3 Leading SGX Dividend Stocks Yielding Up To 5.7%

The Singapore market has shown resilience amidst global economic uncertainties, with major indices maintaining steady performance. In this context, dividend stocks have garnered attention for their potential to provide consistent income streams. A good dividend stock typically combines strong financial health with a history of reliable dividend payments, making it an attractive option in today's market conditions.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

BRC Asia (SGX:BEC) | 7.11% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.75% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.49% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.17% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 7.44% | ★★★★★☆ |

QAF (SGX:Q01) | 6.13% | ★★★★★☆ |

Genting Singapore (SGX:G13) | 4.82% | ★★★★☆☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.30% | ★★★★☆☆ |

Oversea-Chinese Banking (SGX:O39) | 5.77% | ★★★★☆☆ |

Delfi (SGX:P34) | 7.14% | ★★★★☆☆ |

Click here to see the full list of 18 stocks from our Top SGX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

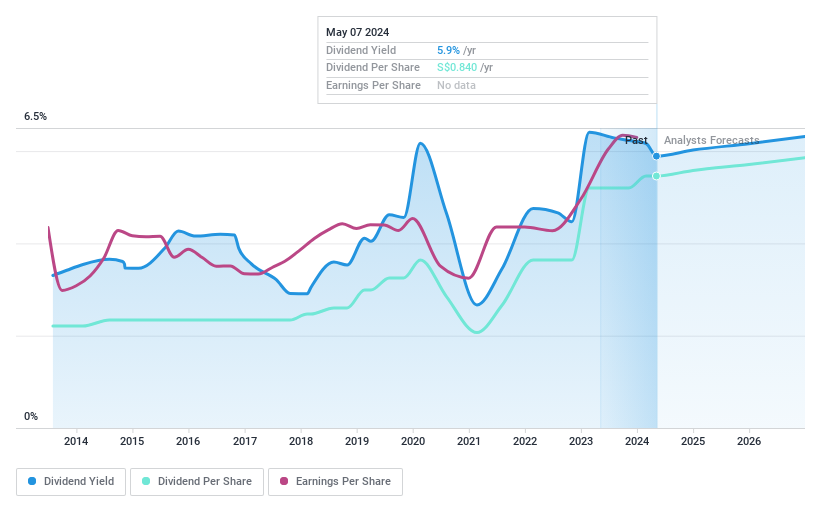

DBS Group Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd provides commercial banking and financial services across Singapore, Hong Kong, Greater China, South and Southeast Asia, and internationally, with a market cap of SGD107.51 billion.

Operations: DBS Group Holdings Ltd's revenue segments include Institutional Banking (SGD9.18 billion), Consumer Banking/Wealth Management (SGD9.34 billion), and Treasury Markets (SGD695 million).

Dividend Yield: 5.7%

DBS Group Holdings' dividends are currently covered by earnings with a payout ratio of 54.1%, and this is expected to remain sustainable over the next three years at 65.4%. Despite a volatile dividend history, recent earnings growth supports stability. The stock trades at 49.8% below its estimated fair value, offering potential upside for investors seeking undervalued opportunities in the Singapore market. Recent leadership changes may influence future strategic directions but do not immediately impact dividend reliability.

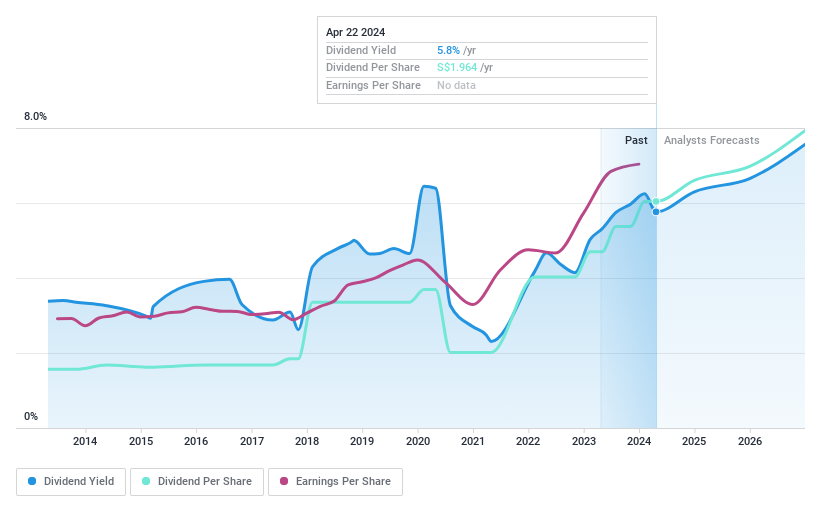

Oversea-Chinese Banking

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oversea-Chinese Banking Corporation Limited, along with its subsidiaries, provides financial services across Singapore, Malaysia, Indonesia, Greater China, the rest of the Asia Pacific region, and internationally, with a market cap of SGD68.56 billion.

Operations: Oversea-Chinese Banking Corporation Limited generates revenue from several segments, including Insurance (SGD1.27 billion), Global Markets (SGD512 million), Global Wholesale Banking (SGD5.23 billion), and Global Consumer/Private Banking (SGD5.19 billion).

Dividend Yield: 5.8%

Oversea-Chinese Banking Corporation's dividends are currently covered by earnings with a payout ratio of 52.8%, and this is forecast to remain sustainable at 54.4% over the next three years. Despite a volatile dividend history, recent earnings growth of 12.8% supports potential stability. The stock trades at 62.1% below its estimated fair value, presenting an attractive opportunity for investors seeking undervalued dividend stocks in Singapore’s market, though volatility remains a concern.

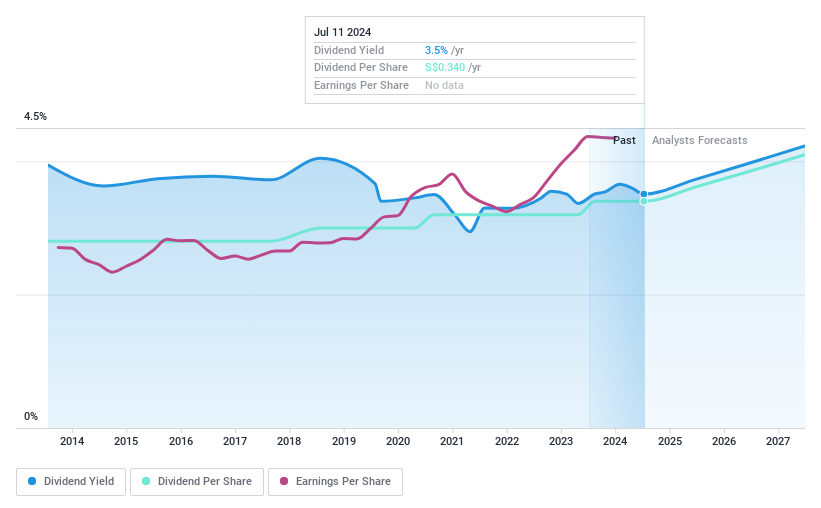

Singapore Exchange

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Exchange Limited operates an integrated securities and derivatives exchange, related clearing houses, and an electricity market in Singapore, with a market cap of SGD12.18 billion.

Operations: Singapore Exchange Limited generates revenue from several segments, including Equities - Cash (SGD334.94 million), Platform and Others (SGD240.20 million), Equities - Derivatives (SGD334.05 million), and Fixed Income, Currencies and Commodities (SGD322.50 million).

Dividend Yield: 3.2%

Singapore Exchange offers a reliable dividend yield of 3.17%, supported by stable earnings growth of 7.1% annually over the past five years. The payout ratio stands at a reasonable 61.7%, ensuring dividends are well-covered by both earnings and cash flows (cash payout ratio: 70%). Recent financial results show revenue at S$1.23 billion with net income rising to S$597.91 million, indicating continued profitability and dividend sustainability, despite trading below estimated fair value by 12%.

Delve into the full analysis dividend report here for a deeper understanding of Singapore Exchange.

Our valuation report here indicates Singapore Exchange may be overvalued.

Where To Now?

Investigate our full lineup of 18 Top SGX Dividend Stocks right here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:D05 SGX:O39 and SGX:S68.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]