3 Top Dividend Stocks To Consider On The ASX

Over the last 7 days, the Australian market has dropped 5.0%, driven by declines in every sector. In contrast to the last week, the market is up 4.4% over the past year and earnings are forecast to grow by 13% annually. In this fluctuating environment, dividend stocks can offer a reliable income stream and potential for capital growth, making them an attractive option for investors seeking stability and returns.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Collins Foods (ASX:CKF) | 3.27% | ★★★★★☆ |

Lindsay Australia (ASX:LAU) | 6.78% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.54% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.72% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 7.51% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.07% | ★★★★★☆ |

MFF Capital Investments (ASX:MFF) | 3.78% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.71% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.46% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.10% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Centuria Capital Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Centuria Capital Group (ASX:CNI) is an investment manager that markets and manages investment products primarily in Australia, with a market cap of approximately A$1.27 billion.

Operations: Centuria Capital Group's revenue segments include Property Funds Management (A$178.53 million), Co-Investments (A$53.33 million), Non-Operating Items (A$51.53 million), Development (A$40.07 million), Property and Development Finance (A$17.46 million), Benefit Funds (A$10.35 million), Investment Bonds Management (A$9.79 million) and Corporate activities (A$2.38 million).

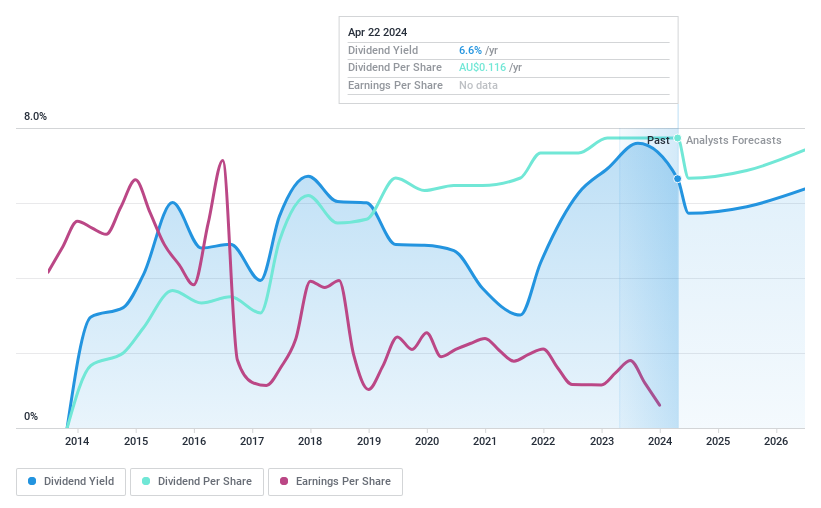

Dividend Yield: 7.5%

Centuria Capital Group's dividend payments have grown over the past decade but have been volatile, with significant annual drops. Despite this instability, dividends are covered by earnings (76.1% payout ratio) and cash flows (73.5% cash payout ratio). The stock trades at 47.4% below its estimated fair value and offers a high dividend yield of 7.51%, placing it in the top 25% of Australian dividend payers. Recent distributions include a final payment of A$0.05 per security for June 2024.

Computershare

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Computershare Limited (ASX:CPU) offers a range of services including issuer, employee share plans and voucher, business communication and utilities, technology, and mortgage and property rental services, with a market cap of A$15.34 billion.

Operations: Computershare Limited (ASX:CPU) generates revenue primarily from issuer services ($1.19 billion), employee share plans and voucher services ($406.20 million), communication services and utilities ($330.42 million), and mortgage and property rental services ($566.33 million).

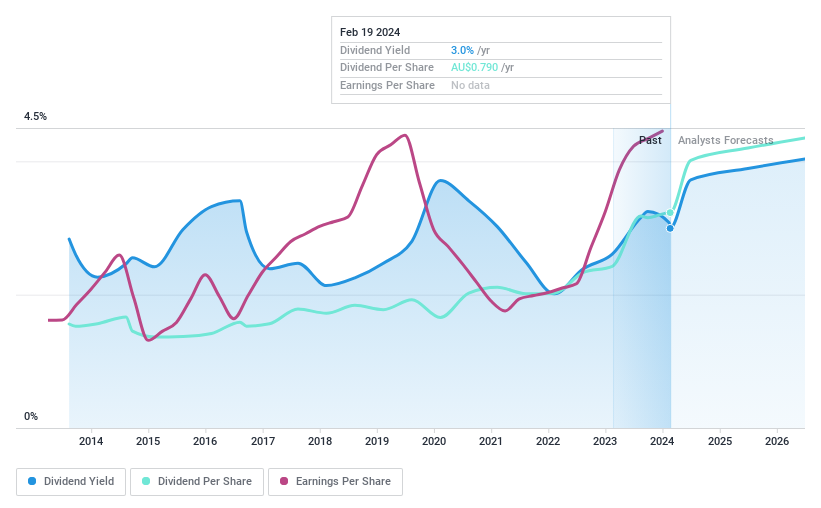

Dividend Yield: 3%

Computershare's dividend payments have been unreliable and volatile over the past decade, despite recent increases. The company has a high debt level but strong earnings growth of 37.2% last year. Dividends are covered by earnings (68.9% payout ratio) and cash flows (44.2% cash payout ratio). However, its dividend yield of 3% is low compared to top Australian dividend payers. Recent news includes losing Spacetalk Limited as a client for shareholder registry services from July 2024.

NRW Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NRW Holdings Limited (ASX:NWH) provides diversified contract services to the resources and infrastructure sectors in Australia, with a market cap of A$1.41 billion.

Operations: NRW Holdings Limited's revenue segments include MET at A$739.07 million, Civil at A$593.62 million, and Mining at A$1.49 billion.

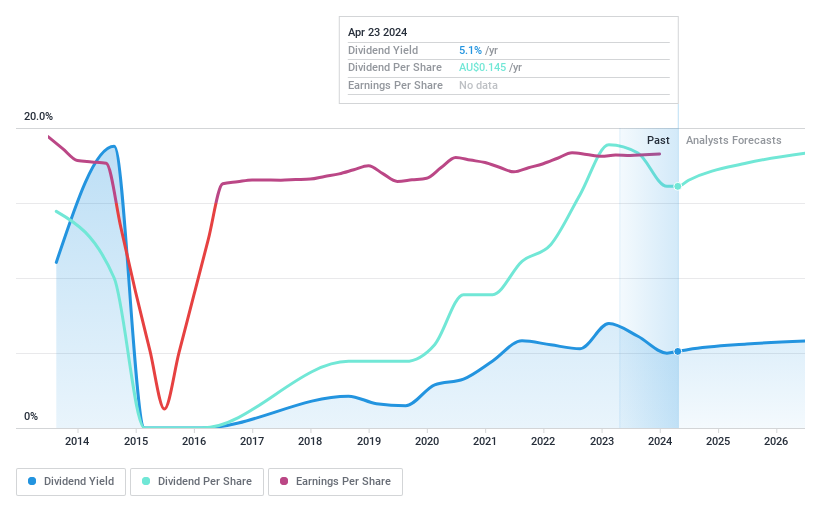

Dividend Yield: 4.7%

NRW Holdings' dividend payments have been volatile over the past decade, but they are covered by earnings (74% payout ratio) and cash flows (68.6% cash payout ratio). The company recently reaffirmed its revenue guidance for 2024 at A$2.9 billion and completed a follow-on equity offering of A$5.26 million. While the current dividend yield of 4.68% is below top-tier Australian dividend payers, dividends have increased over the past 10 years, supported by consistent earnings growth.

Seize The Opportunity

Get an in-depth perspective on all 32 Top ASX Dividend Stocks by using our screener here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:CNI ASX:CPU and ASX:NWH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]