3 Dividend Stocks On Euronext Paris Yielding Up To 6.7%

The French stock market has recently seen gains, with the CAC 40 Index rising by 1.54%, buoyed by an interest rate cut from the European Central Bank amid signs of weakening economic growth and slowing inflation in the eurozone. In this context, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive option for investors seeking stability in uncertain times.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Vicat (ENXTPA:VCT) | 5.78% | ★★★★★★ |

Rubis (ENXTPA:RUI) | 8.18% | ★★★★★★ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.72% | ★★★★★☆ |

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.94% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.22% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 3.65% | ★★★★★☆ |

Samse (ENXTPA:SAMS) | 6.90% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 8.00% | ★★★★★☆ |

Trigano (ENXTPA:TRI) | 3.30% | ★★★★☆☆ |

Infotel (ENXTPA:INF) | 4.81% | ★★★★☆☆ |

Click here to see the full list of 34 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

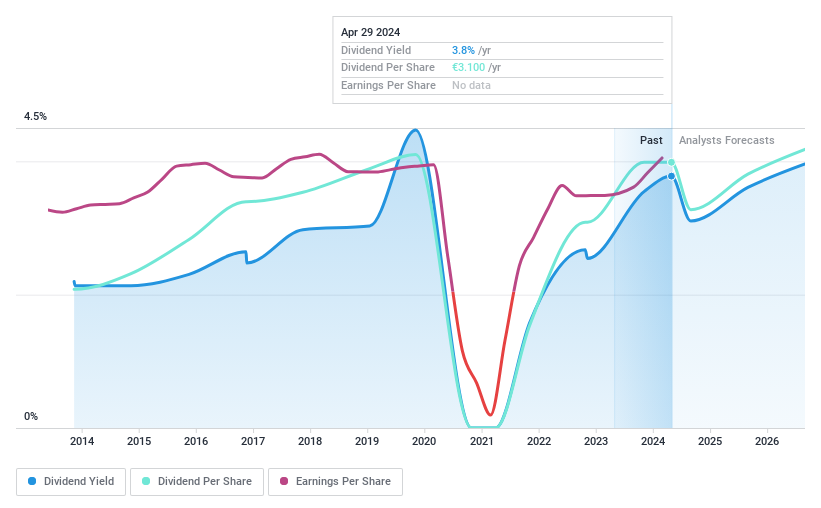

Sodexo

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sodexo S.A. offers food services and facilities management services globally, with a market cap of €11.62 billion.

Operations: Sodexo S.A. generates revenue from three primary regions: €8.30 billion in Europe, €10.74 billion in North America, and €4.12 billion from the rest of the world.

Dividend Yield: 3.9%

Sodexo's dividend payments have been volatile over the past decade, though they are well-covered by both earnings (payout ratio: 63.2%) and cash flows (cash payout ratio: 44%). The company's recent announcement of a special interim dividend of €6.24 per share highlights its commitment to returning value to shareholders. Despite having a high level of debt, Sodexo's recent upsizing of its Syndicated Revolving Credit Facility to €1.75 billion provides additional liquidity headroom and aligns with sustainability commitments.

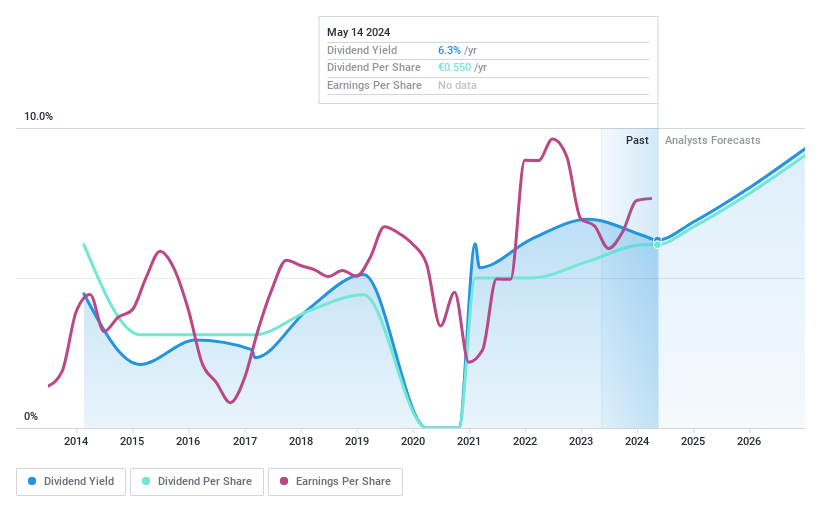

TF1

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TF1 SA operates in broadcasting, studios and entertainment, and digital businesses in France and internationally, with a market cap of €1.73 billion.

Operations: TF1 SA's revenue segments include Newen Studios (€377.40 million) and Media, including Digital (€2.06 billion).

Dividend Yield: 6.7%

TF1's dividend payments are covered by both earnings (62.2% payout ratio) and cash flows (53.3% cash payout ratio). However, the dividends have been volatile over the past decade and have not increased during this period. Despite a recent dip in net income for H1 2024 (€96 million vs €101.3 million a year ago), TF1 remains among the top 25% of dividend payers in France with a yield of 6.73%. The stock trades at good value compared to peers, being 75.2% below its estimated fair value.

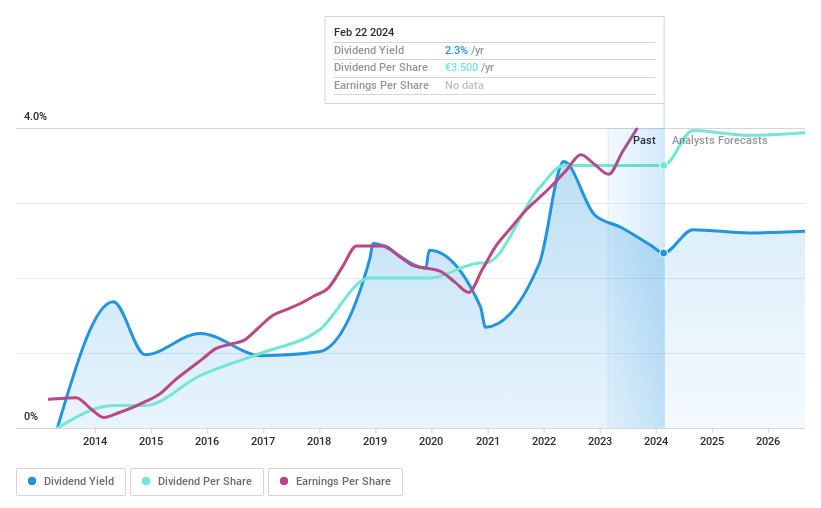

Trigano

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Trigano S.A., with a market cap of €2.05 billion, designs, manufactures, markets, and sells leisure vehicles for individuals and professionals in Europe through its subsidiaries.

Operations: Trigano S.A. generates revenue primarily from its Leisure Vehicles segment, which accounts for €3.59 billion, and its Leisure Equipment segment, contributing €188.90 million.

Dividend Yield: 3.3%

Trigano's dividend yield of 3.3% is lower than the top 25% of French dividend payers (5.55%). While dividends have been stable and growing over the past decade, they are not well covered by free cash flows or earnings, with a high cash payout ratio of 8451.5%. Despite trading at 10.6% below its fair value estimate and recent strong earnings growth (41.8%), future earnings are forecasted to decline by an average of 6.6% annually over the next three years.

Take a closer look at Trigano's potential here in our dividend report.

Upon reviewing our latest valuation report, Trigano's share price might be too pessimistic.

Key Takeaways

Unlock more gems! Our Top Euronext Paris Dividend Stocks screener has unearthed 31 more companies for you to explore.Click here to unveil our expertly curated list of 34 Top Euronext Paris Dividend Stocks.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:SW ENXTPA:TFI and ENXTPA:TRI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]