3 SEHK Growth Stocks With High Insider Ownership

As global markets navigate a complex economic landscape, the Hang Seng Index in Hong Kong recently experienced a significant decline, reflecting broader concerns about China's economic outlook and waning optimism over stimulus measures. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

Akeso (SEHK:9926) | 20.5% | 53% |

Fenbi (SEHK:2469) | 33.1% | 22.4% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

DPC Dash (SEHK:1405) | 38.1% | 104.2% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

Beijing Airdoc Technology (SEHK:2251) | 29.4% | 93.4% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 69.7% |

Kindstar Globalgene Technology (SEHK:9960) | 16.6% | 88% |

Underneath we present a selection of stocks filtered out by our screen.

ESR Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ESR Group Limited operates in logistics real estate development, leasing, and management across various regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe and globally; it has a market cap of HK$52.05 billion.

Operations: The company's revenue segments include Fund Management at $627.98 million and New Economy Development at $113.33 million.

Insider Ownership: 13%

Revenue Growth Forecast: 16.4% p.a.

ESR Group faces challenges with recent leadership changes and a reported net loss of US$218.72 million for H1 2024, compared to a profit last year. Despite this, it trades significantly below its estimated fair value and is forecasted to achieve profitability within three years, with an expected annual profit growth rate of 78.86%. Revenue growth is projected at 16.4% per year, outpacing the Hong Kong market's average rate.

Navigate through the intricacies of ESR Group with our comprehensive analyst estimates report here.

Upon reviewing our latest valuation report, ESR Group's share price might be too optimistic.

Lianlian DigiTech

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lianlian DigiTech Co., Ltd. provides digital payment and value-added services to small and midsized merchants and enterprises in China, with a market capitalization of approximately HK$10.56 billion.

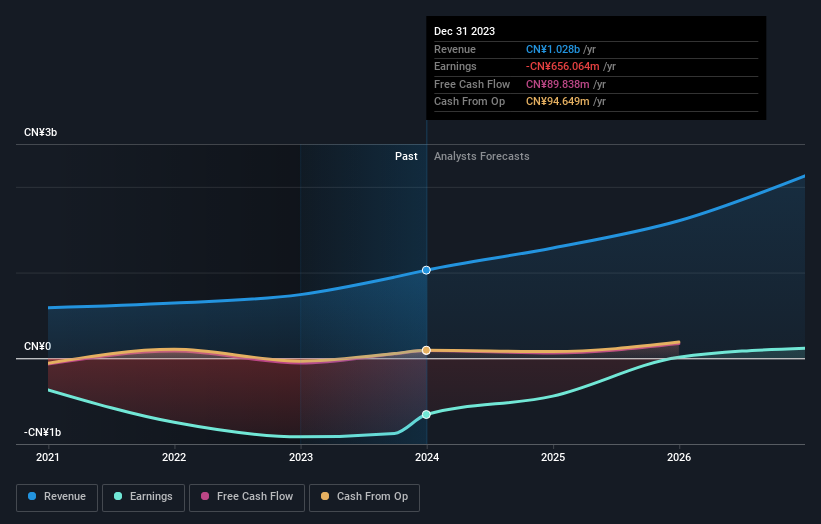

Operations: The company's revenue is derived from three main segments: Global Payment (CN¥722.95 million), Domestic Payment (CN¥309.92 million), and Value-Added Services (CN¥153.01 million).

Insider Ownership: 19.7%

Revenue Growth Forecast: 22.3% p.a.

Lianlian DigiTech reported H1 2024 sales of CNY 617.39 million, up from CNY 440.59 million a year ago, with a reduced net loss of CNY 351.29 million. Revenue is projected to grow at an impressive rate of 22.3% annually, outpacing the Hong Kong market's average growth rate of 7.3%. While profitability is anticipated within three years, its forecasted return on equity remains modest at 14.3%, reflecting potential challenges despite strong growth prospects and insider confidence.

Take a closer look at Lianlian DigiTech's potential here in our earnings growth report.

Our valuation report unveils the possibility Lianlian DigiTech's shares may be trading at a premium.

Vobile Group

Simply Wall St Growth Rating: ★★★★★☆

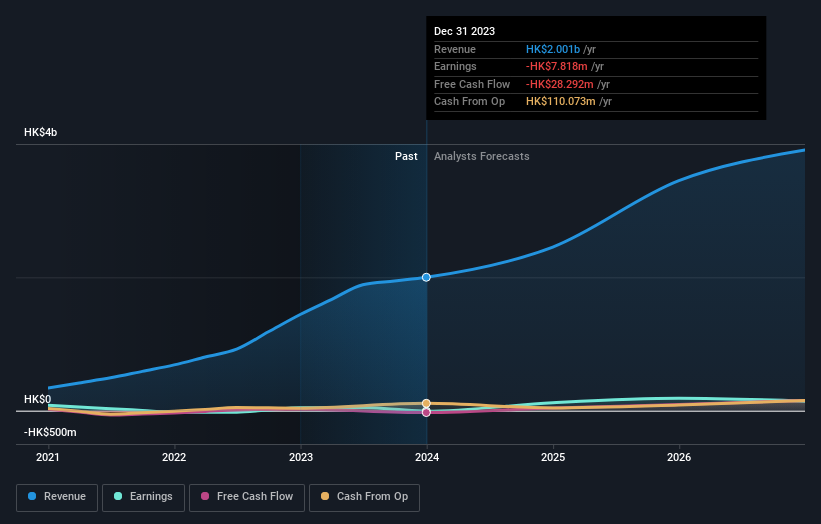

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions across the United States, Japan, Mainland China, and internationally, with a market cap of HK$5.20 billion.

Operations: The company generates revenue of HK$2.18 billion from its software as a service offerings focused on safeguarding and facilitating transactions of digital content assets globally, including in the United States, Japan, and Mainland China.

Insider Ownership: 23.1%

Revenue Growth Forecast: 21.4% p.a.

Vobile Group's recent share repurchase initiative, authorized to buy back up to 10% of its issued shares, aims to enhance net asset value and earnings per share. Despite past shareholder dilution and volatile share prices, the company reported H1 2024 sales growth from HK$1 billion to HK$1.18 billion with improved net income. Forecasts suggest significant annual earnings growth of 68.5% and revenue expansion at 21.4%, outpacing the Hong Kong market's average growth rates.

Delve into the full analysis future growth report here for a deeper understanding of Vobile Group.

Our valuation report here indicates Vobile Group may be overvalued.

Key Takeaways

Unlock more gems! Our Fast Growing SEHK Companies With High Insider Ownership screener has unearthed 44 more companies for you to explore.Click here to unveil our expertly curated list of 47 Fast Growing SEHK Companies With High Insider Ownership.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1821 SEHK:2598 and SEHK:3738.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]