3 Stocks That Might Be Undervalued By Up To 46.8%

As global markets continue to recover from recent volatility, investor sentiment is buoyed by encouraging signs of a potential "soft landing" for the U.S. economy and robust performance in key indices such as the Nasdaq Composite. Amid this optimistic environment, identifying undervalued stocks becomes crucial for investors seeking to capitalize on market inefficiencies. In this article, we will explore three stocks that might be undervalued by up to 46.8%, offering potential opportunities for those looking to enhance their portfolios in a recovering market landscape.

Top 10 Undervalued Stocks Based On Cash Flows

Name | Current Price | Fair Value (Est) | Discount (Est) |

Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥163.10 | CN¥325.20 | 49.8% |

Best Pacific International Holdings (SEHK:2111) | HK$2.19 | HK$4.36 | 49.8% |

Ramssol Group Berhad (KLSE:RAMSSOL) | MYR0.64 | MYR1.28 | 50% |

Manorama Industries (BSE:541974) | ?834.15 | ?1665.51 | 49.9% |

Treasury Wine Estates (ASX:TWE) | A$12.11 | A$24.19 | 49.9% |

EVERTEC (NYSE:EVTC) | US$33.34 | US$66.46 | 49.8% |

Franchise Brands (AIM:FRAN) | £1.805 | £3.61 | 50% |

Green Thumb Industries (CNSX:GTII) | CA$15.02 | CA$29.99 | 49.9% |

Forterra (LSE:FORT) | £1.764 | £3.52 | 49.9% |

Nordisk Bergteknik (OM:NORB B) | SEK18.26 | SEK36.40 | 49.8% |

Let's dive into some prime choices out of the screener.

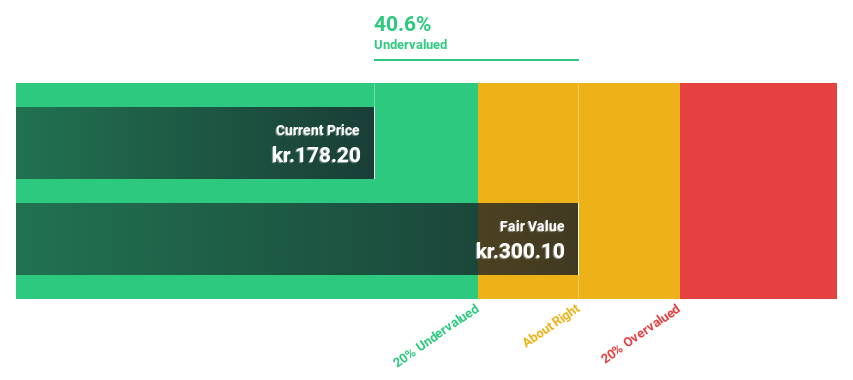

Vestas Wind Systems

Overview: Vestas Wind Systems A/S designs, manufactures, installs, and services wind turbines globally with a market cap of DKK162.20 billion.

Operations: The company's revenue segments include €11.67 billion from Power Solutions and €3.43 billion from Service.

Estimated Discount To Fair Value: 39.4%

Vestas Wind Systems appears undervalued based on cash flows, trading at 39.4% below its estimated fair value of DKK265.16. Despite recent earnings showing a net loss of EUR158 million for Q2 2024, the company's significant order backlog and expansion in renewable energy projects suggest potential for future growth. Recent orders include a 285 MW project in Australia and multiple contracts across Europe, indicating robust demand for Vestas' wind turbines and services.

Click here to discover the nuances of Vestas Wind Systems with our detailed financial health report.

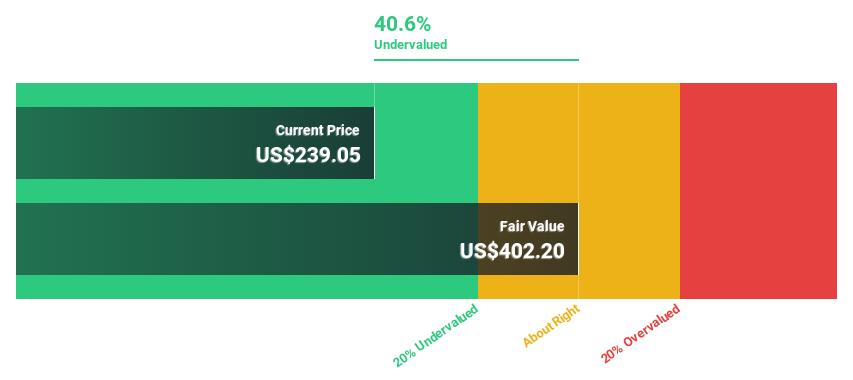

Equifax

Overview: Equifax Inc. operates as a data, analytics, and technology company with a market cap of approximately $36.16 billion.

Operations: The company's revenue segments include International at $1.32 billion, Workforce Solutions at $2.35 billion, and U.S. Information Solutions at $1.80 billion.

Estimated Discount To Fair Value: 41.3%

Equifax is trading at US$295.07, significantly below its estimated fair value of US$502.35, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow 23% annually over the next three years, outpacing the broader US market. Recent developments include a $650 million fixed-income offering and partnerships enhancing fraud prevention solutions, which may bolster revenue growth and operational efficiency despite its high debt levels.

Insights from our recent growth report point to a promising forecast for Equifax's business outlook.

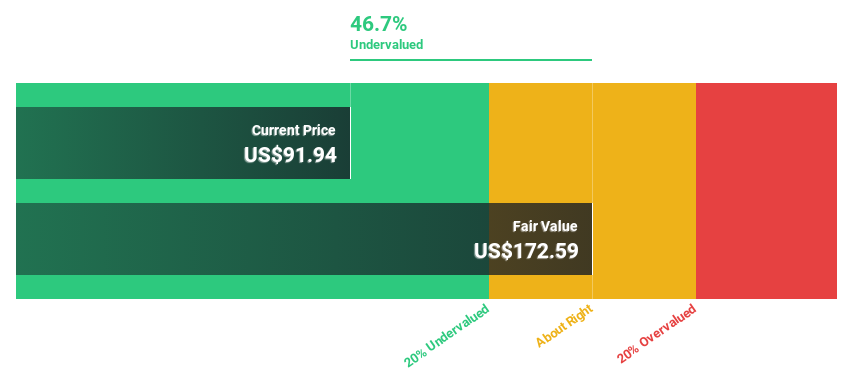

Live Nation Entertainment

Overview: Live Nation Entertainment, Inc. operates as a global live entertainment company with a market cap of $21.92 billion.

Operations: Live Nation Entertainment generates revenue from three main segments: Concerts ($19.72 billion), Ticketing ($3.03 billion), and Sponsorship & Advertising ($1.15 billion).

Estimated Discount To Fair Value: 46.8%

Live Nation Entertainment's recent earnings report shows solid revenue growth, with second-quarter sales at US$6.02 billion, up from US$5.63 billion a year ago. Despite being dropped from several Russell Value Indexes, the stock is trading at US$96.53, significantly below its estimated fair value of US$181.60 based on discounted cash flow analysis. Earnings are expected to grow 29.57% annually over the next three years, outpacing the broader market's growth rate of 15%.

Make It Happen

Investigate our full lineup of 942 Undervalued Stocks Based On Cash Flows right here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include CPSE:VWS NYSE:EFX and NYSE:LYV.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Yahoo Finance

Yahoo Finance