3 Top ASX Dividend Stocks Yielding Up To 7.4%

In the last week, the Australian market has stayed flat, though the Materials sector saw a notable gain of 9.0%. With a 16% rise over the past 12 months and earnings forecasted to grow by 12% annually, investors are increasingly looking at dividend stocks as a reliable source of income. A good dividend stock typically offers consistent payouts and aligns well with current market conditions, providing stability amidst fluctuating sectors.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Perenti (ASX:PRN) | 7.34% | ★★★★★☆ |

Fortescue (ASX:FMG) | 9.17% | ★★★★★☆ |

Super Retail Group (ASX:SUL) | 6.55% | ★★★★★☆ |

Collins Foods (ASX:CKF) | 3.20% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.60% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 3.98% | ★★★★★☆ |

MFF Capital Investments (ASX:MFF) | 3.65% | ★★★★★☆ |

National Storage REIT (ASX:NSR) | 4.31% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.55% | ★★★★★☆ |

Sugar Terminals (NSX:SUG) | 7.56% | ★★★★☆☆ |

Click here to see the full list of 39 stocks from our Top ASX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

GrainCorp

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GrainCorp Limited is an agribusiness and processing company with operations spanning Australasia, Asia, North America, Europe, the Middle East, North Africa, and other international markets; it has a market cap of A$20.34 billion.

Operations: GrainCorp Limited generates revenue primarily from its Agribusiness segment, amounting to A$6.82 billion.

Dividend Yield: 5.9%

GrainCorp's dividend payments have been volatile over the past decade, with an annual drop of over 20% at times, making them unreliable. However, the dividends are covered by earnings (63.4%) and cash flows (37.3%). Despite a lower profit margin this year (1.4% vs. 3.9% last year), recent strategic alliances to develop renewable fuels could bolster future financial stability and potentially improve dividend reliability long-term.

Click to explore a detailed breakdown of our findings in GrainCorp's dividend report.

Our expertly prepared valuation report GrainCorp implies its share price may be too high.

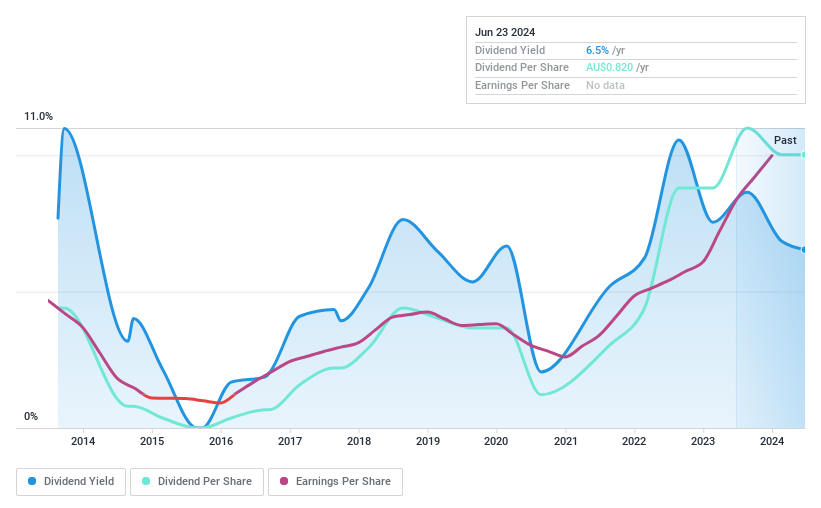

Lycopodium

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lycopodium Limited, with a market cap of A$480.34 million, offers engineering and project delivery services in the resources, rail infrastructure, and industrial processes sectors in Australia.

Operations: Lycopodium Limited generates revenue primarily from the resources sector (A$366.49 million), with additional contributions from process industries (A$11.45 million) and rail infrastructure (A$10.21 million).

Dividend Yield: 6.3%

Lycopodium's dividend payments have been volatile and unreliable over the past decade. Despite a recent addition to the S&P Global BMI Index, its high cash payout ratio (122.9%) indicates dividends are not well covered by free cash flows. However, earnings have grown 33.8% annually over the past five years, and its price-to-earnings ratio (9.5x) is below the Australian market average, suggesting potential value despite dividend sustainability concerns.

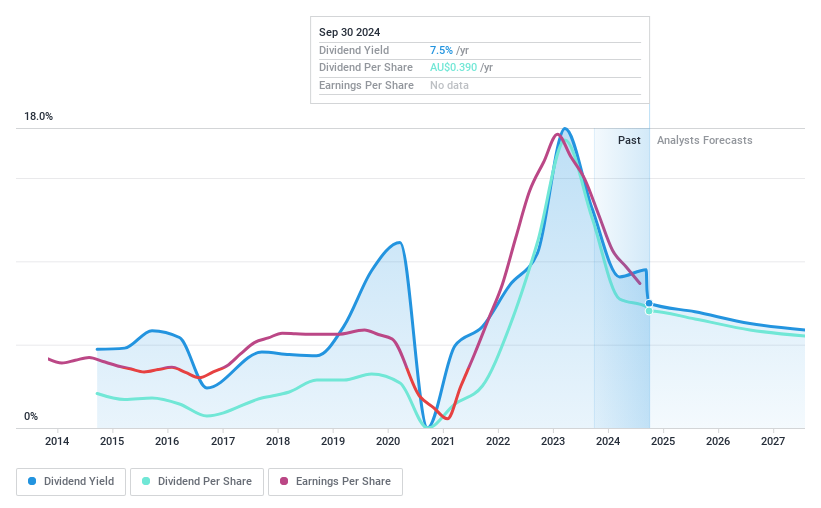

New Hope

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Hope Corporation Limited explores, develops, produces, and processes coal as well as oil and gas properties, with a market cap of A$4.40 billion.

Operations: New Hope Corporation Limited generates revenue primarily from its Coal Mining NSW segment with A$1.56 billion and its Coal Mining QLD (including Treasury and Investments) segment with A$166.52 million.

Dividend Yield: 7.5%

New Hope's dividend payments have been volatile and unreliable over the past decade, despite a recent final dividend announcement of A$0.22 per share. The company's payout ratio is reasonable at 69.3%, but its high cash payout ratio (113.7%) indicates dividends are not well covered by free cash flows. Recent earnings reports show a significant decline in net income to A$475.86 million from A$1,087.4 million last year, raising concerns about future dividend sustainability despite its top-tier yield of 7.49%.

Summing It All Up

Access the full spectrum of 39 Top ASX Dividend Stocks by clicking on this link.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:GNC ASX:LYL and ASX:NHC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]