3 Indian Stocks Possibly Trading Below Fair Value Estimates In August 2024

Over the last 7 days, the Indian market has risen 1.1% and is up 42% over the last 12 months, with earnings forecast to grow by 17% annually. In this robust market environment, identifying stocks that are potentially trading below their fair value can offer significant opportunities for investors.

Top 10 Undervalued Stocks Based On Cash Flows In India

Name | Current Price | Fair Value (Est) | Discount (Est) |

NIIT Learning Systems (NSEI:NIITMTS) | ?457.90 | ?714.79 | 35.9% |

Everest Kanto Cylinder (NSEI:EKC) | ?167.31 | ?304.56 | 45.1% |

Krsnaa Diagnostics (NSEI:KRSNAA) | ?660.85 | ?1165.33 | 43.3% |

RITES (NSEI:RITES) | ?654.10 | ?1045.26 | 37.4% |

Prataap Snacks (NSEI:DIAMONDYD) | ?833.85 | ?1509.79 | 44.8% |

Patel Engineering (BSE:531120) | ?51.13 | ?89.99 | 43.2% |

Texmaco Rail & Engineering (NSEI:TEXRAIL) | ?245.30 | ?395.12 | 37.9% |

Rajesh Exports (NSEI:RAJESHEXPO) | ?295.60 | ?590.84 | 50% |

Piramal Pharma (NSEI:PPLPHARMA) | ?182.73 | ?289.56 | 36.9% |

Strides Pharma Science (NSEI:STAR) | ?1226.30 | ?2032.10 | 39.7% |

Let's explore several standout options from the results in the screener.

Fusion Finance

Overview: Fusion Finance Limited, a non-banking financial company with a market cap of ?29.08 billion, provides micro finance lending services to women entrepreneurs in rural and semi-urban areas in India.

Operations: Fusion Finance's revenue from micro financing activities amounts to ?10.98 billion.

Estimated Discount To Fair Value: 24.3%

Fusion Finance, trading at ?288.9, is undervalued based on cash flows with an estimated fair value of ?381.51. Despite recent earnings showing a net loss of INR 356.2 million for Q1 2024, revenue increased to INR 7.07 billion from INR 5.53 billion a year ago. Earnings are expected to grow significantly over the next three years at 24.7% per year, outpacing the Indian market's forecasted growth rate of 16.9%.

Happiest Minds Technologies

Overview: Happiest Minds Technologies Limited offers IT solutions and services across multiple regions including India, the United States, Canada, and several other countries, with a market cap of ?116.29 billion.

Operations: The company's revenue segments include IT solutions and services provided across India, the United States, Canada, the United Kingdom, Australia, the Netherlands, Singapore, Malaysia, New Zealand, Mexico, Africa, and the Middle East.

Estimated Discount To Fair Value: 25%

Happiest Minds Technologies, trading at ?751.4, is undervalued with a fair value estimate of ?1001.69. Despite recent earnings showing a decline in net income to INR 510.3 million from INR 583.3 million year-over-year, the company’s revenue grew to INR 4,892.6 million from INR 4,045.3 million. Earnings and revenue are forecasted to grow significantly at over 20% per year, outpacing the Indian market's growth rates and indicating strong future potential despite past shareholder dilution concerns.

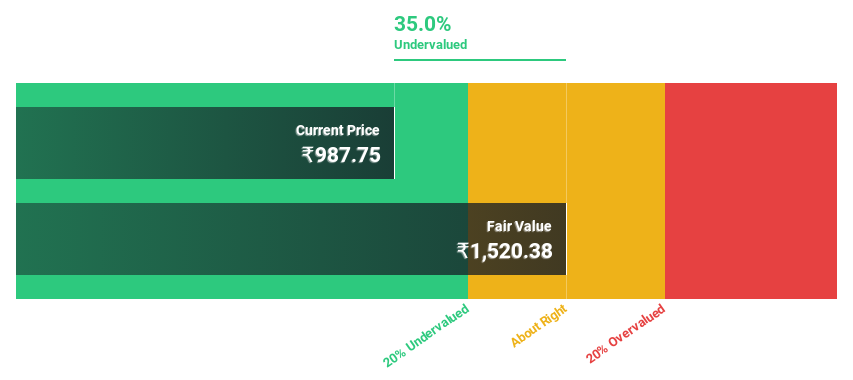

Strides Pharma Science

Overview: Strides Pharma Science Limited develops, manufactures, and sells pharmaceutical products across various regions including Africa, Australia, North America, Europe, Asia, India and internationally with a market cap of ?108.43 billion.

Operations: The company's revenue from the pharmaceutical business, excluding the bio-pharmaceutical segment, amounts to ?42.09 billion.

Estimated Discount To Fair Value: 39.7%

Strides Pharma Science, trading at ?1226.3, is undervalued with a fair value estimate of ?2032.1. The company reported significant revenue growth to ?11 billion in Q1 2024 from ?9.39 billion the previous year and turned a net loss into a net income of ?702 million. Forecasted annual profit growth is high, and earnings are expected to grow 98% per year, outpacing the Indian market's average growth rate significantly.

Summing It All Up

Explore the 32 names from our Undervalued Indian Stocks Based On Cash Flows screener here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:FUSION NSEI:HAPPSTMNDS and NSEI:STAR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]