3 Top Undervalued Small Caps With Insider Buying To Watch

As global markets react positively to the Federal Reserve's announcement of potential interest rate cuts, small-cap stocks have been outperforming their larger counterparts. This favorable environment, coupled with insider buying activity, presents a unique opportunity to explore undervalued small-cap stocks that may offer significant growth potential. In this context, identifying promising small-cap stocks involves looking for companies with solid fundamentals and positive insider activity. Here are three such undervalued small caps worth watching.

Top 10 Undervalued Small Caps With Insider Buying

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Ramaco Resources | 11.5x | 0.9x | 38.88% | ★★★★★★ |

Bytes Technology Group | 24.4x | 5.5x | 13.33% | ★★★★★☆ |

Essentra | 848.9x | 1.6x | 47.21% | ★★★★★☆ |

Thryv Holdings | NA | 0.8x | 22.22% | ★★★★★☆ |

Norcros | 7.4x | 0.5x | 3.23% | ★★★★☆☆ |

CVS Group | 22.5x | 1.2x | 40.33% | ★★★★☆☆ |

Primaris Real Estate Investment Trust | 11.4x | 3.0x | 43.53% | ★★★★☆☆ |

NSI | NA | 4.6x | 43.24% | ★★★☆☆☆ |

Franchise Brands | 115.2x | 2.9x | 49.48% | ★★★☆☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Codan

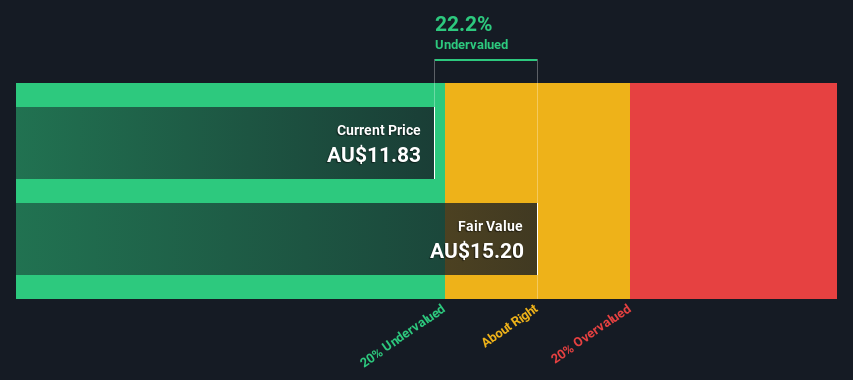

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Codan is a company that specializes in communications and metal detection technologies, with a market cap of A$1.25 billion.

Operations: Codan generates revenue primarily from its Communications and Metal Detection segments, with respective contributions of A$326.91 million and A$219.85 million. The company's net profit margin has shown variability, with a recent figure of 14.79% as of June 2024.

PE: 33.3x

Codan reported sales of A$550.46 million for the fiscal year ending June 30, 2024, up from A$456.5 million the previous year, and net income increased to A$81.39 million from A$67.7 million. Basic earnings per share rose to A$0.45 from A$0.375 a year ago, reflecting solid profitability growth despite higher-risk external borrowing as its sole funding source. Insider confidence is evident with recent purchases by executives in the past six months, indicating potential future value appreciation.

Click to explore a detailed breakdown of our findings in Codan's valuation report.

Understand Codan's track record by examining our Past report.

Lindblad Expeditions Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lindblad Expeditions Holdings operates expedition cruises and adventure travel experiences, with a market cap of approximately $0.57 billion.

Operations: Lindblad generates revenue primarily from its Lindblad and Land Experiences segments, with recent figures showing $405.86 million and $185.61 million respectively. The company has seen fluctuations in its gross profit margin, with the most recent quarter reporting a 44.10%.

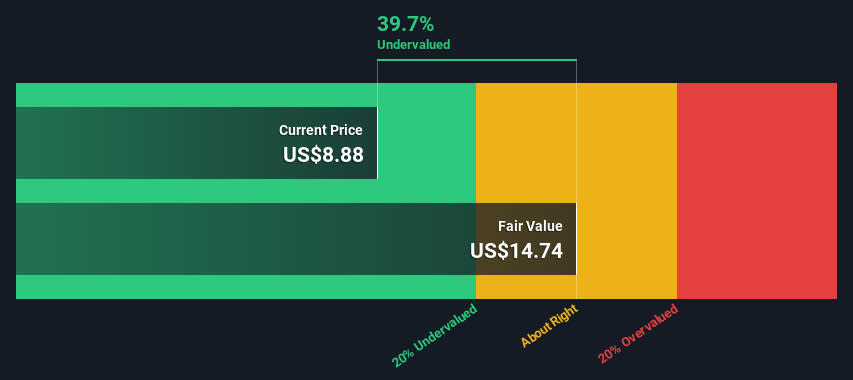

PE: -10.3x

Lindblad Expeditions Holdings, a small-cap stock, recently closed a shelf registration worth US$6 million on August 1, 2024. For Q2 2024, the company reported sales of US$136.5 million, up from US$124.8 million year-over-year but faced a net loss of US$24.67 million. Notably, insider confidence is evident with recent share purchases by executives in the past quarter. The addition of two new independent directors and expansion into the Galápagos fleet signal strategic growth initiatives for future potential value increase.

American Woodmark

Simply Wall St Value Rating: ★★★★☆☆

Overview: American Woodmark manufactures and distributes kitchen, bath, and home organization products with a market cap of $1.23 billion.

Operations: American Woodmark's primary revenue stream comes from manufacturing and distributing kitchen, bath, and home organization products. The company reported a gross profit margin of 20.45% for the most recent period ending August 26, 2024. Operating expenses include significant allocations to sales & marketing and general & administrative functions.

PE: 13.4x

American Woodmark's recent earnings report for Q1 2025 showed sales of US$459.13 million, down from US$498.26 million a year ago, with net income also falling to US$29.63 million from US$37.85 million. Despite this dip, insider confidence remains high with recent share purchases suggesting optimism about future performance. The company anticipates a low single-digit decline in net sales for fiscal 2025, indicating cautious but steady management amidst current market conditions.

Seize The Opportunity

Take a closer look at our Undervalued Small Caps With Insider Buying list of 219 companies by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:CDA NasdaqCM:LIND and NasdaqGS:AMWD.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]