3 ASX Dividend Stocks Yielding Up To 6.6%

The ASX200 recently closed up 0.58% at 8,091.9 points amid a flurry of earnings reports and mixed economic data, including flat retail sales for July which has analysts speculating on future interest rate movements. While sectors like Industrials and Energy saw gains, Consumer Discretionary stocks faced challenges. In this environment of fluctuating market conditions, dividend stocks can offer stability and consistent returns for investors seeking reliable income streams.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Perenti (ASX:PRN) | 7.73% | ★★★★★☆ |

Collins Foods (ASX:CKF) | 3.64% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.27% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.80% | ★★★★★☆ |

MFF Capital Investments (ASX:MFF) | 3.66% | ★★★★★☆ |

Super Retail Group (ASX:SUL) | 6.66% | ★★★★★☆ |

National Storage REIT (ASX:NSR) | 4.55% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 3.85% | ★★★★★☆ |

New Hope (ASX:NHC) | 9.60% | ★★★★☆☆ |

Grange Resources (ASX:GRR) | 7.27% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Amotiv

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amotiv Limited, with a market cap of A$1.48 billion, manufactures, imports, distributes, and sells automotive products across Australia, New Zealand, Thailand, South Korea, France, and the United States through its subsidiaries.

Operations: Amotiv Limited generates revenue from three primary segments: Powertrain & Undercar (A$313.90 million), Lighting Power & Electrical (A$324.47 million), and 4WD Accessories & Trailering (A$348.81 million).

Dividend Yield: 3.8%

Amotiv Limited's dividend payments are well-covered by both earnings (57.2% payout ratio) and cash flows (37.7% cash payout ratio). Despite a history of volatility in dividends over the past decade, recent announcements affirm a fully franked final dividend of A$0.22 per share, with an ex-dividend date of August 23, 2024. The company's earnings have shown consistent growth, with net income rising to A$98.8 million for the year ended June 30, 2024.

Click here to discover the nuances of Amotiv with our detailed analytical dividend report.

Our valuation report unveils the possibility Amotiv's shares may be trading at a discount.

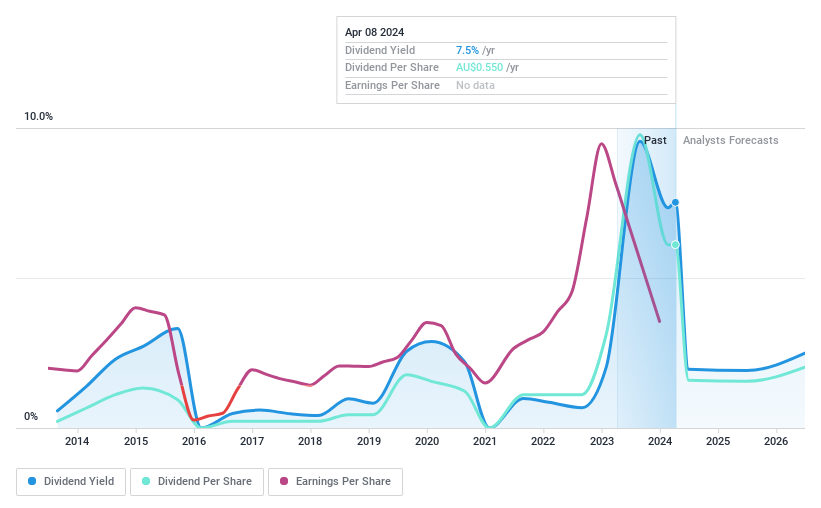

IGO

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IGO Limited is an Australian exploration and mining company focused on discovering, developing, and operating assets for clean energy metals with a market cap of A$4.20 billion.

Operations: IGO Limited's revenue segments include A$48.80 million from the Cosmos Project, A$539.10 million from the Nova Operation, and A$234.80 million from the Forrestania Operation, along with A$18.10 million in interest revenue.

Dividend Yield: 6.7%

IGO's dividend payments have been volatile and unreliable over the past decade, with a high payout ratio of 10008.1%, indicating poor coverage by earnings. However, its cash payout ratio of 41.6% suggests dividends are well-covered by cash flows. Recent earnings reports show a significant decline in net income to A$2.8 million from A$549.1 million last year, raising concerns about future dividend sustainability despite its top-tier yield of 6.67%.

Jumbo Interactive

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jumbo Interactive Limited operates in the retail of lottery tickets via internet and mobile devices across Australia, the United Kingdom, Canada, Fiji, and internationally with a market cap of A$867.81 million.

Operations: Jumbo Interactive Limited's revenue segments include Managed Services (A$25.84 million), Lottery Retailing (A$123.40 million), and Software-As-A-Service (SaaS) (A$50.73 million).

Dividend Yield: 3.9%

Jumbo Interactive recently announced a fully franked dividend of A$0.275 per share, payable on September 20, 2024. The company reported strong earnings for the year ended June 30, 2024, with net income rising to A$43.35 million from A$31.57 million and basic earnings per share increasing to A$0.6886 from A$0.502 last year. Despite a volatile dividend history, current dividends are well-covered by both earnings (79.1% payout ratio) and cash flows (63.4% cash payout ratio).

Next Steps

Navigate through the entire inventory of 32 Top ASX Dividend Stocks here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:AOV ASX:IGO and ASX:JIN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Yahoo Finance

Yahoo Finance