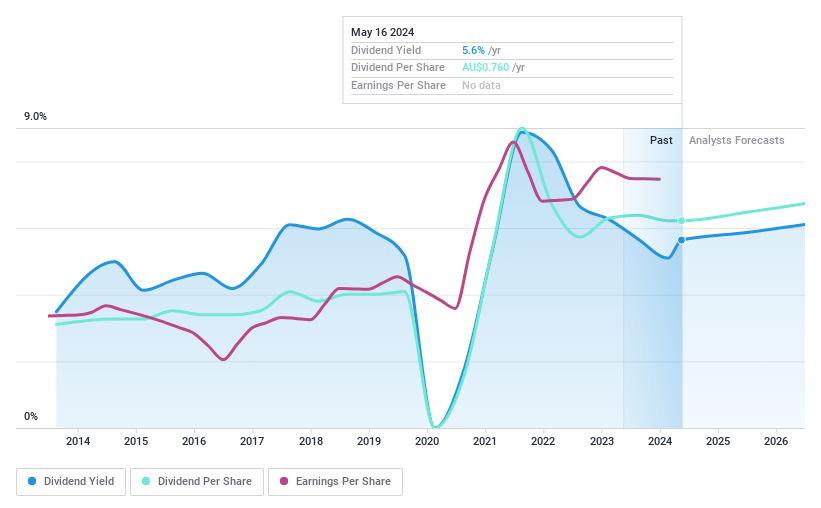

Super Retail Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Super Retail Group Limited operates retail stores specializing in auto, sports, and outdoor leisure products across Australia and New Zealand, with a market cap of A$3.69 billion.

Operations: Super Retail Group Limited's revenue segments include Rebel at A$1.30 billion, Macpac at A$220.60 million, Super Cheap Auto (SCA) at A$1.48 billion, and Boating, Camping and Fishing (BCF) at A$876 million.

Dividend Yield: 4.7%

Super Retail Group's dividend yield of 4.66% is lower than the top 25% in Australia, but its dividends are well covered by earnings (65.5%) and cash flows (28.6%). The company has a history of volatile dividends over the past decade despite recent increases. Trading at a P/E ratio of 14.1x, it offers good value compared to the broader market. The appointment of Colin Storrie as Non-Executive Director may bring valuable expertise to the board.

Next Steps

Take a closer look at our Top ASX Dividend Stocks list of 33 companies by clicking here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:APE ASX:CBA and ASX:SUL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]