3 SEHK Dividend Stocks Yielding Up To 9.5%

As global markets react to the U.S. Federal Reserve's recent rate cut, Hong Kong's Hang Seng Index has shown a notable 5.12% gain, reflecting investor optimism amid broader economic uncertainties. In this dynamic environment, dividend stocks can offer a stable income stream and potential for capital appreciation. When considering dividend stocks in such market conditions, it's essential to look for companies with strong financial health and consistent payout histories. Here are three SEHK dividend stocks yielding up to 9.5% that investors might find appealing in the current climate.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Consun Pharmaceutical Group (SEHK:1681) | 9.23% | ★★★★★☆ |

China Hongqiao Group (SEHK:1378) | 9.90% | ★★★★★☆ |

Chongqing Rural Commercial Bank (SEHK:3618) | 7.79% | ★★★★★☆ |

China Construction Bank (SEHK:939) | 7.05% | ★★★★★☆ |

Bank of China (SEHK:3988) | 7.00% | ★★★★★☆ |

PC Partner Group (SEHK:1263) | 9.64% | ★★★★★☆ |

China Electronics Huada Technology (SEHK:85) | 9.55% | ★★★★★☆ |

Tianjin Development Holdings (SEHK:882) | 7.72% | ★★★★★☆ |

China Resources Land (SEHK:1109) | 6.02% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 5.09% | ★★★★★☆ |

Click here to see the full list of 86 stocks from our Top SEHK Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

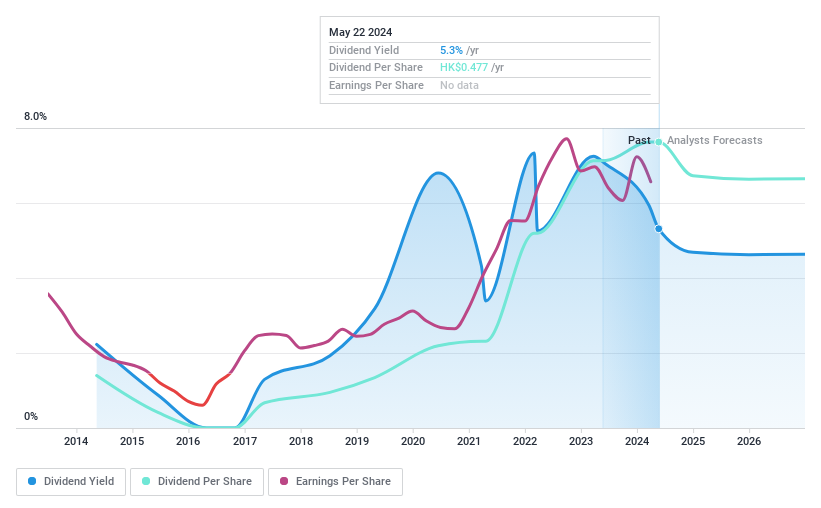

China Coal Energy

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Coal Energy Company Limited mines, produces, processes, trades in, and sells coal both within the People’s Republic of China and internationally, with a market cap of HK$183.22 billion.

Operations: China Coal Energy Company Limited generates revenue primarily from its Coal Division (CN¥146.92 billion), followed by the Coal Chemical Division (CN¥21.00 billion), the Coal Mine Equipment Division (CN¥11.67 billion), and the Financial Division (CN¥2.55 billion).

Dividend Yield: 5.1%

China Coal Energy's recent interim dividend of RMB 0.221 per share and a final dividend of RMB 0.442 per share reflect its commitment to returning value to shareholders, despite a decline in sales and net income for H1 2024 (CNY 92.98 billion and CNY 10.70 billion respectively). Production volumes for key products like commercial coal and polyethylene have shown stability, though some declines were noted in methanol and urea.

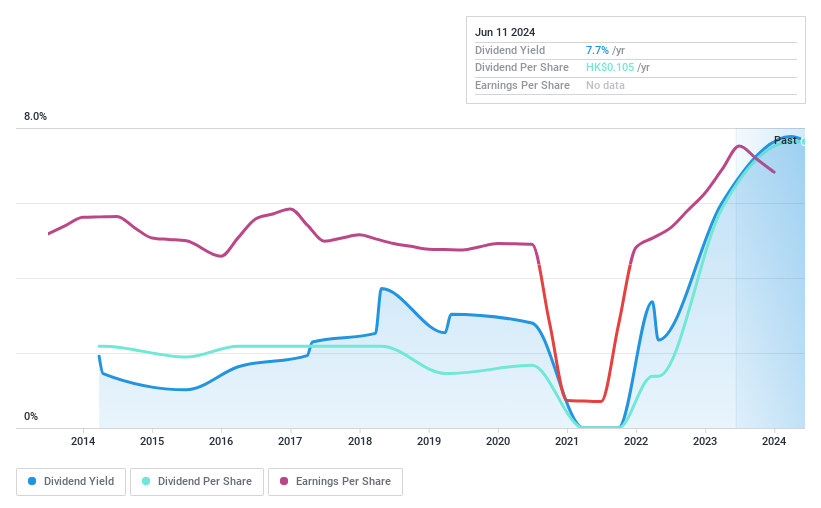

China Electronics Huada Technology

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Electronics Huada Technology Company Limited, with a market cap of HK$2.23 billion, focuses on the design, development, and sale of integrated circuit chips in the People’s Republic of China.

Operations: The company generated HK$2.57 billion in revenue from the design and sale of integrated circuit chips.

Dividend Yield: 9.5%

China Electronics Huada Technology's recent dividend of HK$0.105 per share was approved at the AGM, reflecting a commitment to shareholder returns despite a decline in sales and net income for H1 2024 (HK$1.36 billion and HK$309.55 million respectively). The company's dividends are well covered by earnings (37.7% payout ratio) and cash flows (26.5% cash payout ratio), although it has an unstable dividend track record over the past decade.

Xinyi Glass Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinyi Glass Holdings Limited, with a market cap of HK$32.99 billion, produces and sells automobile, construction, float, and other glass products for commercial and industrial applications.

Operations: Xinyi Glass Holdings Limited generates revenue from three main segments: Float Glass (HK$20.30 billion), Automobile Glass (HK$6.25 billion), and Architectural Glass (HK$3.30 billion).

Dividend Yield: 8.7%

Xinyi Glass Holdings declared an interim dividend of HK$0.31 per share for H1 2024, offering a scrip option. Despite a decline in sales to HK$11.81 billion, net income rose to HK$2.73 billion, with EPS up from HK$0.52 to HK$0.65 year-over-year. The company’s dividend yield is among the top 25% in Hong Kong but is not well covered by free cash flows and has been volatile over the past decade despite growth in earnings last year.

Next Steps

Dive into all 86 of the Top SEHK Dividend Stocks we have identified here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1898 SEHK:85 and SEHK:868.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]