3 Top Dividend Stocks On Euronext Amsterdam Yielding Up To 9.8%

As European markets rally and inflation nears the European Central Bank's target, investors are increasingly looking at dividend stocks on Euronext Amsterdam for stable income. In this favorable economic climate, selecting dividend stocks that offer consistent yields and robust financial health can be a prudent strategy for income-focused investors.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Koninklijke Heijmans (ENXTAM:HEIJM) | 3.72% | ★★★★☆☆ |

Aalberts (ENXTAM:AALB) | 3.30% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 5.23% | ★★★★☆☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.81% | ★★★★☆☆ |

Signify (ENXTAM:LIGHT) | 7.33% | ★★★★☆☆ |

ING Groep (ENXTAM:INGA) | 6.86% | ★★★★☆☆ |

Acomo (ENXTAM:ACOMO) | 6.64% | ★★★★☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

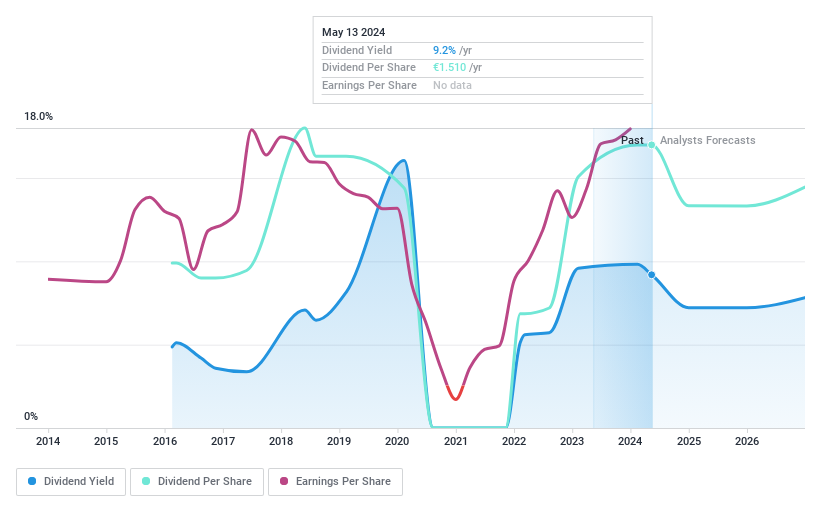

ABN AMRO Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and internationally, with a market cap of €12.83 billion.

Operations: ABN AMRO Bank N.V.'s revenue segments include Corporate Banking (€3.46 billion), Wealth Management (€1.55 billion), and Personal & Business Banking (€4.02 billion).

Dividend Yield: 9.8%

ABN AMRO Bank's dividend payments have been volatile over the past 9 years, with a recent interim dividend set at €0.60 per share. Despite its unstable dividend track record, the current payout ratio of 50.5% suggests dividends are covered by earnings and forecasted to remain sustainable. Earnings have grown 21.5% annually over the past five years but are expected to decline by an average of 8.6% annually for the next three years.

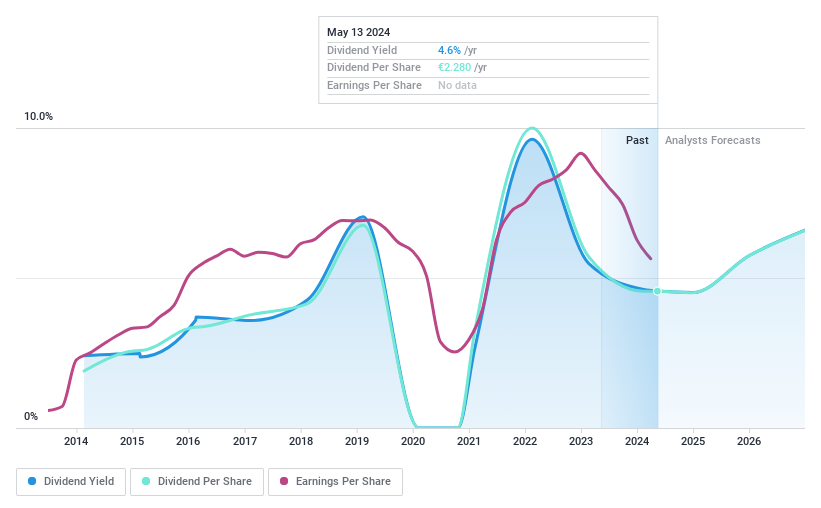

ING Groep

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ING Groep N.V. offers a range of banking products and services across the Netherlands, Belgium, Germany, other parts of Europe, and globally, with a market cap of €51.23 billion.

Operations: ING Groep N.V.'s revenue segments include Retail Banking in the Netherlands (€4.97 billion), Belgium (€2.61 billion), and Germany (€2.97 billion), as well as Wholesale Banking (€6.69 billion) and Corporate Line Banking (€334 million).

Dividend Yield: 6.9%

ING Groep has shown a volatile dividend track record over its 9-year history of payments. Despite this, the current payout ratio of 69.8% indicates dividends are covered by earnings, with future coverage projected at 50.8%. The company recently affirmed an interim dividend of €0.35 per share for the first half of 2024 and completed significant share buybacks totaling €2.03 billion, which could support shareholder returns but also highlights some financial strain with declining net income reported in recent quarters.

Navigate through the intricacies of ING Groep with our comprehensive dividend report here.

Our valuation report unveils the possibility ING Groep's shares may be trading at a discount.

Randstad

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Randstad N.V. is a company that offers work and human resources (HR) services, with a market cap of €7.64 billion.

Operations: Randstad N.V.'s revenue segments include solutions in the field of work and human resources services, with a market cap of €7.64 billion.

Dividend Yield: 5.2%

Randstad's dividend payments have been volatile over the past decade, with a current payout ratio of 81.3% indicating dividends are covered by earnings. The company recently completed a share buyback program totaling €399.95 million, which may bolster shareholder value despite declining net income and sales in recent quarters. Trading at 57.4% below its estimated fair value, Randstad offers good relative value compared to peers but has lower profit margins than last year (2% vs 3%).

Make It Happen

Get an in-depth perspective on all 7 Top Euronext Amsterdam Dividend Stocks by using our screener here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ABN ENXTAM:INGA and ENXTAM:RAND.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]