3 Euronext Paris Growth Companies With High Insider Ownership Expecting Up To 49% Earnings Growth

The French market has been buoyed by optimism surrounding potential interest rate cuts from both the Federal Reserve and the European Central Bank, with the CAC 40 Index gaining 1.71% recently. Amid this positive economic backdrop, growth companies with high insider ownership can present compelling investment opportunities due to their alignment of interests between management and shareholders. In this context, we explore three Euronext Paris-listed growth companies that not only exhibit strong insider ownership but are also projecting earnings growth of up to 49%.

Top 10 Growth Companies With High Insider Ownership In France

Name | Insider Ownership | Earnings Growth |

Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 36% |

VusionGroup (ENXTPA:VU) | 13.4% | 25.7% |

Adocia (ENXTPA:ADOC) | 11.9% | 63% |

Icape Holding (ENXTPA:ALICA) | 30.2% | 35.1% |

Arcure (ENXTPA:ALCUR) | 21.4% | 27.5% |

La Fran?aise de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

S.M.A.I.O (ENXTPA:ALSMA) | 17.4% | 35.2% |

Munic (ENXTPA:ALMUN) | 29.2% | 149.2% |

MedinCell (ENXTPA:MEDCL) | 15.8% | 93.9% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

Here's a peek at a few of the choices from the screener.

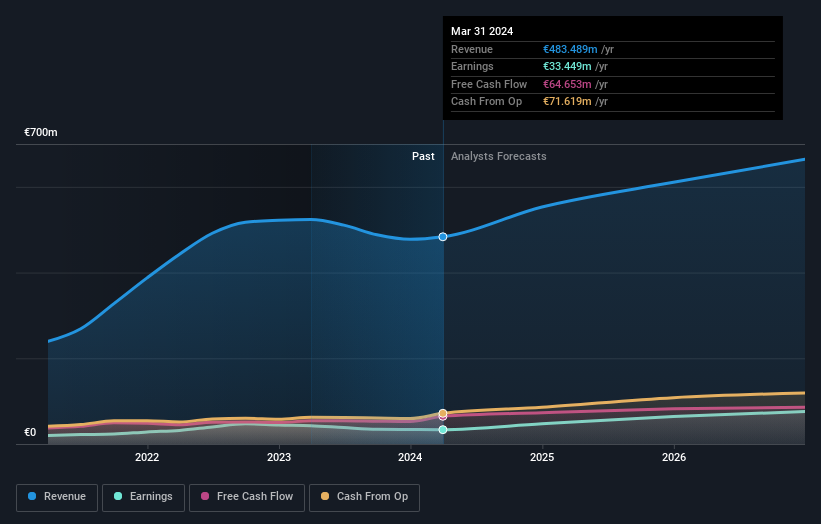

Lectra

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA provides industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of €1.06 billion.

Operations: The company's revenue segments are as follows: Americas: €172.65 million, Asia-Pacific: €118.54 million, and Segment Adjustment: €209.13 million.

Insider Ownership: 19.6%

Earnings Growth Forecast: 29.3% p.a.

Lectra exhibits strong growth potential with earnings forecasted to grow 29.3% annually, significantly outpacing the French market's 12.2%. Revenue is also expected to increase at a rate of 10.4% per year, above the market average of 5.8%. Despite trading at 46.3% below its estimated fair value, recent half-year results showed a slight decline in net income to €12.51 million from €14.47 million, impacting earnings per share from €0.38 to €0.33.

Get an in-depth perspective on Lectra's performance by reading our analyst estimates report here.

The valuation report we've compiled suggests that Lectra's current price could be quite moderate.

Eurazeo

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eurazeo SE is a private equity and venture capital firm that focuses on growth capital, acquisitions, leveraged buyouts, and investments in mid-market and listed public companies, with a market cap of €5.17 billion.

Operations: Eurazeo SE generates revenue through growth capital, acquisitions, leveraged buyouts, and investments in mid-market and listed public companies.

Insider Ownership: 12.1%

Earnings Growth Forecast: 49.9% p.a.

Eurazeo demonstrates strong growth potential with revenue expected to grow 47.4% annually, significantly above the French market's average of 5.8%. Despite reporting a net loss of €104.56 million for H1 2024, the company is forecasted to become profitable within three years and has completed a €109 million share buyback. Trading at 84% below its estimated fair value, analysts predict a stock price increase of 29%.

Click here to discover the nuances of Eurazeo with our detailed analytical future growth report.

Upon reviewing our latest valuation report, Eurazeo's share price might be too pessimistic.

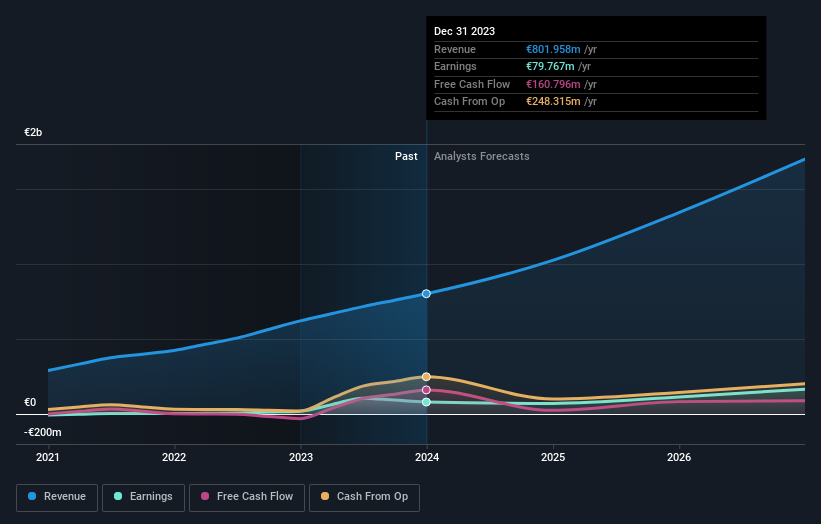

VusionGroup

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America, with a market cap of €2.19 billion.

Operations: Revenue from installing and maintaining electronic shelf labels amounts to €801.96 million.

Insider Ownership: 13.4%

Earnings Growth Forecast: 25.7% p.a.

VusionGroup, a growth company with high insider ownership, has seen its earnings grow by 320.8% over the past year and is forecasted to achieve annual revenue growth of 21.3%, surpassing the French market average. Recent partnerships with Ace Hardware and Hy-Vee highlight its innovative digital solutions, enhancing operational efficiency and customer experience. Analysts expect VusionGroup’s stock price to rise by 41.1%, driven by significant earnings growth projected at 25.7% annually over the next three years.

Make It Happen

Reveal the 23 hidden gems among our Fast Growing Euronext Paris Companies With High Insider Ownership screener with a single click here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTPA:LSS ENXTPA:RF and ENXTPA:VU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]