3 Swedish Dividend Stocks Yielding Up To 9.5%

The Swedish stock market has been navigating through a period of volatility, influenced by global economic uncertainties and fluctuating consumer demand. Despite these challenges, certain dividend stocks in Sweden stand out for their potential to provide stable income streams. In the current market environment, a good dividend stock is characterized by consistent payout history and solid fundamentals. Here are three Swedish dividend stocks yielding up to 9.5% that could offer attractive opportunities for income-focused investors.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Bredband2 i Skandinavien (OM:BRE2) | 4.36% | ★★★★★★ |

Betsson (OM:BETS B) | 5.86% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.81% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 4.02% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.60% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.19% | ★★★★★☆ |

Duni (OM:DUNI) | 5.01% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.63% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.83% | ★★★★★☆ |

Afry (OM:AFRY) | 3.05% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Swedish Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Bredband2 i Skandinavien

Simply Wall St Dividend Rating: ★★★★★★

Overview: Bredband2 i Skandinavien AB (publ) offers data communication and security solutions to individuals and companies in Sweden, with a market cap of SEK1.98 billion.

Operations: Bredband2 i Skandinavien AB (publ) generates revenue through its data communication and security solutions provided to both individuals and businesses in Sweden.

Dividend Yield: 4.4%

Bredband2 i Skandinavien reported strong earnings for Q2 2024, with sales reaching SEK 429.55 million and net income at SEK 24.35 million, showing growth from the previous year. The company offers a high and reliable dividend yield of 4.36%, placing it in the top quartile of Swedish dividend payers. Dividends are well-covered by both earnings (87.6% payout ratio) and cash flows (39.1% cash payout ratio), ensuring sustainability and stability over the past decade.

Skandinaviska Enskilda Banken

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Skandinaviska Enskilda Banken AB (publ) offers corporate, retail, investment, and private banking services with a market cap of SEK309.49 billion.

Operations: Skandinaviska Enskilda Banken AB (publ) generates revenue from various segments including Life (SEK3.89 billion), Baltic (SEK13.82 billion), Asset Management (SEK3.22 billion), Large Corporates & Financial Institutions (SEK31.90 billion), Private Wealth Management & Family Office (SEK4.56 billion), and Corporate & Private Customers excluding Private Wealth Management & Family Office (SEK25.65 billion).

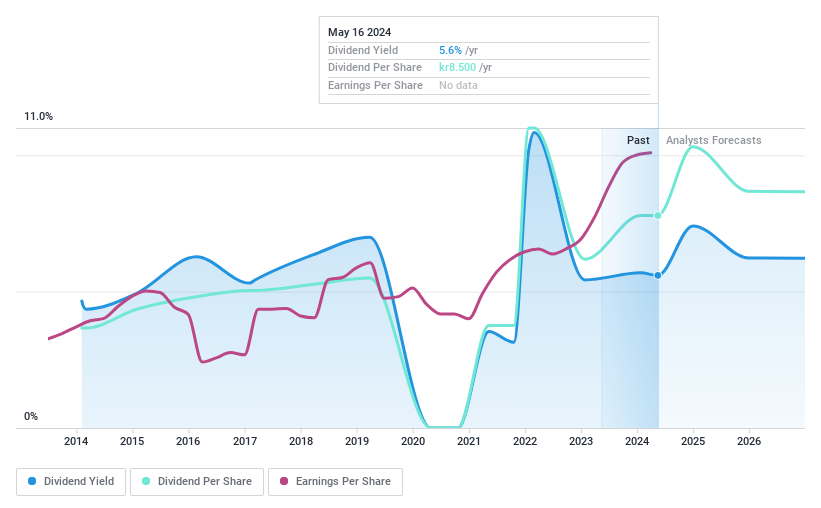

Dividend Yield: 5.6%

Skandinaviska Enskilda Banken AB (publ) reported a slight decline in net income and earnings per share for Q2 2024 compared to the previous year, with net income at SEK 9.42 billion. Despite this, SEB A's dividend yield is competitive at 5.63%, placing it among the top 25% of Swedish dividend payers. The bank's dividends are currently well-covered by earnings with a payout ratio of 46.5%, though its dividend history has been volatile over the past decade.

SSAB

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SSAB AB (publ) produces and sells steel products in Sweden, Finland, the rest of Europe, the United States, and internationally with a market cap of SEK51.22 billion.

Operations: SSAB AB (publ) generates revenue from several segments: Tibnor (SEK12.50 billion), SSAB Europe (SEK43.44 billion), SSAB Americas (SEK26.81 billion), Ruukki Construction (SEK5.41 billion), and SSAB Special Steels (SEK30.49 billion).

Dividend Yield: 9.6%

SSAB's dividend payments are well covered by earnings (48.7% payout ratio) and cash flows (49.5% cash payout ratio). Despite a top-tier dividend yield of 9.57%, the company's dividend history is unreliable, with volatility over the past six years. Recent buybacks totaling SEK 2.56 billion indicate strong capital management, but declining sales and net income in Q2 2024 highlight potential challenges ahead for sustaining dividends long-term.

Taking Advantage

Access the full spectrum of 23 Top Swedish Dividend Stocks by clicking on this link.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BRE2 OM:SEB A and OM:SSAB A.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]