3 ASX Growth Stocks With High Insider Ownership

As the ASX200 edges closer to a new record, buoyed by strong performances in sectors like IT and Financials, investors are keenly observing growth opportunities within the Australian market. In this vibrant landscape, companies with high insider ownership often stand out, as they may indicate confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

Catalyst Metals (ASX:CYL) | 17% | 54.5% |

Genmin (ASX:GEN) | 12% | 117.7% |

Hillgrove Resources (ASX:HGO) | 10.4% | 71.5% |

AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

Pointerra (ASX:3DP) | 20.1% | 126.4% |

Liontown Resources (ASX:LTR) | 14.7% | 60.7% |

Acrux (ASX:ACR) | 17.4% | 91.6% |

Adveritas (ASX:AV1) | 21.1% | 144.2% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Let's review some notable picks from our screened stocks.

Mineral Resources

Simply Wall St Growth Rating: ★★★★☆☆

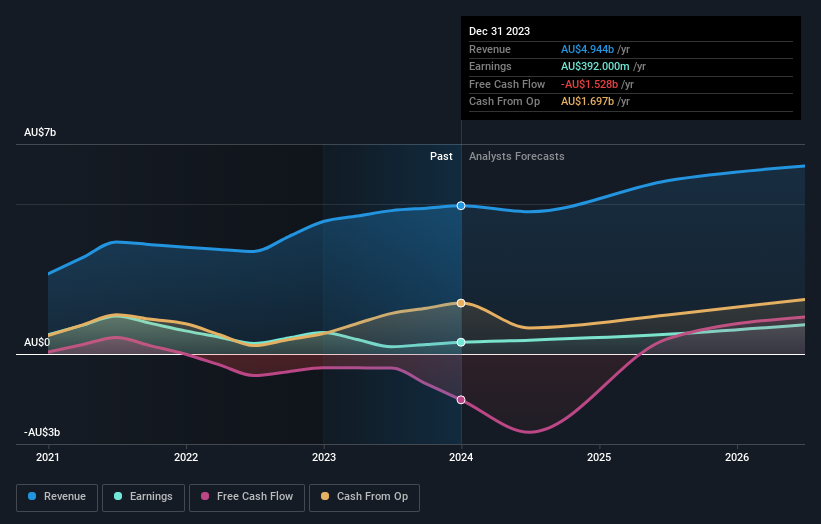

Overview: Mineral Resources Limited operates as a mining services company in Australia, Asia, and internationally, with a market cap of A$10.40 billion.

Operations: The company's revenue segments include A$0.02 billion from Energy, A$1.41 billion from Lithium, A$2.58 billion from Iron Ore, and A$3.38 billion from Mining Services, along with A$0.02 billion from Other Commodities.

Insider Ownership: 11.7%

Mineral Resources, backed by significant insider ownership, is navigating financial challenges with strategic asset sales and partnerships. Recent M&A discussions highlight a potential sale of its Perth Basin assets to bolster its balance sheet. Despite lower profit margins and high net debt of A$4.4 billion, earnings are forecasted to grow at 38% annually, outpacing the Australian market's growth rate. The company trades below estimated fair value and insiders have shown confidence with recent share purchases.

Mesoblast

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mesoblast Limited is a company focused on developing regenerative medicine products across Australia, the United States, Singapore, and Switzerland with a market cap of A$1.70 billion.

Operations: The company's revenue segment includes the development of a cell technology platform for commercialization, generating $5.90 million.

Insider Ownership: 22.2%

Mesoblast, with substantial insider ownership, is focusing on growth through innovative therapies like Ryoncil for SR-aGVHD. Despite being dropped from the S&P/ASX Emerging Companies Index and reporting a net loss of US$87.96 million, revenue is expected to grow at 45.8% annually, surpassing market averages. Recent insider buying indicates confidence amidst financial challenges such as limited cash runway and past shareholder dilution. The company secured A$72.7 million via convertible notes to support its initiatives.

Click here and access our complete growth analysis report to understand the dynamics of Mesoblast.

Our valuation report here indicates Mesoblast may be undervalued.

Technology One

Simply Wall St Growth Rating: ★★★★☆☆

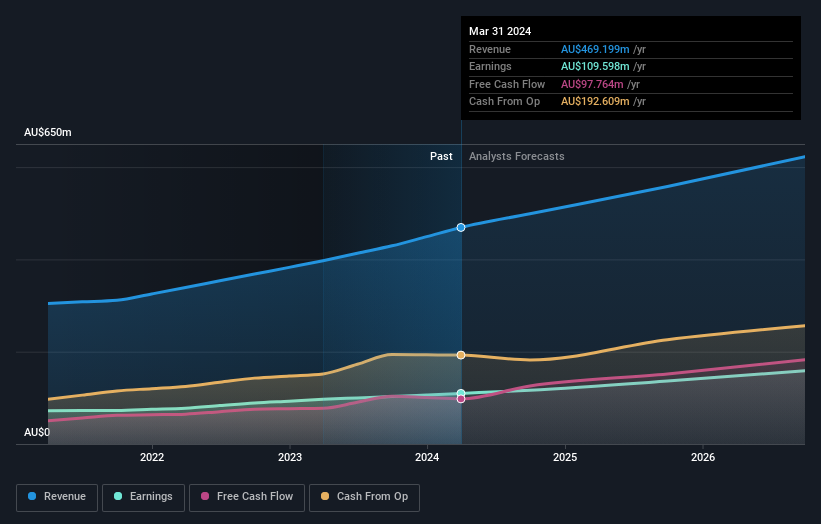

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$8.02 billion.

Operations: The company's revenue segments include A$317.24 million from Software, A$83.83 million from Corporate, and A$68.13 million from Consulting.

Insider Ownership: 12.3%

Technology One, with considerable insider ownership, is poised for growth as its revenue is forecast to increase by 10.8% annually, outpacing the Australian market's 5.5%. Although earnings are not expected to grow significantly, they are projected to rise at 13.6% per year, above market averages. The company's return on equity is anticipated to be robust at 32.7% in three years. Trading slightly below estimated fair value suggests potential investment appeal amidst steady financial performance.

Summing It All Up

Dive into all 99 of the Fast Growing ASX Companies With High Insider Ownership we have identified here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:MIN ASX:MSB and ASX:TNE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]