3 Top Dividend Stocks To Consider On SGX

As the Singapore market continues to navigate global economic shifts and local developments, investors are increasingly focused on stability and income generation. In this context, dividend stocks on the SGX present an attractive option for those seeking consistent returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

BRC Asia (SGX:BEC) | 6.67% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.38% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 7.44% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.36% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.08% | ★★★★★☆ |

QAF (SGX:Q01) | 6.06% | ★★★★★☆ |

Aztech Global (SGX:8AZ) | 9.90% | ★★★★☆☆ |

Genting Singapore (SGX:G13) | 4.71% | ★★★★☆☆ |

Oversea-Chinese Banking (SGX:O39) | 5.83% | ★★★★☆☆ |

Delfi (SGX:P34) | 6.66% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

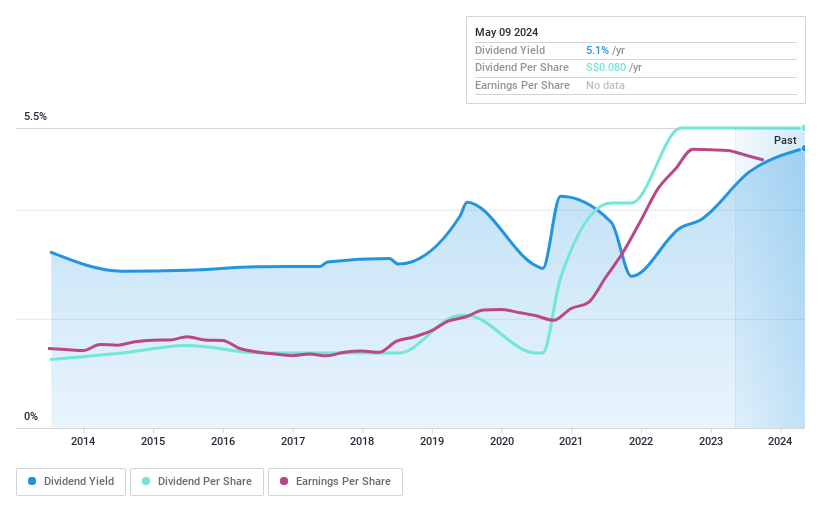

Hour Glass

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Hour Glass Limited is an investment holding company involved in the retailing and distribution of watches, jewelry, and other luxury products across several countries including Singapore and Hong Kong, with a market cap of SGD1.08 billion.

Operations: The Hour Glass Limited generates revenue of SGD1.13 billion from its activities in retailing and distributing watches, jewelry, and luxury products across various regions.

Dividend Yield: 4.8%

The Hour Glass has a volatile dividend history, with payments experiencing significant drops over the past decade, making them unreliable. Despite this, its dividends are well-covered by earnings (33.5% payout ratio) and cash flows (46.2% cash payout ratio), indicating sustainability. A recent approval of a 6-cent dividend per share highlights ongoing shareholder returns. The stock's price-to-earnings ratio of 6.9x suggests it is undervalued compared to the Singapore market average of 11.6x.

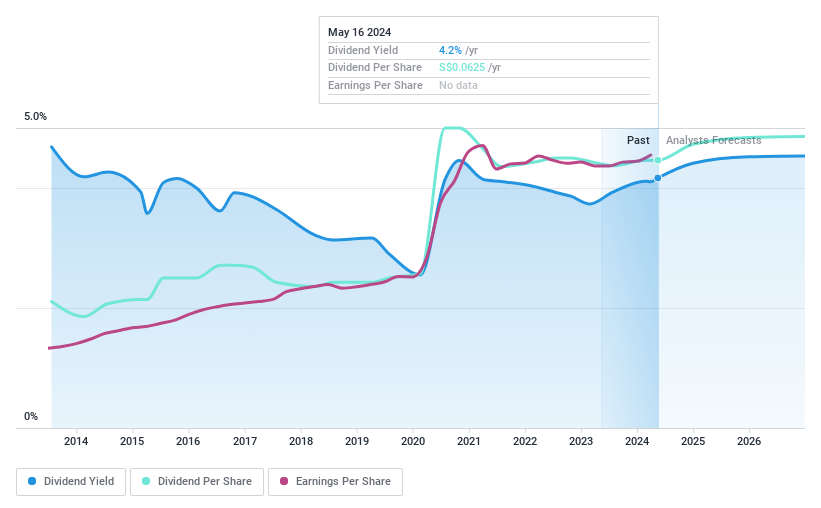

Sheng Siong Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sheng Siong Group Ltd is an investment holding company that operates a chain of supermarket retail stores in Singapore with a market cap of SGD2.39 billion.

Operations: Sheng Siong Group Ltd generates its revenue primarily through its supermarket operations, with sales of consumer goods amounting to SGD1.39 billion.

Dividend Yield: 3.9%

Sheng Siong Group's dividends are covered by earnings (69.6% payout ratio) and cash flows (51.8% cash payout ratio), suggesting sustainability despite a history of volatility with significant drops over the past decade. Its recent half-year earnings report showed an increase in net income to S$69.91 million, supporting continued dividend payments, though its yield of 3.93% is lower than top-tier Singapore dividend stocks. Recent board changes may influence future governance strategies.

Click to explore a detailed breakdown of our findings in Sheng Siong Group's dividend report.

Our valuation report here indicates Sheng Siong Group may be undervalued.

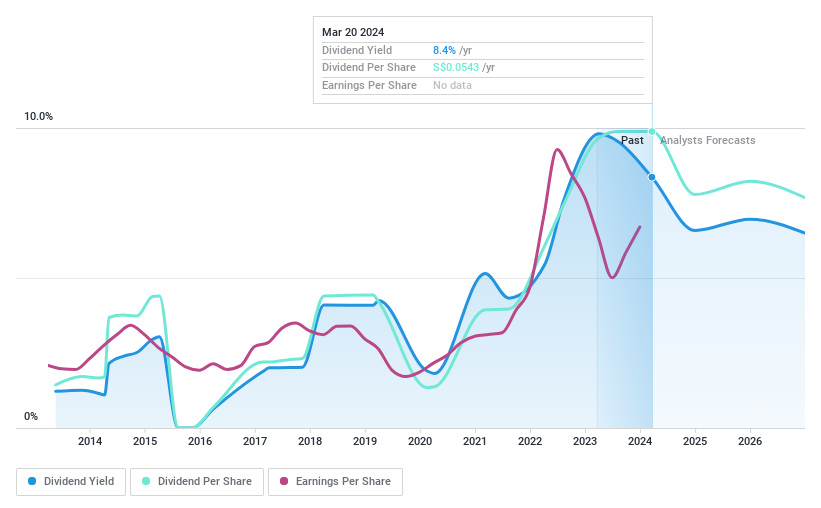

Bumitama Agri

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bumitama Agri Ltd. is an investment holding company involved in the production and trade of crude palm oil, palm kernel, and related products for refineries in Indonesia, with a market capitalization of SGD1.30 billion.

Operations: Bumitama Agri Ltd. generates its revenue primarily from its Plantations and Palm Oil Mills segment, which amounted to IDR15.55 trillion.

Dividend Yield: 6.4%

Bumitama Agri's dividends are well-covered by earnings (47.2% payout ratio) and cash flows (54.8% cash payout ratio), indicating sustainability despite a volatile track record over the past decade. The dividend yield of 6.38% ranks in the top 25% of Singaporean dividend stocks, though recent reductions reflect instability, with the interim dividend decreasing to 1.20 Singapore cents from 1.25 cents previously. Recent board changes could impact future governance and strategy decisions.

Make It Happen

Reveal the 19 hidden gems among our Top SGX Dividend Stocks screener with a single click here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:AGS SGX:OV8 and SGX:P8Z.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]