### 3 Indian Growth Stocks With Up To 36% Earnings Growth ###

Over the last 7 days, the Indian market has risen 2.6%, driven by gains in every sector. In the last year, the market has climbed 44%, with earnings expected to grow by 17% per annum over the next few years. In this thriving environment, growth companies with high insider ownership can be particularly promising as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Kirloskar Pneumatic (BSE:505283) | 30.6% | 30.1% |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 35% |

Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 36.6% |

Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 21.8% |

Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.7% |

KEI Industries (BSE:517569) | 19.1% | 20.4% |

Aether Industries (NSEI:AETHER) | 31.1% | 43.6% |

Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

Underneath we present a selection of stocks filtered out by our screen.

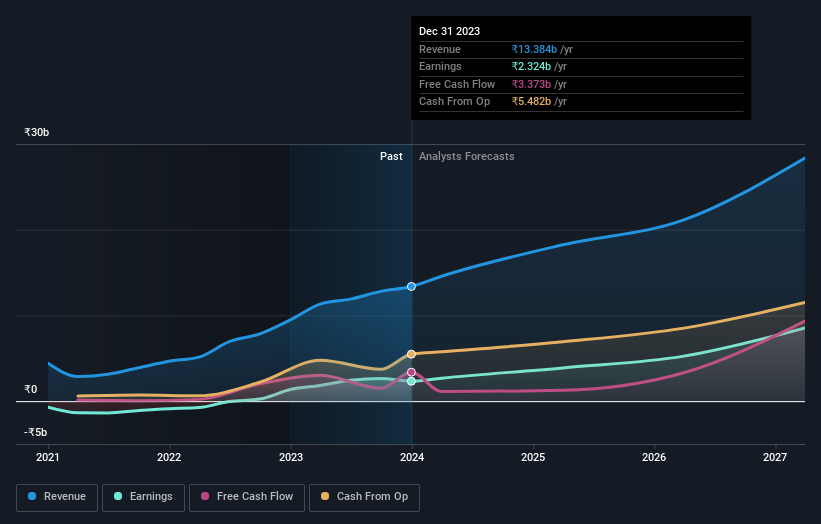

Chalet Hotels

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chalet Hotels Limited owns, develops, manages, and operates hotels and resorts in India with a market cap of ?168.94 billion.

Operations: Chalet Hotels generates revenue primarily from its Hospitality (Hotels) segment, which accounts for ?13.36 billion, and its Rental/Annuity Business segment, contributing ?1.31 billion.

Insider Ownership: 11.9%

Earnings Growth Forecast: 36.3% p.a.

Chalet Hotels Limited, with high insider ownership, is expanding its portfolio by acquiring a land parcel in Goa for INR 1.37 billion to develop a 5-star luxury hotel. Despite reporting lower net income of INR 606.69 million for Q1 FY2024 compared to the previous year, Chalet's revenue and earnings are forecasted to grow significantly faster than the Indian market. However, interest payments are not well covered by earnings and shareholders have faced dilution over the past year.

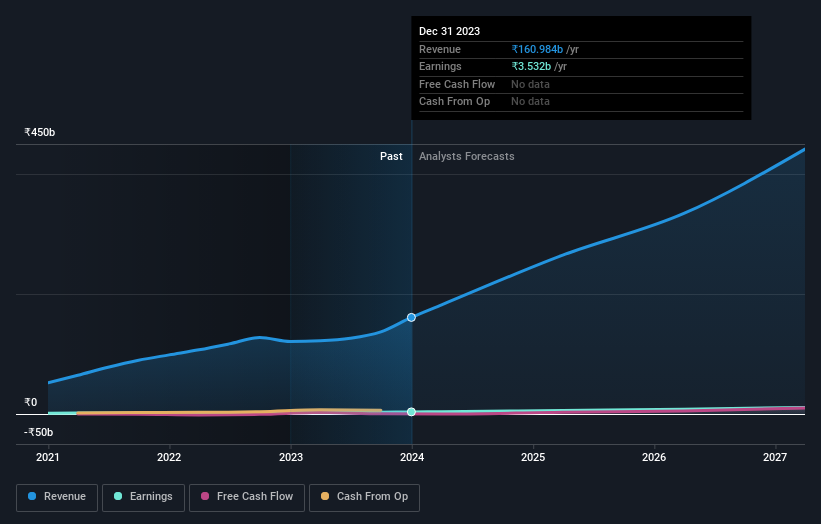

Dixon Technologies (India)

Simply Wall St Growth Rating: ★★★★★★

Overview: Dixon Technologies (India) Limited provides electronic manufacturing services in India and has a market cap of ?762.09 billion.

Operations: The company's revenue segments include Home Appliances (?12.51 billion), Lighting Products (?7.92 billion), Mobile & EMS Division (?143.16 billion), and Consumer Electronics & Appliances (?41.21 billion).

Insider Ownership: 24.6%

Earnings Growth Forecast: 36.6% p.a.

Dixon Technologies (India) Limited, with high insider ownership, reported strong Q1 2024 results, doubling revenue to ?65.88 billion and net income to ?1.34 billion compared to the previous year. The company's earnings are forecasted to grow significantly over the next three years at 36.6% annually, outpacing the Indian market's growth rate. Recent management changes include appointing Sunil Ranjhan as Chief Human Resource Officer, enhancing leadership depth and strategic HR capabilities.

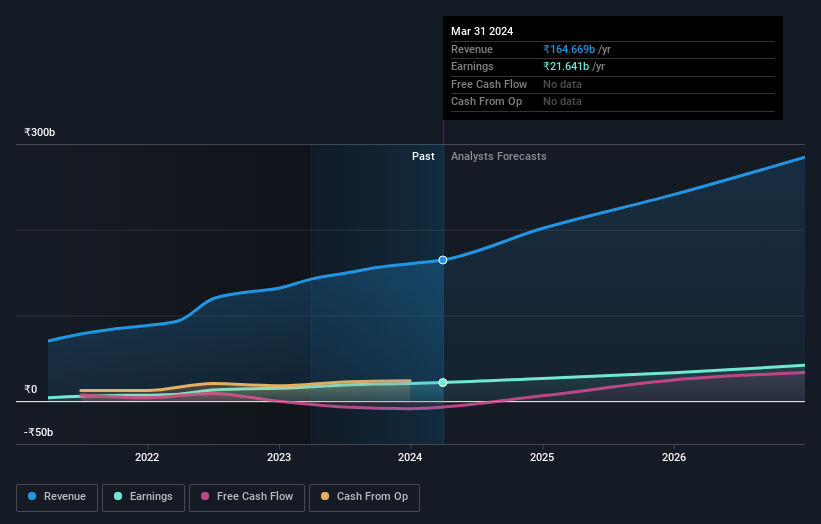

Varun Beverages

Simply Wall St Growth Rating: ★★★★★☆

Overview: Varun Beverages Limited, with a market cap of ?2.01 trillion, operates as the franchisee for PepsiCo's carbonated soft drinks and non-carbonated beverages through its subsidiaries.

Operations: Varun Beverages generates ?180.52 billion from the manufacturing and sale of beverages, including carbonated soft drinks and non-carbonated beverages under PepsiCo trademarks.

Insider Ownership: 36.3%

Earnings Growth Forecast: 22.3% p.a.

Varun Beverages, with high insider ownership, reported robust Q2 2024 results, showing revenue of ?73.78 billion and net income of ?12.53 billion, up from the previous year. Earnings are forecasted to grow significantly at 22.3% annually over the next three years, outpacing the Indian market's growth rate. Recent developments include a proposed stock split and an interim dividend of ?1.25 per share for FY 2024, reflecting strong financial health despite high debt levels.

Turning Ideas Into Actions

Unlock our comprehensive list of 93 Fast Growing Indian Companies With High Insider Ownership by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:CHALET NSEI:DIXON and NSEI:VBL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]