3 Growth Companies On Euronext Amsterdam With Insider Ownership And Up To 35% Revenue Growth

In the Netherlands, the market has been buoyed by recent interest rate cuts by the European Central Bank, which have fueled expectations for further monetary easing and contributed to gains in major stock indexes. Amidst this economic backdrop, growth companies with high insider ownership on Euronext Amsterdam are capturing attention due to their potential for robust revenue growth of up to 35%. Identifying such stocks often involves looking at factors like strong management alignment through insider ownership and a proven track record of revenue expansion.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

Name | Insider Ownership | Earnings Growth |

Ebusco Holding (ENXTAM:EBUS) | 31% | 107.8% |

Envipco Holding (ENXTAM:ENVI) | 36.7% | 84% |

MotorK (ENXTAM:MTRK) | 35.7% | 108.4% |

Basic-Fit (ENXTAM:BFIT) | 12% | 77.7% |

CVC Capital Partners (ENXTAM:CVC) | 20.2% | 33.5% |

PostNL (ENXTAM:PNL) | 35.6% | 38.6% |

We'll examine a selection from our screener results.

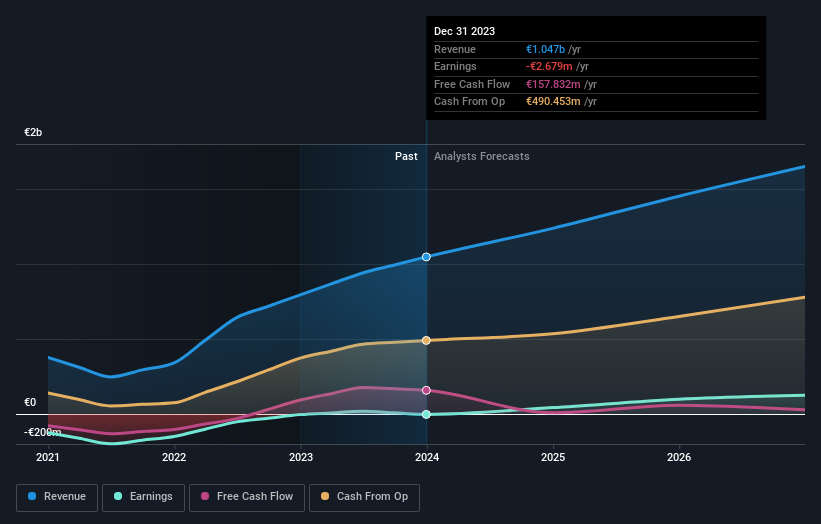

Basic-Fit

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V., along with its subsidiaries, operates fitness clubs and has a market cap of €1.66 billion.

Operations: The company generates revenue from its fitness clubs with €505.17 million coming from the Benelux region and €626.41 million from France, Spain, and Germany.

Insider Ownership: 12%

Revenue Growth Forecast: 14.8% p.a.

Basic-Fit shows promising growth potential, with revenue and earnings projected to outpace the Dutch market significantly. Despite lower profit margins compared to last year, its return on equity is expected to be high in three years. Recent investor activism highlights potential strategic opportunities, though management remains uninterested in a sale. The company reported improved financials for H1 2024, with sales reaching €584.76 million and a net income of €4.18 million from a prior loss.

CVC Capital Partners

Simply Wall St Growth Rating: ★★★★★☆

Overview: CVC Capital Partners plc is a private equity and venture capital firm that focuses on middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts with a market cap of €21.93 billion.

Operations: CVC Capital Partners plc does not have specific revenue segments listed in the provided text.

Insider Ownership: 20.2%

Revenue Growth Forecast: 13.6% p.a.

CVC Capital Partners is poised for substantial growth, with earnings expected to rise significantly faster than the Dutch market. Its return on equity is forecasted to be very high in three years. Despite trading below its estimated fair value, CVC's high debt level could be a concern. Recent M&A activities, including interest in HPS Investment Partners and Deutsche Bahn’s logistics unit, highlight strategic expansion efforts but also underscore competitive challenges in securing deals.

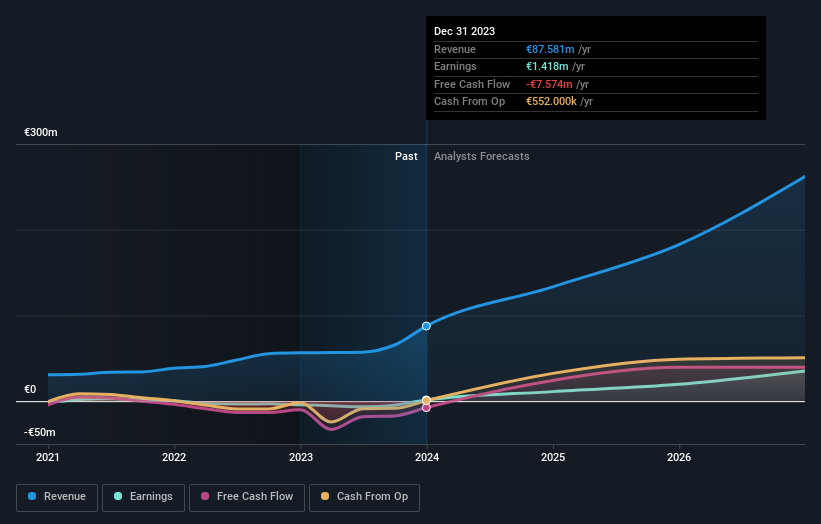

Envipco Holding

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. operates in the design, development, manufacturing, assembly, marketing, sales, leasing, and servicing of reverse vending machines for collecting and processing used beverage containers across the Netherlands, North America, and Europe with a market cap of €294.22 million.

Operations: Envipco generates revenue through the design, development, and servicing of reverse vending machines for the collection and processing of used beverage containers in key markets including the Netherlands, North America, and Europe.

Insider Ownership: 36.7%

Revenue Growth Forecast: 35.6% p.a.

Envipco Holding demonstrates robust growth potential, with earnings projected to increase significantly faster than the Dutch market. Recent client announcements include a substantial follow-on order from a major Romanian retail group for over 140 Optima RVMs, indicating expanding market presence. Despite achieving profitability this year and strong revenue forecasts, the company has experienced shareholder dilution recently. Board changes and auditor appointments reflect ongoing corporate governance adjustments amid its volatile share price history.

Turning Ideas Into Actions

Unlock more gems! Our Fast Growing Euronext Amsterdam Companies With High Insider Ownership screener has unearthed 3 more companies for you to explore.Click here to unveil our expertly curated list of 6 Fast Growing Euronext Amsterdam Companies With High Insider Ownership.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTAM:BFIT ENXTAM:CVC and ENXTAM:ENVI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]