3 Key Dividend Stocks Offering Up To 4.3% Yield

As global markets navigate through a mix of trade tensions and shifting investment trends, investors are increasingly looking for stable returns in uncertain times. Dividend stocks, known for their potential to provide steady income, can be particularly appealing against this backdrop of mixed economic signals and market volatility.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.31% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 5.01% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.64% | ★★★★★★ |

Guaranty Trust Holding (NGSE:GTCO) | 7.11% | ★★★★★★ |

Mitsubishi Shokuhin (TSE:7451) | 3.56% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.61% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 4.38% | ★★★★★★ |

James Latham (AIM:LTHM) | 5.81% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.58% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.19% | ★★★★★★ |

Click here to see the full list of 2032 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Maytronics

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Maytronics Ltd. specializes in the development, production, marketing, distribution, and technical support of swimming pool equipment across various global markets including Israel, North America, Europe, and Oceania, with a market capitalization of approximately ?1.72 billion.

Operations: Maytronics Ltd. generates revenue primarily through the sale of safety products and related pool products (?315.69 million), the manufacture of robots for cleaning public pools (?102.66 million), and the manufacture of robots for cleaning private pools (?1.40 billion).

Dividend Yield: 4.4%

Maytronics Ltd. recently adjusted its 2024 revenue and gross margin forecasts due to underperforming Q1 results, with revenues potentially decreasing by up to 2% or increasing by up to 4%, and gross margins expected between 40% and 41%. Despite a low dividend yield of 4.37% compared to the market's top dividend payers at 6.62%, Maytronics' dividends are reasonably covered by earnings with a payout ratio of 74.1%. However, the company's dividend history has been marked by volatility over the past decade, reflecting an unstable track record in consistent payments, further compounded by a highly volatile share price in recent months.

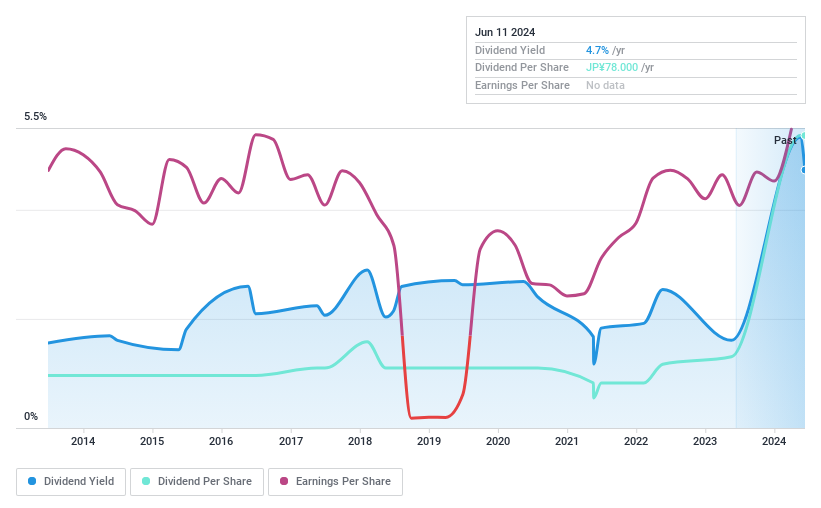

Tohokushinsha Film

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tohokushinsha Film Corporation, based in Japan, operates as a media business company with a market capitalization of approximately ¥76.19 billion.

Operations: Tohokushinsha Film Corporation generates its revenue through various media-related business activities in Japan.

Dividend Yield: 3.9%

Tohokushinsha Film has recently attracted attention with a potential acquisition by 3D Investment Partners, offering a buyout at a premium, which could lead to privatization due to low public share circulation. The company announced dividends of ¥19.00-¥20.00 per share for upcoming quarters but noted a significant dividend cut from ¥78.00 last year to ¥20.00 this year-end, signaling volatility in its dividend policy despite being covered by earnings and cash flows with respective ratios of 28.4% and 63.4%.

Get an in-depth perspective on Tohokushinsha Film's performance by reading our dividend report here.

Selena FM

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Selena FM S.A. operates in the production and distribution of construction chemicals, building materials for doors and windows, and general building accessories, serving both professional and individual users with a market cap of PLN 830.94 million.

Operations: Selena FM S.A. generates revenue primarily from its operations in Western Europe (PLN 445.59 million), Eastern Europe and Asia (PLN 477.81 million), production in Poland (PLN 674.85 million), and distribution within Poland (PLN 358.15 million).

Dividend Yield: 3.9%

Selena FM S.A. has demonstrated a mixed performance in its dividend reliability, with payments showing volatility over the last decade despite being well-covered by both earnings and cash flows, with payout ratios of 46.2% and 36.9% respectively. Recently, the company reported a significant recovery in its first-quarter earnings for 2024, posting a net income of PLN 19.09 million compared to a net loss the previous year and trading at a substantial discount to estimated fair value. However, its dividend yield remains low at 3.91%, underperforming against top market payers.

Dive into the specifics of Selena FM here with our thorough dividend report.

Upon reviewing our latest valuation report, Selena FM's share price might be too pessimistic.

Summing It All Up

Access the full spectrum of 2032 Top Dividend Stocks by clicking on this link.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TASE:MTRN TSE:2329 and WSE:SEL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]