3 ASX Growth Stocks With Up To 12% Insider Ownership

Over the last 7 days, the Australian market has remained flat, but it has risen by 12% over the past 12 months with earnings forecasted to grow by 14% annually. In this context, identifying growth companies with significant insider ownership can be particularly appealing as it often indicates strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 102.6% |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 28.1% |

Acrux (ASX:ACR) | 14.6% | 115.6% |

Liontown Resources (ASX:LTR) | 16.4% | 69.7% |

Catalyst Metals (ASX:CYL) | 17.5% | 75.7% |

Hillgrove Resources (ASX:HGO) | 10.4% | 49.4% |

Adveritas (ASX:AV1) | 21.1% | 103.9% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Change Financial (ASX:CCA) | 26.6% | 77.9% |

Underneath we present a selection of stocks filtered out by our screen.

Aussie Broadband

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aussie Broadband Limited provides telecommunications services to residential and business customers in Australia, with a market cap of A$1.03 billion.

Operations: The company's revenue segments include Business (A$94.21 million), Wholesale (A$125.25 million), Residential (A$549.59 million), and Enterprise and Government (A$85.85 million).

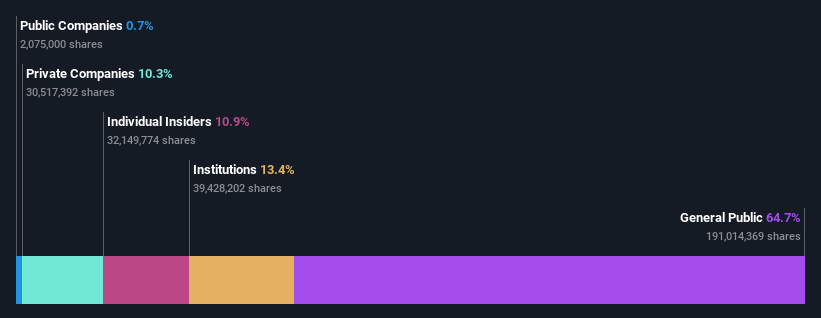

Insider Ownership: 10.8%

Aussie Broadband is trading at 71.6% below its estimated fair value and has high insider ownership, aligning with significant growth potential. Earnings are forecast to grow 27.57% annually over the next three years, outpacing the Australian market's 13.6%. Despite revenue growth projections of 12.8% per year being slower than ideal, they still surpass the market average of 5.3%. However, shareholders have experienced dilution in the past year and Return on Equity is expected to be low at 10.1%.

Mineral Resources

Simply Wall St Growth Rating: ★★★★★☆

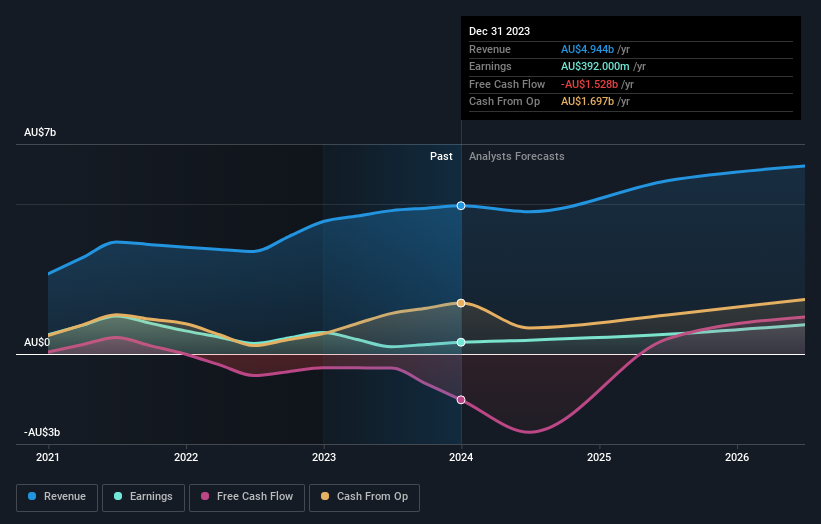

Overview: Mineral Resources Limited, with a market cap of A$8.77 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

Operations: Mineral Resources Limited generates revenue from three main segments: Lithium (A$1.60 billion), Iron Ore (A$2.50 billion), and Mining Services (A$2.82 billion).

Insider Ownership: 11.6%

Mineral Resources demonstrates significant growth potential with earnings forecasted to grow 23.3% annually, outpacing the Australian market's 13.6%. Revenue is expected to increase by 10.7% per year, also exceeding market averages. Despite trading at a substantial discount of 65.7% below its estimated fair value, profit margins have declined from last year's 16.3% to 7.9%. High insider ownership aligns with these growth prospects, although interest payments are not well covered by earnings and no recent insider trading activity has been noted.

Technology One

Simply Wall St Growth Rating: ★★★★☆☆

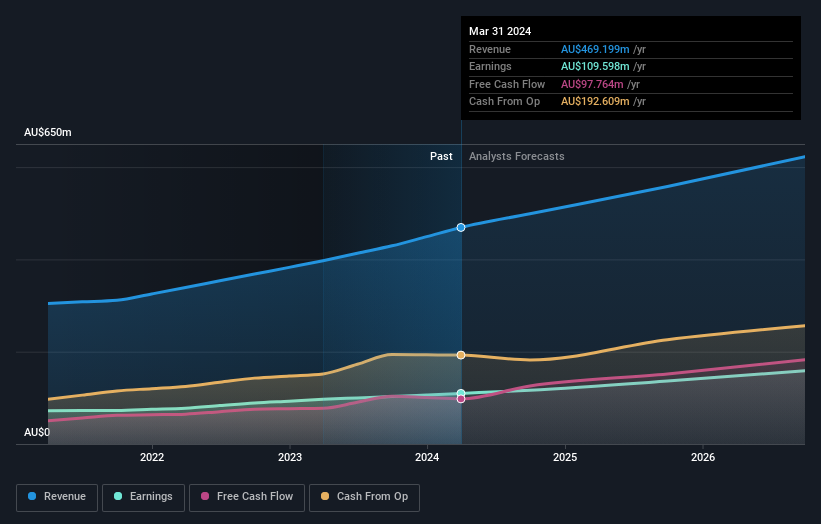

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$7.46 billion.

Operations: The company's revenue segments include Software (A$317.24 million), Corporate (A$83.83 million), and Consulting (A$68.13 million).

Insider Ownership: 12.3%

Technology One's earnings are projected to grow 14.8% annually, surpassing the Australian market's 13.6%. Revenue growth is forecasted at 11.5% per year, outpacing the market average of 5.3%. The company's Return on Equity is expected to reach a high of 32.6% in three years. Recent board changes include Paul Robson's appointment as an independent Non-Executive Director, bringing extensive SaaS and strategic transformation expertise to support ongoing global expansion efforts.

Next Steps

Click through to start exploring the rest of the 86 Fast Growing ASX Companies With High Insider Ownership now.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:ABB ASX:MIN and ASX:TNE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]