3 SEHK Growth Stocks With High Insider Ownership

The Hong Kong market has faced a challenging environment recently, with the Hang Seng Index declining amid weak manufacturing data and broader economic concerns. Despite these headwinds, growth companies with high insider ownership can present unique opportunities for investors, as significant insider stakes often signal confidence in the company's long-term prospects. In this article, we will explore three growth stocks listed on the SEHK that exhibit high levels of insider ownership. These companies stand out not only for their potential to grow but also because their leadership teams have substantial personal investments at stake, aligning their interests closely with those of other shareholders.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 18.8% | 104.1% |

Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

Fenbi (SEHK:2469) | 31.1% | 42.8% |

Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

DPC Dash (SEHK:1405) | 38.2% | 91.4% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 23.3% | 93.7% |

Beijing Airdoc Technology (SEHK:2251) | 28.6% | 83.9% |

We're going to check out a few of the best picks from our screener tool.

LifeTech Scientific

Simply Wall St Growth Rating: ★★★★☆☆

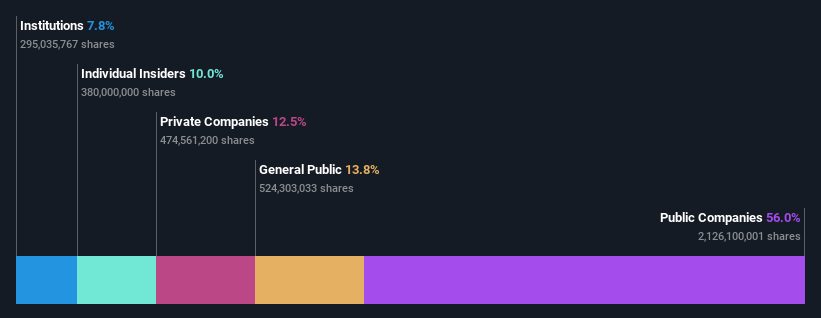

Overview: LifeTech Scientific Corporation develops, manufactures, and trades interventional medical devices for cardiovascular and peripheral vascular diseases globally, with a market cap of HK$7.41 billion.

Operations: The company generates revenue from three primary segments: CN¥495.67 million from the Structural Heart Diseases Business, CN¥707.11 million from the Peripheral Vascular Diseases Business, and CN¥64.40 million from the Cardiac Pacing and Electrophysiology Business.

Insider Ownership: 16%

LifeTech Scientific, a growth company with high insider ownership, recently announced promising one-year follow-up results for its IBS ? Coronary Scaffold, demonstrating comparable safety and effectiveness to existing drug-eluting stents. The company's revenue is forecasted to grow at 16.8% annually, outpacing the broader Hong Kong market's growth rate of 7.4%. Earnings are expected to rise significantly over the next three years at 20.5% per year. Recent bylaw amendments also indicate strategic corporate governance adjustments.

MGM China Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MGM China Holdings Limited is an investment holding company that develops, owns, and operates gaming and lodging resorts in the Greater China region, with a market cap of HK$44.61 billion.

Operations: The company's revenue primarily comes from its Casinos & Resorts segment, generating HK$24.68 billion.

Insider Ownership: 10%

MGM China Holdings, with substantial insider ownership, is trading at 51.5% below its estimated fair value and analysts expect the stock price to rise by 45.1%. Earnings are forecasted to grow at 18.1% annually, outpacing the Hong Kong market's growth rate of 11.3%, while revenue is projected to increase by 8.3% per year. The company recently issued $500 million in senior notes due 2031 to refinance existing debt and commenced a significant share repurchase program aimed at enhancing shareholder value.

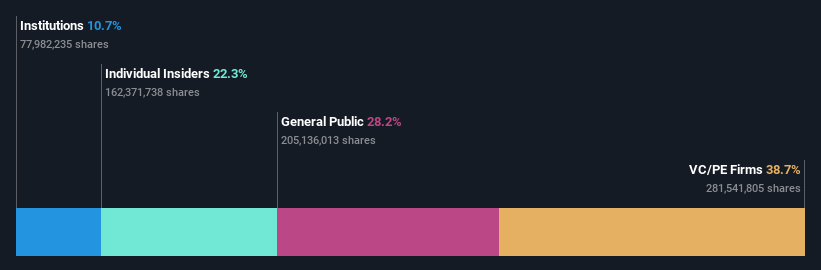

Adicon Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: Adicon Holdings Limited operates medical laboratories in the People’s Republic of China and has a market cap of HK$7.21 billion.

Operations: Adicon Holdings generates revenue of CN¥3.30 billion from its Healthcare Facilities & Services segment.

Insider Ownership: 22.4%

Adicon Holdings, with high insider ownership, has initiated a share repurchase program to buy back up to 10% of its issued shares, potentially increasing net asset value and earnings per share. Analysts forecast the company's revenue to grow at 14.3% annually and earnings at 28.3%, both outpacing the Hong Kong market averages. Recent board changes include the appointment of Mr. ZHOU Mintao as a non-executive director and chairman of the strategy committee, signaling strategic shifts within the company.

Make It Happen

Click through to start exploring the rest of the 51 Fast Growing SEHK Companies With High Insider Ownership now.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1302 SEHK:2282 and SEHK:9860.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]