3 Euronext Amsterdam Growth Stocks With Strong Insider Confidence

As geopolitical tensions in the Middle East weigh on global markets, European indices, including those in the Netherlands, have experienced cautious investor sentiment. Despite these challenges, the Dutch market continues to offer opportunities for growth investors, particularly in companies where high insider ownership signals strong confidence from those most familiar with their potential. In this environment, identifying stocks with robust insider backing can be a key factor for investors seeking to navigate uncertainty and capitalize on long-term growth prospects.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

Name | Insider Ownership | Earnings Growth |

Envipco Holding (ENXTAM:ENVI) | 36.7% | 83.7% |

Ebusco Holding (ENXTAM:EBUS) | 31% | 107.8% |

MotorK (ENXTAM:MTRK) | 35.7% | 108.4% |

Basic-Fit (ENXTAM:BFIT) | 12% | 77.7% |

CVC Capital Partners (ENXTAM:CVC) | 20.2% | 31% |

PostNL (ENXTAM:PNL) | 35.6% | 36.4% |

Let's review some notable picks from our screened stocks.

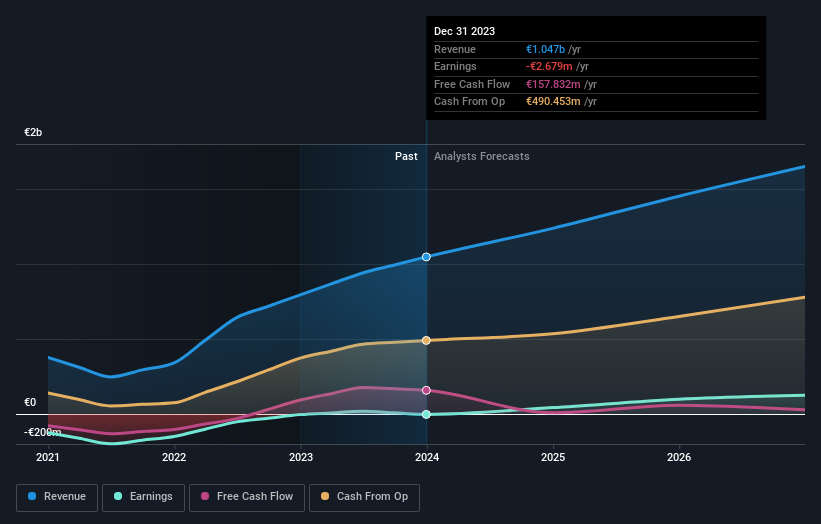

Basic-Fit

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V., along with its subsidiaries, operates fitness clubs and has a market cap of €1.64 billion.

Operations: The company's revenue segments consist of €505.17 million from Benelux and €626.41 million from France, Spain, and Germany.

Insider Ownership: 12%

Basic-Fit shows significant growth potential with expected annual earnings growth of 77.7%, outpacing the Dutch market's 18.4%. Despite a decline in profit margins, revenue is forecasted to grow at 14.8% annually, faster than the market average. However, interest payments aren't well covered by earnings and large one-off items impact financial results. Recent investor activism highlights potential strategic opportunities, including a sale that could unlock value given private equity interest and its valuable assets.

Dive into the specifics of Basic-Fit here with our thorough growth forecast report.

The valuation report we've compiled suggests that Basic-Fit's current price could be inflated.

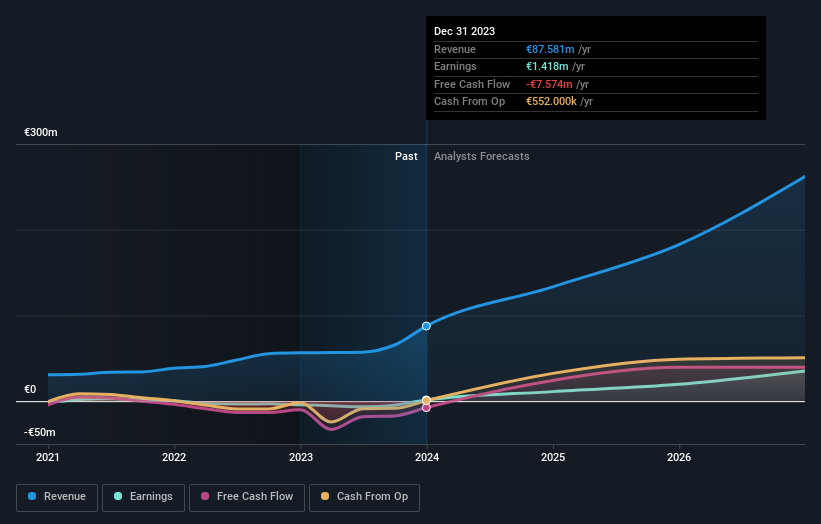

Envipco Holding

Simply Wall St Growth Rating: ★★★★★★

Overview: Envipco Holding N.V. specializes in the design, development, and servicing of reverse vending machines for collecting used beverage containers across the Netherlands, North America, and Europe, with a market cap of €305.76 million.

Operations: Envipco Holding N.V. generates revenue through the design, manufacturing, and servicing of reverse vending machines for used beverage container collection in key markets including the Netherlands, North America, and Europe.

Insider Ownership: 36.7%

Envipco Holding demonstrates strong growth potential with forecasted annual earnings growth of 83.7%, significantly outpacing the Dutch market's 18.4%. Revenue is expected to grow at 34.6% annually, surpassing market averages. Recent orders from a major Romanian retail group indicate expanding operations, though past shareholder dilution and share price volatility present challenges. Despite recent board changes, Envipco's profitability has improved this year, reflecting its strategic positioning in the recycling sector.

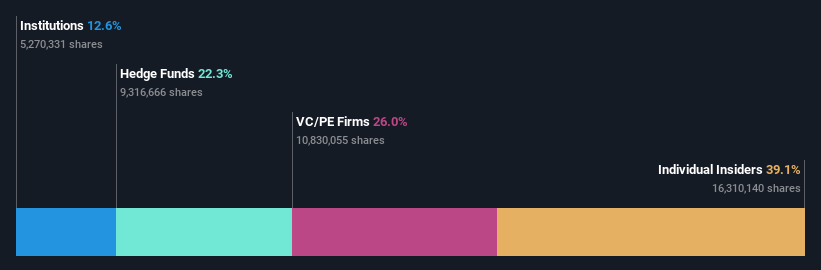

MotorK

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc offers software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union with a market cap of €266.54 million.

Operations: The company generates revenue of €42.50 million from its software-as-a-service offerings tailored for the automotive retail sector in Italy, Spain, France, Germany, and the Benelux Union.

Insider Ownership: 35.7%

MotorK's revenue is projected to grow at 22.1% annually, outpacing the Dutch market's 9.5%. Earnings are forecast to increase by 108.44% per year, with profitability expected within three years, indicating strong growth potential despite recent losses of €6.48 million for H1 2024. The company has undergone executive changes with Zoltan Gelencser appointed as CFO, bringing extensive experience from major global firms, which may bolster its financial strategy amidst limited cash runway challenges.

Unlock comprehensive insights into our analysis of MotorK stock in this growth report.

Our valuation report here indicates MotorK may be overvalued.

Next Steps

Delve into our full catalog of 6 Fast Growing Euronext Amsterdam Companies With High Insider Ownership here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTAM:BFIT ENXTAM:ENVI and ENXTAM:MTRK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]