3 Euronext Paris Stocks Estimated To Be Undervalued By Up To 47.9%

As global markets respond to China's robust stimulus measures, European indices like France's CAC 40 have seen significant gains, reflecting renewed investor optimism. Amidst this positive sentiment, identifying undervalued stocks can offer compelling opportunities for investors looking to capitalize on market inefficiencies. In the current environment, a good stock is often characterized by strong fundamentals and potential for growth despite broader economic uncertainties. Here are three Euronext Paris stocks estimated to be undervalued by up to 47.9%.

Top 10 Undervalued Stocks Based On Cash Flows In France

Name | Current Price | Fair Value (Est) | Discount (Est) |

SPIE (ENXTPA:SPIE) | €34.32 | €53.46 | 35.8% |

NSE (ENXTPA:ALNSE) | €29.60 | €57.44 | 48.5% |

Vivendi (ENXTPA:VIV) | €10.42 | €18.11 | 42.5% |

Lectra (ENXTPA:LSS) | €28.80 | €53.52 | 46.2% |

Groupe Berkem Société anonyme (ENXTPA:ALKEM) | €3.06 | €5.09 | 39.8% |

Vogo (ENXTPA:ALVGO) | €3.19 | €6.36 | 49.9% |

Exail Technologies (ENXTPA:EXA) | €17.42 | €34.23 | 49.1% |

VusionGroup (ENXTPA:VU) | €154.00 | €295.48 | 47.9% |

Solutions 30 (ENXTPA:S30) | €1.373 | €2.48 | 44.7% |

Pullup Entertainment Société anonyme (ENXTPA:ALPUL) | €21.60 | €38.91 | 44.5% |

Let's review some notable picks from our screened stocks.

Edenred

Overview: Edenred SE operates a global digital platform offering services and payments for companies, employees, and merchants, with a market cap of €8.63 billion.

Operations: Edenred SE generates €2.50 billion in revenue from its Business Services segment, which includes digital services and payment solutions for companies, employees, and merchants worldwide.

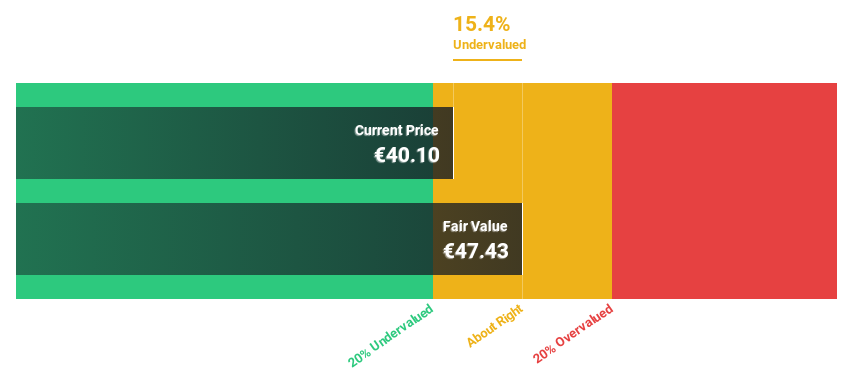

Estimated Discount To Fair Value: 15%

Edenred is trading at €35.21, 15% below its estimated fair value of €41.44, indicating potential undervaluation based on cash flows. Despite a high level of debt and profit margins decreasing from 19.6% to 12%, its revenue and earnings are forecast to grow faster than the French market at 10.1% and 19.2% per year, respectively. Recent earnings reports show strong performance with net income rising to €235 million for H1 2024 from €202 million last year, alongside a completed share buyback worth €115 million.

OVH Groupe

Overview: OVH Groupe S.A. offers public and private cloud services, shared hosting, and dedicated server solutions globally, with a market cap of approximately €1.29 billion.

Operations: The company's revenue segments include Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web Cloud & Other (€185.43 million).

Estimated Discount To Fair Value: 25.1%

OVH Groupe is trading at €6.79, 25.1% below its estimated fair value of €9.06, highlighting its potential undervaluation based on discounted cash flow analysis. Despite a highly volatile share price over the past three months, OVH is forecast to become profitable within the next three years and achieve earnings growth of 101.12% annually. However, its return on equity is expected to remain low at 1.7%, and revenue growth (9.7% per year) will outpace the French market but stay below 20%.

VusionGroup

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America, with a market cap of €2.47 billion.

Operations: The company's revenue primarily comes from installing and maintaining electronic shelf labels, which generated €830.16 million.

Estimated Discount To Fair Value: 47.9%

VusionGroup is trading significantly below its fair value estimate of €295.48 at €154, suggesting potential undervaluation based on discounted cash flow analysis. Despite reporting a net loss of €24.4 million for H1 2024, the company’s revenue grew to €408.9 million from €380.7 million year-over-year. With forecasted annual revenue growth of 28.4% and earnings growth of 81.78%, VusionGroup is expected to become profitable within three years, bolstered by strategic partnerships like Ace Hardware's digital shelf label integration.

Navigate through the intricacies of VusionGroup with our comprehensive financial health report here.

Summing It All Up

Explore the 23 names from our Undervalued Euronext Paris Stocks Based On Cash Flows screener here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:EDEN ENXTPA:OVH and ENXTPA:VU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]