3 Euronext Paris Dividend Stocks Yielding Up To 5.3%

The French stock market has shown resilience, with the CAC 40 Index advancing by 2.48% amid growing hopes for interest rate cuts in the near future. As investors look for stability and income in these dynamic times, dividend stocks on Euronext Paris offer an attractive option. In this article, we will explore three such dividend stocks yielding up to 5.3%, highlighting their potential as reliable sources of income within a robust economic framework.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Vicat (ENXTPA:VCT) | 6.53% | ★★★★★★ |

Rubis (ENXTPA:RUI) | 7.21% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.86% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 6.08% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.41% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 4.05% | ★★★★★☆ |

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.84% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.44% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 8.33% | ★★★★★☆ |

Eiffage (ENXTPA:FGR) | 4.45% | ★★★★☆☆ |

Click here to see the full list of 35 stocks from our Top Euronext Paris Dividend Stocks screener.

We'll examine a selection from our screener results.

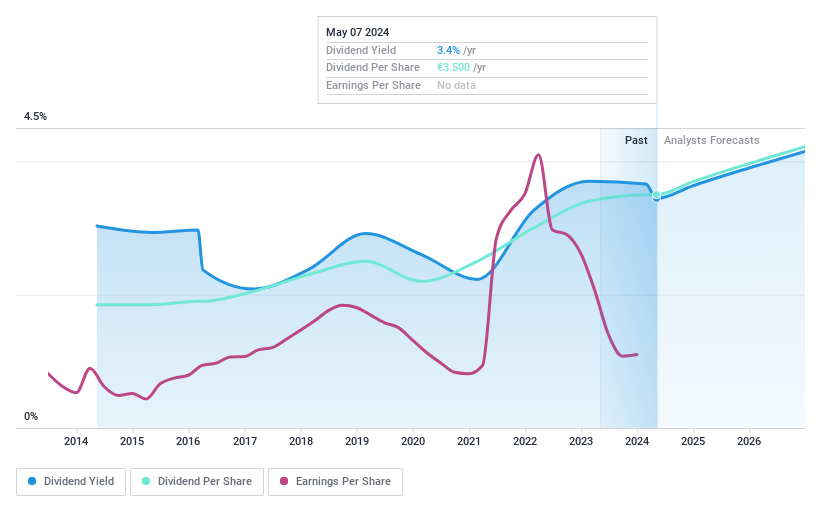

Arkema

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Arkema S.A. is a global manufacturer and seller of specialty chemicals and advanced materials, with a market cap of approximately €5.93 billion.

Operations: Arkema S.A. generates its revenue from four main segments: Intermediates (€779 million), Coating Solutions (€2.39 billion), Adhesive Solutions (€2.71 billion), and Advanced Materials (€3.51 billion).

Dividend Yield: 4.4%

Arkema S.A. is actively seeking acquisitions, notably in flexible packaging laminating adhesives, which could enhance shareholder value. Recent earnings showed a slight decline with sales at €4.88 billion and net income at €224 million for H1 2024. Despite lower earnings, Arkema offers a reliable dividend yield of 4.41%, with stable and growing payouts over the past decade, well-covered by both earnings (76.4% payout ratio) and cash flows (47% cash payout ratio).

Click here and access our complete dividend analysis report to understand the dynamics of Arkema.

Our valuation report here indicates Arkema may be undervalued.

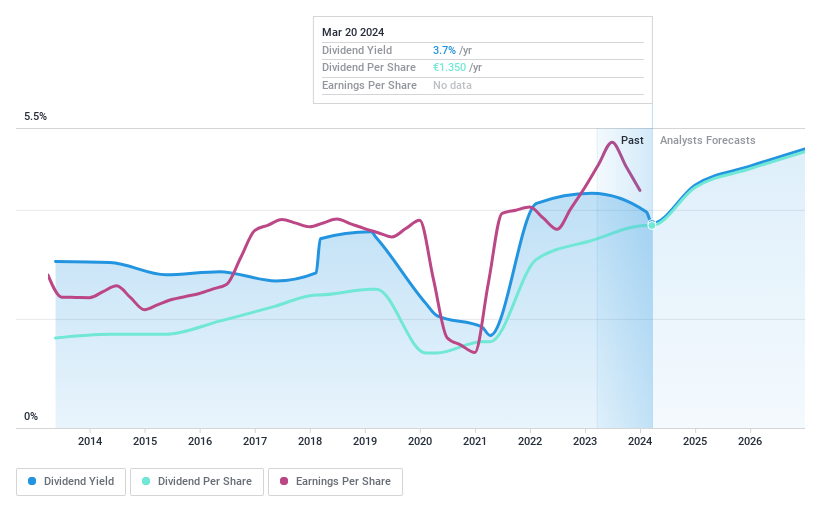

Gaztransport & Technigaz

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gaztransport & Technigaz SA is a technology and engineering company that offers cryogenic membrane containment systems for the maritime transportation and storage of liquefied gas and LNG, with a market cap of €5.06 billion.

Operations: Gaztransport & Technigaz SA generates revenue primarily from its core business including services (€530.73 million) and hydrogen (€13.96 million).

Dividend Yield: 5.4%

Gaztransport & Technigaz reported strong H1 2024 earnings with net income of €170.31 million, up from €84.03 million a year ago, and announced an interim dividend of €3.67 per share for 2024. Despite the high payout ratio (79.4%), dividends are not well covered by free cash flow (139.7% cash payout ratio). The company's dividends have been volatile over the past decade but show growth potential, supported by recent robust earnings performance and strategic client partnerships like Argent LNG's development project.

Compagnie Générale des établissements Michelin Société en commandite par actions

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Compagnie Générale des établissements Michelin Société en commandite par actions manufactures and sells tires worldwide, with a market cap of €24.68 billion.

Operations: Compagnie Générale des établissements Michelin Société en commandite par actions generates revenue from three main segments: Automotive and Related Distribution (€14.16 billion), Road Transportation and Related Distribution (€6.84 billion), and Specialty Businesses and Related Distribution (€6.74 billion).

Dividend Yield: 3.9%

Compagnie Générale des établissements Michelin Société en commandite par actions reported H1 2024 earnings with net income of €1.16 billion, down from €1.22 billion a year ago. Despite a volatile dividend track record, the company maintains a sustainable payout ratio (50.2%) and covers dividends with cash flows (32.6% cash payout ratio). Recent strategic alliances in biotechnology could bolster long-term growth, though the current dividend yield (3.88%) is below top-tier market payers in France (5.38%).

Seize The Opportunity

Explore the 35 names from our Top Euronext Paris Dividend Stocks screener here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:AKE ENXTPA:GTT and ENXTPA:ML.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]