3 ASX Stocks Estimated To Be Undervalued In July 2024

The Australian market has been flat over the last week but is up 7.8% over the past year, with earnings forecast to grow by 13% annually. In this context, identifying undervalued stocks can offer investors opportunities to capitalize on potential growth at attractive prices.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

Name | Current Price | Fair Value (Est) | Discount (Est) |

Ansell (ASX:ANN) | A$27.19 | A$51.53 | 47.2% |

Count (ASX:CUP) | A$0.635 | A$1.17 | 45.9% |

VEEM (ASX:VEE) | A$1.80 | A$3.54 | 49.2% |

IPH (ASX:IPH) | A$5.98 | A$11.72 | 49% |

hipages Group Holdings (ASX:HPG) | A$1.055 | A$2.06 | 48.7% |

ReadyTech Holdings (ASX:RDY) | A$3.30 | A$6.21 | 46.8% |

Atturra (ASX:ATA) | A$0.82 | A$1.51 | 45.5% |

Red 5 (ASX:RED) | A$0.38 | A$0.75 | 49.1% |

Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

EVT (ASX:EVT) | A$11.25 | A$21.30 | 47.2% |

Let's take a closer look at a couple of our picks from the screened companies.

Credit Corp Group

Overview: Credit Corp Group Limited (ASX:CCP) operates in Australia and the United States, offering debt ledger purchase and collection services as well as consumer lending, with a market cap of A$1.18 billion.

Operations: The company's revenue segments include A$40.32 million from debt ledger purchasing in the United States, A$235.28 million from debt ledger purchasing in Australia and New Zealand, and A$164.48 million from consumer lending across Australia, New Zealand, and the United States.

Estimated Discount To Fair Value: 31.7%

Credit Corp Group is trading at A$17.32, significantly below its estimated fair value of A$25.37, suggesting it may be undervalued based on cash flows. However, the company's net income for the full year ended June 30, 2024, dropped to A$50.71 million from A$91.25 million a year ago, impacting earnings per share negatively. Despite this decline and a low forecasted return on equity (12.1%), earnings are expected to grow significantly at 23.6% annually over the next three years.

IPH

Overview: IPH Limited, with a market cap of A$1.48 billion, provides intellectual property services and products across Australia, New Zealand, Asia, Canada, and internationally.

Operations: The company's revenue segments include Intellectual Property Services in Australia and New Zealand (A$284.78 million), Asia (A$120.45 million), and Canada (A$134.91 million).

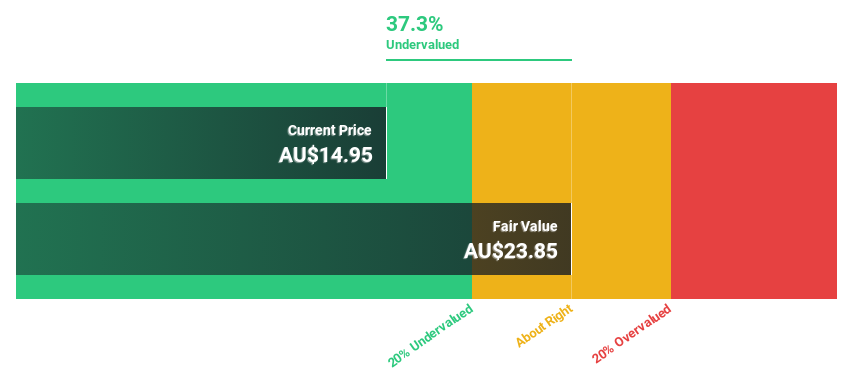

Estimated Discount To Fair Value: 49%

IPH Limited, trading at A$5.98, is significantly undervalued with an estimated fair value of A$11.72. Despite a high level of debt and past shareholder dilution, the company’s earnings are forecast to grow 15.49% annually, outpacing the Australian market's growth rate of 13.2%. Recent developments include extending its buyback plan until May 2025 and presenting at the Macquarie Australia Conference in May 2024.

Kogan.com

Overview: Kogan.com Ltd is an online retailer in Australia with a market cap of A$426.61 million.

Operations: Kogan.com Ltd generates revenue from its Australian operations through Mighty Ape (A$11.39 million) and Kogan Parent (A$274.85 million), and from its New Zealand operations through Mighty Ape (A$142.52 million) and Kogan Parent (A$33.40 million).

Estimated Discount To Fair Value: 30.5%

Kogan.com, trading at A$4.24, is significantly undervalued with an estimated fair value of A$6.10 and is trading 30.5% below this estimate. The company recently became profitable and its earnings are forecast to grow 36.54% annually, outpacing the Australian market's growth rate of 13.2%. Revenue is expected to grow at 6% per year, faster than the market average of 4.9%. Kogan.com presented at the Bell Potter Emerging Leaders Conference in May 2024.

The growth report we've compiled suggests that Kogan.com's future prospects could be on the up.

Take a closer look at Kogan.com's balance sheet health here in our report.

Seize The Opportunity

Embark on your investment journey to our 44 Undervalued ASX Stocks Based On Cash Flows selection here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:CCP ASX:IPH and ASX:KGN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]