3 Top TSX Dividend Stocks To Boost Your Portfolio

With the Canadian TSX up over 5% and positive market sentiment returning, investors are increasingly looking for stable opportunities amid easing inflation and better-than-expected economic data. In this environment, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for bolstering your portfolio.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.56% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.15% | ★★★★★★ |

Secure Energy Services (TSX:SES) | 3.31% | ★★★★★☆ |

Labrador Iron Ore Royalty (TSX:LIF) | 8.58% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.52% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 8.79% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.44% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.22% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.31% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.68% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top TSX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

North West

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The North West Company Inc. (TSX:NWC) operates retail stores providing food and everyday products to rural and urban communities in northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market cap of CA$2.16 billion.

Operations: The North West Company Inc. (TSX:NWC) generates CA$2.50 billion in revenue from its retail operations, which include food and everyday products and services provided to rural communities and urban neighborhood markets across northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Dividend Yield: 3.5%

The North West Company Inc. reported first-quarter 2024 earnings with sales of C$617.52 million and net income of C$25.53 million, showing year-over-year growth. The company declared a quarterly dividend of C$0.39 per share, consistent with its stable and growing dividends over the past decade. Trading at 54% below estimated fair value, NWC's dividends are well-covered by earnings (55.2% payout ratio) and cash flows (59.8% cash payout ratio), though its yield (3.48%) is lower than top-tier Canadian dividend payers.

Olympia Financial Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Olympia Financial Group Inc., with a market cap of CA$269.75 million, operates as a non-deposit taking trust company in Canada through its subsidiary, Olympia Trust Company.

Operations: Olympia Financial Group Inc. generates revenue from various segments including Health (CA$10.21 million), Corporate (CA$0.13 million), Exempt Edge (CA$1.41 million), Investment Account Services (CA$79.02 million), Currency and Global Payments (CA$8.43 million), and Corporate and Shareholder Services (CA$3.98 million).

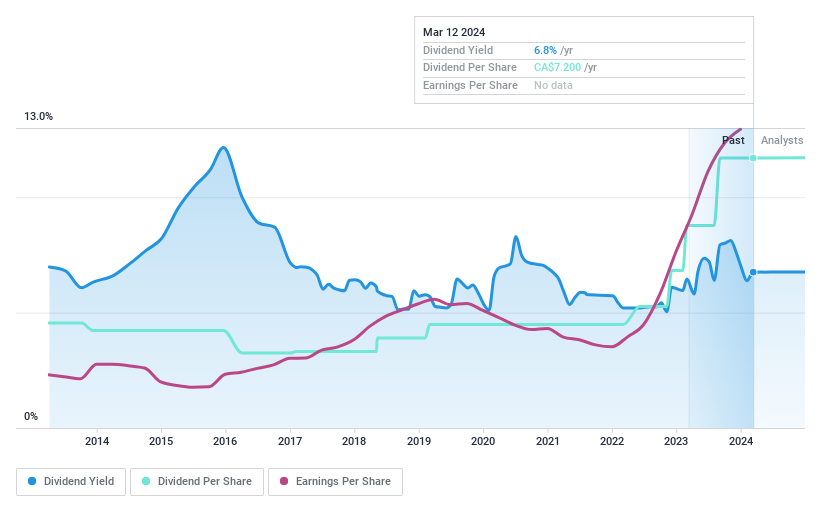

Dividend Yield: 6.5%

Olympia Financial Group reported Q2 2024 earnings with revenue of C$26.25 million and net income of C$5.89 million, showing stable year-over-year performance. The company declared a monthly dividend of C$0.60 per share, maintaining consistent payouts despite a historically volatile dividend track record. Trading at 21.2% below estimated fair value, Olympia's dividends are well-covered by earnings (68.1% payout ratio) and cash flows (72.7% cash payout ratio), offering an attractive yield in the Canadian market.

Richards Packaging Income Fund

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Richards Packaging Income Fund, with a market cap of CA$343.55 million, designs, manufactures, and distributes packaging containers and healthcare supplies across North America.

Operations: Richards Packaging Income Fund generates revenue from its wholesale miscellaneous segment, amounting to CA$415.52 million.

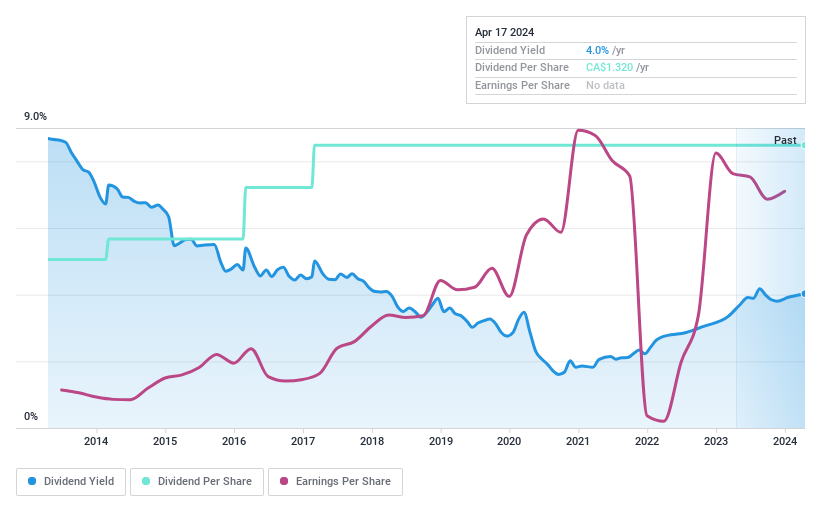

Dividend Yield: 4.2%

Richards Packaging Income Fund consistently pays a monthly dividend of C$0.11 per unit, indicating stability over the past decade. Despite a lower yield (4.22%) compared to top Canadian dividend payers, its dividends are well-covered by earnings (56.4% payout ratio) and cash flows (20.6% cash payout ratio). Recent Q2 2024 results show net income of C$11.8 million on sales of C$107.41 million, reflecting steady financial performance that supports sustainable dividends for investors.

Next Steps

Delve into our full catalog of 34 Top TSX Dividend Stocks here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:NWC TSX:OLY and TSX:RPI.UN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]