3 Indian Dividend Stocks With Yields Up To 8.5%

Over the last 7 days, the Indian market has dropped 1.1%, but it has risen by an impressive 41% over the past year, with earnings expected to grow by 17% per annum in the coming years. In this dynamic environment, identifying dividend stocks with solid yields can provide a steady income stream and potential for capital appreciation.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Castrol India (BSE:500870) | 3.26% | ★★★★★★ |

Balmer Lawrie Investments (BSE:532485) | 3.99% | ★★★★★★ |

D. B (NSEI:DBCORP) | 5.01% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.20% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.64% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.55% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.10% | ★★★★★☆ |

Canara Bank (NSEI:CANBK) | 3.05% | ★★★★★☆ |

Bank of Baroda (NSEI:BANKBARODA) | 3.17% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.70% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top Indian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Gulf Oil Lubricants India

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gulf Oil Lubricants India Limited manufactures, markets, and trades lubricants for the automobile and industrial sectors in India, with a market cap of ?65.41 billion.

Operations: Gulf Oil Lubricants India Limited generates ?33.83 billion in revenue from its lubricants segment.

Dividend Yield: 3%

Gulf Oil Lubricants India Limited's dividend payments are covered by earnings with a payout ratio of 57.4% and cash flows at 62.7%. Recent earnings showed strong growth, with net income rising to ?860.38 million in Q1 2024 from ?680.22 million a year ago, supporting its dividend sustainability despite past volatility. The stock trades at a favorable P/E ratio of 20.1x compared to the Indian market average of 33x, making it an attractive option for dividend investors seeking value.

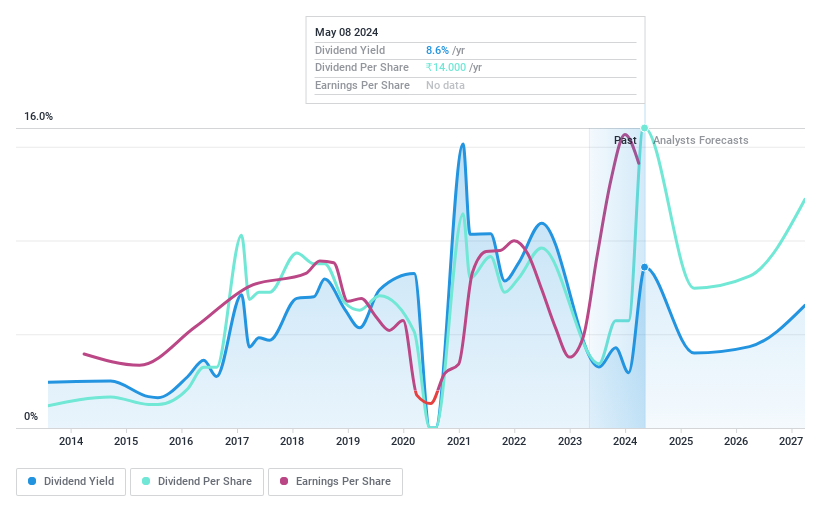

Indian Oil

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Indian Oil Corporation Limited, along with its subsidiaries, engages in the refining, pipeline transportation, and marketing of petroleum products both in India and internationally, with a market cap of ?2.25 trillion.

Operations: Indian Oil Corporation Limited generates revenue primarily from petroleum products amounting to ?8.25 billion and petrochemicals totaling ?262.95 million.

Dividend Yield: 8.6%

Indian Oil Corporation's dividend payments have been volatile over the past decade but are covered by earnings (39.6% payout ratio) and cash flows (56.8% cash payout ratio). The stock trades at a favorable P/E ratio of 7.3x, well below the Indian market average of 33x, indicating good value. Despite an unstable track record, recent increases in dividends and strong earnings growth last year bolster its appeal for dividend investors.

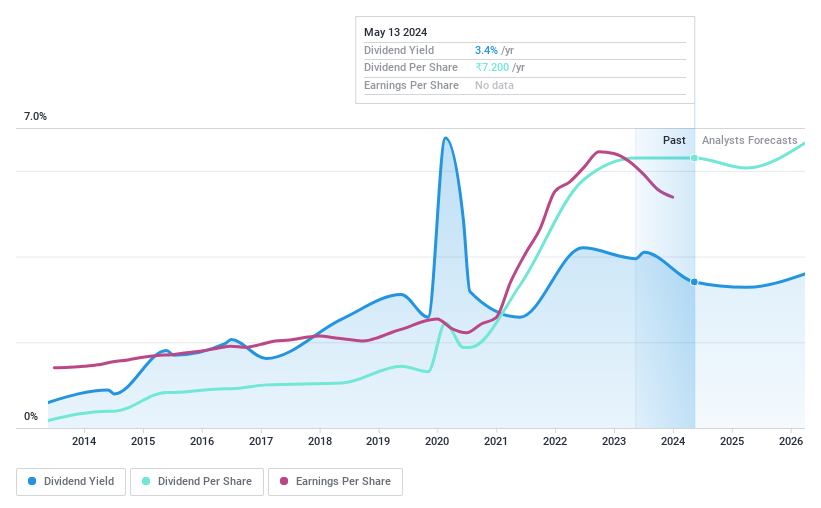

Redington

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Redington Limited, with a market cap of ?156.39 billion, provides supply chain solutions both in India and internationally.

Operations: Redington Limited generates revenue through its supply chain solutions business, which operates both domestically and globally.

Dividend Yield: 3.1%

Redington Limited recently declared a dividend of INR 6.20 per share for FY2024, though its dividend history has been volatile over the past decade. The company's dividends are well-covered by earnings (39.8% payout ratio) and cash flows (50.6% cash payout ratio). Despite modest revenue growth in Q1 2024, net income slightly declined to INR 2.46 billion from INR 2.49 billion year-over-year, indicating potential challenges ahead for sustaining dividend increases.

Get an in-depth perspective on Redington's performance by reading our dividend report here.

Our expertly prepared valuation report Redington implies its share price may be lower than expected.

Where To Now?

Unlock our comprehensive list of 21 Top Indian Dividend Stocks by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:GULFOILLUB NSEI:IOC and NSEI:REDINGTON.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance