3 ASX Growth Companies With High Insider Ownership And Up To 106% Earnings Growth

The ASX200 has been up 0.3% at 8,220 points after hitting a new all-time high of 8,246 in intra-day trade, following the upward momentum seen in US indices. With all Australian sectors showing positive performance and IT leading the charge, investors are keenly eyeing growth opportunities. In this buoyant market environment, identifying growth companies with high insider ownership can be particularly rewarding as it often signals strong confidence from those closest to the business. Here are three ASX-listed growth companies that not only exhibit robust earnings potential but also boast significant insider ownership.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

Catalyst Metals (ASX:CYL) | 17% | 54.5% |

Genmin (ASX:GEN) | 12% | 117.7% |

Hillgrove Resources (ASX:HGO) | 10.4% | 70.9% |

AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

Pointerra (ASX:3DP) | 18.7% | 126.4% |

Liontown Resources (ASX:LTR) | 16.4% | 69.4% |

Acrux (ASX:ACR) | 17.4% | 91.6% |

Adveritas (ASX:AV1) | 21.1% | 144.2% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Let's review some notable picks from our screened stocks.

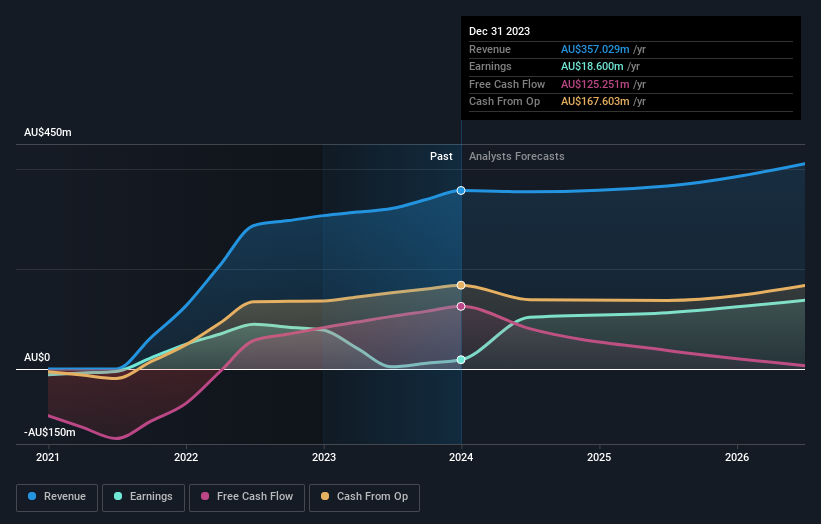

Capricorn Metals

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capricorn Metals Ltd is an Australian company involved in the evaluation, exploration, development, and production of gold properties with a market cap of A$2.40 billion.

Operations: Capricorn Metals generates revenue primarily from its Karlawinda gold property, amounting to A$359.73 million.

Insider Ownership: 11.9%

Earnings Growth Forecast: 19.9% p.a.

Capricorn Metals has demonstrated significant growth, with earnings surging from A$4.4 million to A$87.14 million over the past year, reflecting strong financial performance. The company's revenue is forecast to grow 18.6% annually, outpacing the broader Australian market's 5.4%. Insider ownership remains high, aligning management interests with shareholders. Recent developments include a major expansion study at the Karlawinda Gold Project and increased mineral reserves, supporting long-term growth prospects despite moderate annual profit forecasts of 19.93%.

Liontown Resources

Simply Wall St Growth Rating: ★★★★★★

Overview: Liontown Resources Limited (ASX:LTR) focuses on the exploration, evaluation, and development of mineral properties in Australia with a market cap of A$1.61 billion.

Operations: Liontown Resources generates revenue through the exploration, evaluation, and development of mineral properties in Australia.

Insider Ownership: 16.4%

Earnings Growth Forecast: 69.4% p.a.

Liontown Resources is forecast to become profitable within three years, with earnings expected to grow 69.38% annually and revenue projected to increase by 43.4% per year, outpacing the Australian market. Recent strategic partnership with LG Energy Solution includes a US$250 million (A$379 million) investment and extended offtake agreements, reinforcing long-term growth potential. Despite past shareholder dilution, insider ownership remains strong with no substantial recent insider selling and modest insider buying observed in the last three months.

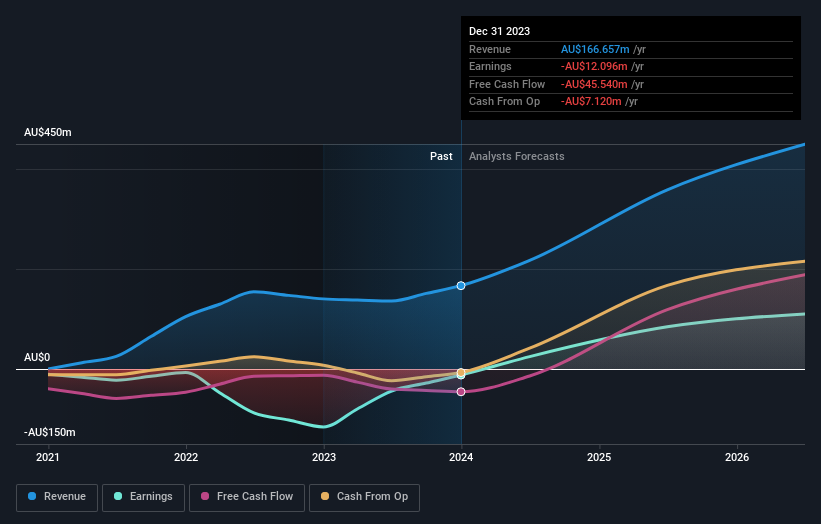

Ora Banda Mining

Simply Wall St Growth Rating: ★★★★★★

Overview: Ora Banda Mining Limited, with a market cap of A$1.18 billion, focuses on the exploration, operation, and development of mineral properties in Australia.

Operations: Ora Banda Mining generates revenue primarily from its gold mining operations, amounting to A$166.66 million.

Insider Ownership: 10.2%

Earnings Growth Forecast: 106.9% p.a.

Ora Banda Mining is forecast to become profitable within three years, with earnings expected to grow 106.93% annually and revenue projected to increase by 46.3% per year, significantly outpacing the Australian market. Despite past shareholder dilution, insider ownership remains strong with no substantial recent insider selling or buying. Recent executive changes include the appointment of Doug Warden as CFO and Kathryn Cutler as an independent Non-executive Director, bolstering leadership expertise in finance and mineral exploration.

Make It Happen

Unlock more gems! Our Fast Growing ASX Companies With High Insider Ownership screener has unearthed 96 more companies for you to explore.Click here to unveil our expertly curated list of 99 Fast Growing ASX Companies With High Insider Ownership.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:CMM ASX:LTR and ASX:OBM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]