3 High Growth Companies With Strong Insider Ownership On TSX

In the last week, the Canadian market has been flat, with a notable 3.4% drop in the Materials sector, yet it has risen 8.6% over the past 12 months and earnings are forecast to grow by 15% annually. In this environment, growth companies with strong insider ownership can be particularly attractive as they often align management's interests with those of shareholders and demonstrate confidence in future prospects.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Vox Royalty (TSX:VOXR) | 12.6% | 63.4% |

Allied Gold (TSX:AAUC) | 22.5% | 68.9% |

goeasy (TSX:GSY) | 21.5% | 17.1% |

Payfare (TSX:PAY) | 14.7% | 37.7% |

Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

Ivanhoe Mines (TSX:IVN) | 12.3% | 40.9% |

Alpha Cognition (CNSX:ACOG) | 17.9% | 66.5% |

Aya Gold & Silver (TSX:AYA) | 10.3% | 68.5% |

Silver X Mining (TSXV:AGX) | 14.1% | 144.2% |

Almonty Industries (TSX:AII) | 17.7% | 105% |

Let's review some notable picks from our screened stocks.

Canfor

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Canfor Corporation is an integrated forest products company with operations in the United States, Asia, Canada, Europe, and internationally, and has a market cap of CA$1.72 billion.

Operations: The company's revenue segments are comprised of CA$4.67 billion from Lumber and CA$825 million from Pulp & Paper.

Insider Ownership: 22.4%

Canfor Corporation, a growth company with high insider ownership in Canada, reported Q2 2024 sales of CAD 1.38 billion and a net loss of CAD 191.1 million. Despite recent losses, analysts forecast earnings to grow by 71.82% annually and expect the company to become profitable within three years. CEO Don Kayne's upcoming retirement marks a significant leadership transition, with Susan Yurkovich set to take over in January 2025, bringing extensive industry experience to the role.

Knight Therapeutics

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Knight Therapeutics Inc. develops, manufactures, acquires, licenses, markets, and distributes pharmaceutical and consumer health products as well as medical devices worldwide with a market cap of CA$589.07 million.

Operations: Knight Therapeutics generates revenue through the development, manufacturing, acquisition, licensing, marketing, and distribution of pharmaceutical and consumer health products as well as medical devices globally.

Insider Ownership: 22.3%

Knight Therapeutics, with substantial insider ownership, reported Q2 2024 sales of CAD 95.57 million, up from CAD 89.91 million a year ago, but faced a net loss of CAD 1.94 million compared to net income of CAD 1.84 million previously. Despite recent losses and slower revenue growth forecasts (6.9% per year), the company has revised its annual revenue guidance upwards to between $355 million and $365 million and announced a share repurchase program for up to 5.24% of its shares.

Vitalhub

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. (TSX:VHI) provides technology solutions for health and human service providers across multiple regions including Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally, with a market cap of CA$444.46 million.

Operations: Vitalhub's revenue segments include technology solutions for health and human service providers in Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally.

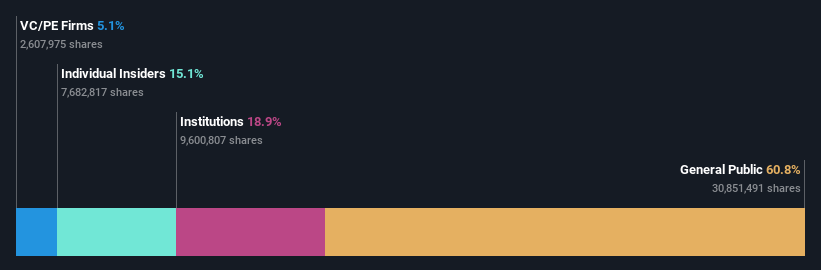

Insider Ownership: 15.1%

Vitalhub, a growth company with high insider ownership, reported Q2 2024 revenue of CAD 16.24 million, up from CAD 13.09 million a year ago, but faced a net loss of CAD 0.34 million compared to net income of CAD 0.62 million previously. Despite recent losses and shareholder dilution over the past year, the company's earnings are forecast to grow significantly at 63.3% per year over the next three years, outpacing market expectations.

Key Takeaways

Embark on your investment journey to our 36 Fast Growing TSX Companies With High Insider Ownership selection here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:CFP TSX:GUD and TSX:VHI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]