3 Dividend Stocks On Euronext Amsterdam With Up To 6.8% Yield

Amidst the backdrop of escalating Middle East tensions and fluctuating oil prices, European markets have experienced a downturn, with major indices seeing significant declines. Despite these challenges, the Euronext Amsterdam remains a focal point for investors seeking stability through dividend stocks, which can provide income even in volatile times. A good dividend stock is typically characterized by its ability to maintain consistent payouts and financial resilience, making it an attractive option for those navigating uncertain market conditions.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Koninklijke Heijmans (ENXTAM:HEIJM) | 3.36% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 5.13% | ★★★★☆☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.67% | ★★★★☆☆ |

Signify (ENXTAM:LIGHT) | 6.87% | ★★★★☆☆ |

Aalberts (ENXTAM:AALB) | 3.16% | ★★★★☆☆ |

ING Groep (ENXTAM:INGA) | 6.91% | ★★★★☆☆ |

Acomo (ENXTAM:ACOMO) | 6.50% | ★★★★☆☆ |

We'll examine a selection from our screener results.

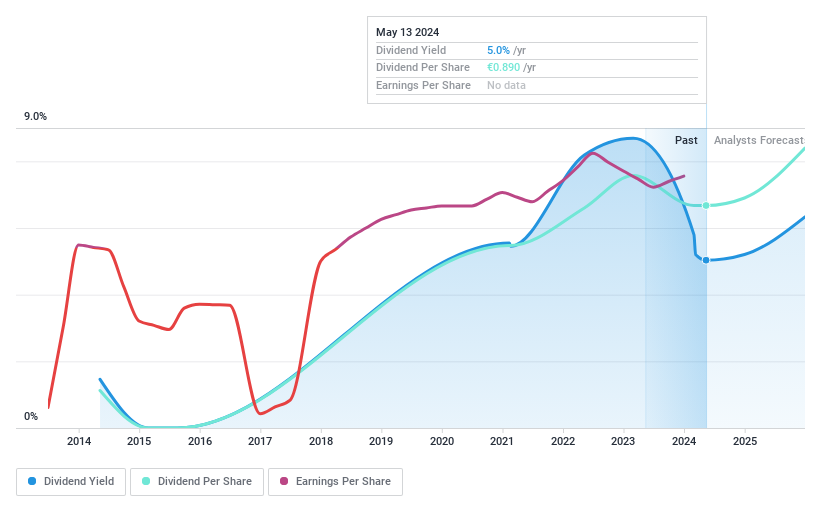

Koninklijke Heijmans

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors both in the Netherlands and internationally, with a market cap of €710.89 million.

Operations: Koninklijke Heijmans N.V. generates revenue from its Connecting segment, which amounts to €871.03 million, and includes a Segment Adjustment of €1.83 billion.

Dividend Yield: 3.4%

Koninklijke Heijmans has shown robust earnings growth, with a 65.5% increase over the past year and a forecasted annual growth of 12.7%. Despite its volatile dividend history, recent increases in payments and low payout ratios (earnings: 30%, cash flow: 20.7%) suggest dividends are currently sustainable. However, the dividend yield of 3.36% is below top-tier levels in the Dutch market. Recent earnings report highlights significant sales growth to €1.22 billion and net income doubling to €37 million compared to last year.

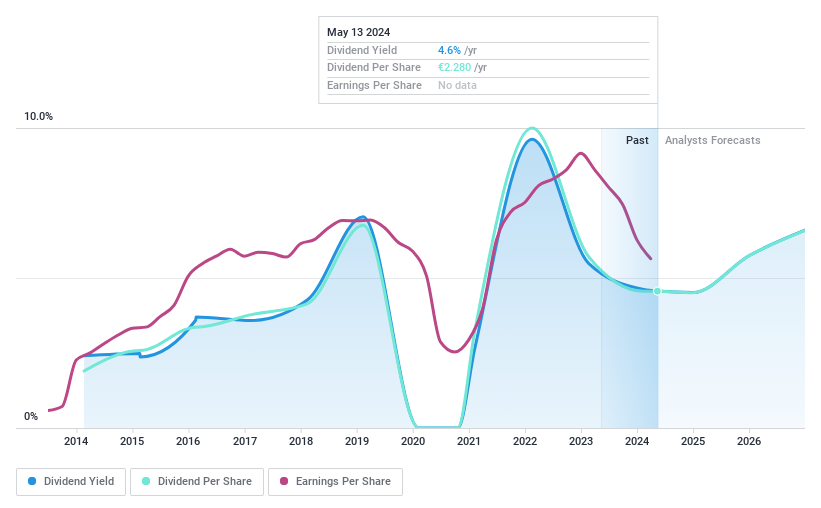

Signify

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. is a company that offers lighting products, systems, and services across Europe, the Americas, and internationally with a market cap of €2.85 billion.

Operations: Signify N.V.'s revenue is primarily derived from its Conventional segment, which generated €519 million.

Dividend Yield: 6.9%

Signify's dividend yield of 6.87% ranks in the top 25% among Dutch dividend payers, yet its track record is unstable with payments showing volatility over the past eight years. Despite recent earnings growth, with net income rising to €106 million for the first half of 2024, dividends are covered by both earnings (payout ratio: 80.4%) and cash flows (cash payout ratio: 34.2%). However, its removal from the FTSE All-World Index could impact investor sentiment.

Dive into the specifics of Signify here with our thorough dividend report.

Our valuation report here indicates Signify may be undervalued.

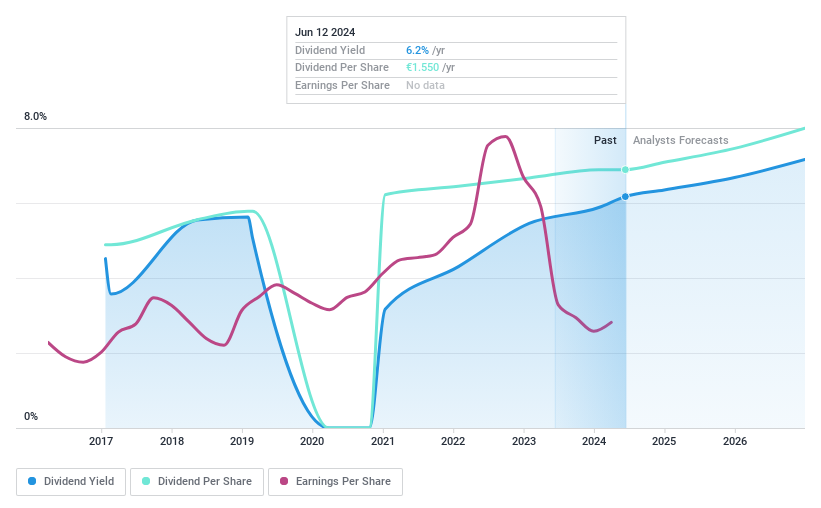

Randstad

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Randstad N.V. offers work and human resources (HR) services solutions and has a market cap of €7.79 billion.

Operations: Randstad N.V. generates its revenue from various segments within the work and human resources services industry.

Dividend Yield: 5.1%

Randstad's dividend yield of 5.13% is below the top 25% in the Dutch market, and its track record shows volatility over the past decade. Despite this, dividends are covered by earnings (payout ratio: 81.3%) and cash flows (cash payout ratio: 51.5%). Recent initiatives like a strategic partnership with iZafe Group AB for healthcare staffing in Norway highlight Randstad's adaptability, though recent earnings showed a decline with net income at €166 million for the first half of 2024 compared to €291 million previously.

Turning Ideas Into Actions

Unlock our comprehensive list of 7 Top Euronext Amsterdam Dividend Stocks by clicking here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:HEIJM ENXTAM:LIGHT and ENXTAM:RAND.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]