3 Dividend Stocks In US With Yields Up To 7.3%

The U.S. stock market has shown significant resilience, with the S&P 500 and Nasdaq posting their largest gains since 2022 as economic fears ease and technology stocks rally. Amid this backdrop of renewed optimism, dividend stocks remain a reliable choice for investors seeking steady income. In the current market environment, selecting dividend stocks with robust yields can provide both stability and attractive returns. Here are three U.S.-based dividend stocks offering yields up to 7.3%.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

BCB Bancorp (NasdaqGM:BCBP) | 5.66% | ★★★★★★ |

WesBanco (NasdaqGS:WSBC) | 4.79% | ★★★★★★ |

Columbia Banking System (NasdaqGS:COLB) | 6.14% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.05% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 5.05% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.60% | ★★★★★★ |

Dillard's (NYSE:DDS) | 5.51% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 5.23% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.80% | ★★★★★★ |

OTC Markets Group (OTCPK:OTCM) | 4.62% | ★★★★★★ |

Click here to see the full list of 184 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

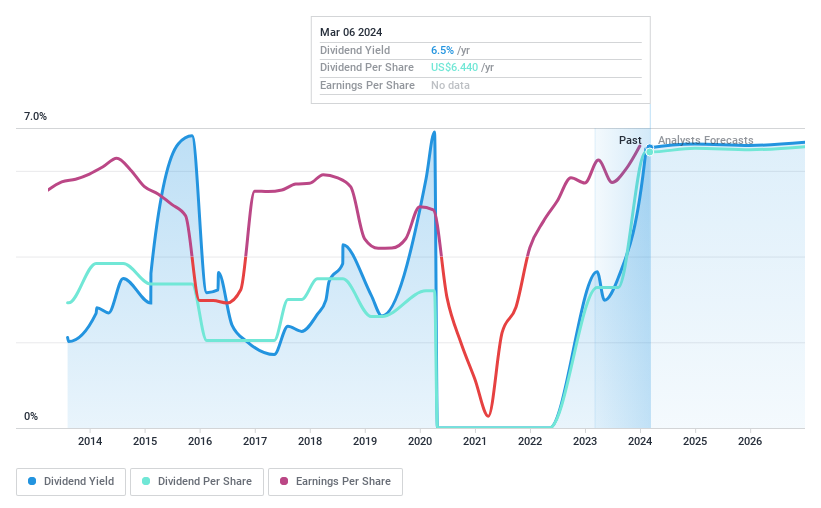

Copa Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Copa Holdings, S.A., with a market cap of $3.45 billion, operates through its subsidiaries to offer airline passenger and cargo services.

Operations: Copa Holdings, S.A. generates revenue primarily through its airline passenger and cargo services.

Dividend Yield: 7.4%

Copa Holdings reported strong earnings growth with net income rising to US$120.25 million for Q2 2024 from US$17.51 million a year ago, and revenue increasing to US$819.4 million from US$809.19 million. Despite a high dividend yield of 7.36%, the dividend is not well covered by free cash flows, posing sustainability concerns. The company announced its third dividend payment of 2024 at $1.61 per share, payable on September 13, reflecting ongoing shareholder returns despite historical volatility in payouts and recent shareholder dilution.

EOG Resources

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EOG Resources, Inc. explores for, develops, produces, and markets crude oil, natural gas liquids, and natural gas primarily in the United States and internationally with a market cap of approximately $70.01 billion.

Operations: EOG Resources, Inc. generates $24.11 billion in revenue from crude oil and natural gas exploration and production activities.

Dividend Yield: 4.1%

EOG Resources reported Q2 2024 earnings with revenue of US$6.03 billion and net income of US$1.69 billion, showing growth from the previous year. The company declared a regular dividend of $0.91 per share, payable on October 31, 2024, indicating an annual rate of $3.64 per share. Despite a volatile dividend history and lower yield compared to top-tier payers, EOG's dividends are well-covered by earnings (payout ratio: 27.3%) and cash flows (cash payout ratio: 57.8%).

LCI Industries

Simply Wall St Dividend Rating: ★★★★★☆

Overview: LCI Industries, with a market cap of $2.84 billion, manufactures and supplies engineered components for recreational vehicles (RVs) and adjacent industries both in the United States and internationally.

Operations: LCI Industries generates revenue from two main segments: Aftermarket, which contributes $878.43 million, and Original Equipment Manufacturer (OEM), which accounts for $2.94 billion.

Dividend Yield: 3.7%

LCI Industries' dividends are well-covered by cash flows (27.5% payout ratio) and earnings (87.8% payout ratio). The company has a reliable dividend history with stable and growing payments over the past 10 years, currently yielding 3.7%. Despite recent index exclusions and high debt levels, Q2 2024 earnings showed significant improvement with net income rising to US$61.16 million from US$33.43 million a year ago, supporting dividend sustainability.

Unlock comprehensive insights into our analysis of LCI Industries stock in this dividend report.

The valuation report we've compiled suggests that LCI Industries' current price could be inflated.

Next Steps

Gain an insight into the universe of 184 Top US Dividend Stocks by clicking here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NYSE:CPA NYSE:EOG and NYSE:LCII.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]