3 Top Stocks Estimated To Be Trading At Discounts Of 18.4% To 42.4%

As global markets continue their recovery from the recent sell-off, investors are buoyed by positive news on inflation and economic growth, fostering hopes for a "soft landing" in the U.S. economy. With major indices like the Nasdaq Composite and S&P 500 showing significant gains, it’s an opportune time to identify stocks that may be trading at attractive discounts. In this environment of renewed optimism, finding undervalued stocks can offer potential for substantial returns. Here are three top stocks currently estimated to be trading at discounts ranging from 18.4% to 42.4%.

Top 10 Undervalued Stocks Based On Cash Flows

Name | Current Price | Fair Value (Est) | Discount (Est) |

Syuppin (TSE:3179) | ¥1335.00 | ¥2669.07 | 50% |

Ingenia Communities Group (ASX:INA) | A$5.31 | A$10.57 | 49.8% |

TORIDOLL Holdings (TSE:3397) | ¥3531.00 | ¥7051.89 | 49.9% |

MaxLinear (NasdaqGS:MXL) | US$12.49 | US$24.93 | 49.9% |

Kesla Oyj (HLSE:KELAS) | €3.72 | €7.43 | 49.9% |

Honkarakenne Oyj (HLSE:HONBS) | €2.88 | €5.75 | 49.9% |

QuinStreet (NasdaqGS:QNST) | US$17.28 | US$34.44 | 49.8% |

Grifols (BME:GRF) | €8.876 | €17.75 | 50% |

Cytek Biosciences (NasdaqGS:CTKB) | US$5.31 | US$10.61 | 50% |

Digital Workforce Services Oyj (HLSE:DWF) | €3.86 | €7.71 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener.

América Móvil. de

Overview: América Móvil, S.A.B. de C.V. provides telecommunications services in Latin America and internationally, with a market cap of approximately MX$997.95 billion.

Operations: América Móvil's revenue from cellular services amounts to approximately MX$813.38 billion.

Estimated Discount To Fair Value: 42.4%

América Móvil is trading at MX$16.29, significantly below its estimated fair value of MX$28.27, making it highly undervalued based on discounted cash flow analysis. Despite a forecasted annual earnings growth of 22.86%, recent financial results show a net loss of MX$1,093 million for Q2 2024 compared to net income last year. The company has also repurchased MX$7,700 million worth of shares recently but carries a high level of debt.

Akbank T.A.S

Overview: Akbank T.A.S., with a market cap of TRY311.48 billion, offers a range of banking products and services both in Turkey and internationally through its subsidiaries.

Operations: Akbank T.A.S. generates revenue from Consumer Banking and Private Banking (TRY77.29 billion) and Commercial Banking, Corporate Banking, and SME Banking (TRY88.67 billion).

Estimated Discount To Fair Value: 18.4%

Akbank T.A.S. is trading at TRY59.9, 18.4% below its estimated fair value of TRY73.45, indicating it may be undervalued based on cash flows. Despite a drop in net income for Q2 2024 to TRY10,919.66 million from TRY20,307.21 million a year ago, earnings are forecast to grow significantly at 35.4% annually over the next three years, outpacing the market's growth rate of 28.2%. The company recently completed a $500 million fixed-income offering with a high level of bad loans (2.1%).

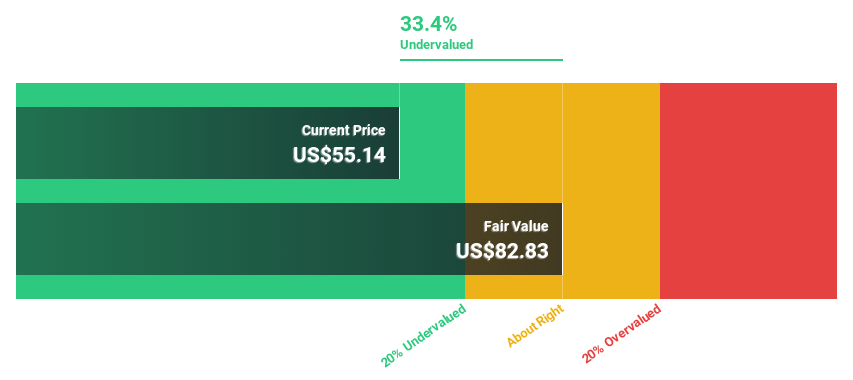

DocuSign

Overview: DocuSign, Inc. offers electronic signature solutions both in the United States and internationally, with a market cap of $11.71 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $2.81 billion.

Estimated Discount To Fair Value: 37.2%

DocuSign, trading at US$56.87, is significantly undervalued with a fair value estimate of US$90.61 based on cash flows. Earnings are forecast to grow 27.2% annually, outpacing the market's 15.2%. Recent strategic moves include a partnership with Sandbox Banking to enhance financial workflows and new executive hires to drive growth in Intelligent Agreement Management. The company also reported increased Q1 revenue of US$709.64 million and net income of US$33.76 million, reflecting its profitability trajectory.

Make It Happen

Take a closer look at our Undervalued Stocks Based On Cash Flows list of 925 companies by clicking here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include BMV:AMX B IBSE:AKBNK and NasdaqGS:DOCU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]