3 TSX Growth Companies With High Insider Ownership Expecting 23% Revenue Growth

The market has been flat in the last week but is up 13% over the past year, with earnings expected to grow by 15% per annum over the next few years. In this context, identifying growth companies with high insider ownership can be particularly compelling, as these stocks often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Vox Royalty (TSX:VOXR) | 12.6% | 70.7% |

Allied Gold (TSX:AAUC) | 22.5% | 73.6% |

Almonty Industries (TSX:AII) | 17.7% | 117.6% |

goeasy (TSX:GSY) | 21.3% | 17.1% |

Alvopetro Energy (TSXV:ALV) | 19.4% | 72.4% |

Propel Holdings (TSX:PRL) | 40% | 37.2% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 60.9% |

Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

Alpha Cognition (CNSX:ACOG) | 17.9% | 69.5% |

ROK Resources (TSXV:ROK) | 16.6% | 161.8% |

We'll examine a selection from our screener results.

Payfare

Simply Wall St Growth Rating: ★★★★★☆

Overview: Payfare Inc. is a financial technology company offering instant payout and digital banking solutions to gig economy workers across Canada, the United States, and Mexico, with a market cap of CA$417.92 million.

Operations: The company's revenue segment is primarily derived from Internet Software & Services, amounting to CA$205.11 million.

Insider Ownership: 14.7%

Revenue Growth Forecast: 23.1% p.a.

Payfare has shown robust growth, with Q2 2024 sales reaching C$55.99 million and net income at C$4.9 million, both significantly higher than the previous year. The company recently announced new features for its Lyft Direct debit card, enhancing financial wellness for drivers. Payfare's revenue is forecast to grow faster than the Canadian market, supported by strategic partnerships and insider ownership that aligns management interests with shareholders.

Dive into the specifics of Payfare here with our thorough growth forecast report.

The valuation report we've compiled suggests that Payfare's current price could be inflated.

Propel Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: Propel Holdings Inc. is a financial technology company with a market cap of CA$1.04 billion.

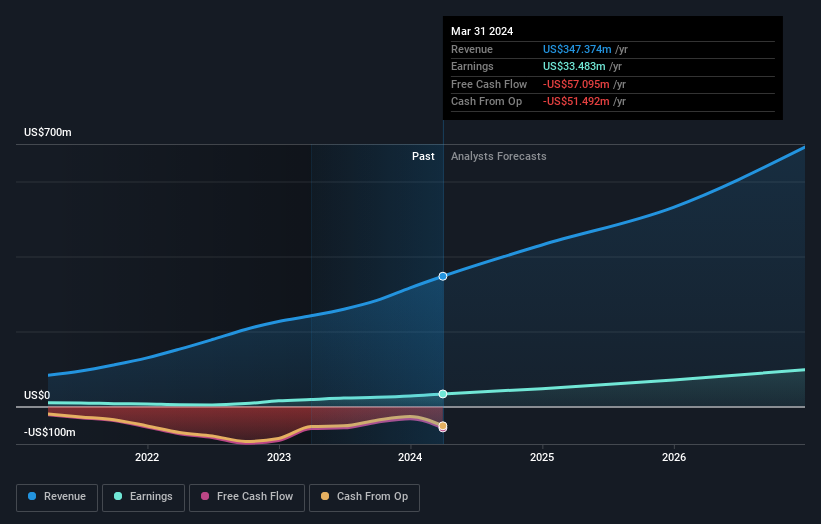

Operations: Propel Holdings generates its revenue of $382.44 million by providing lending-related services to borrowers, banks, and other institutions.

Insider Ownership: 40%

Revenue Growth Forecast: 23.5% p.a.

Propel Holdings has demonstrated significant growth, with Q2 2024 sales of US$106.75 million and net income of US$11.12 million, both markedly higher than the previous year. Earnings are forecast to grow at 37.2% annually, outpacing the Canadian market's expected growth rate. Despite substantial insider selling over the past three months, Propel's high insider ownership aligns management interests with shareholders. However, interest payments are not well covered by earnings, indicating potential financial constraints.

TerraVest Industries

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TerraVest Industries Inc. manufactures and sells goods and services to energy, agriculture, mining, transportation, and other markets in Canada and the United States with a market cap of CA$1.89 billion.

Operations: The company's revenue segments include Service (CA$201.78 million), Processing Equipment (CA$117.58 million), Compressed Gas Equipment (CA$243.77 million), and HVAC and Containment Equipment (CA$292.90 million).

Insider Ownership: 21.9%

Revenue Growth Forecast: 12.2% p.a.

TerraVest Industries has shown impressive financial growth, with earnings increasing by 43.6% over the past year and revenue for Q3 2024 reaching C$238.13 million, up from C$150.36 million a year ago. Earnings are forecast to grow at 21.1% annually, surpassing the Canadian market's expected growth rate of 15.4%. Despite high debt levels and some shareholder dilution in the past year, insider ownership remains strong with more shares bought than sold recently, aligning management interests with shareholders'.

Our expertly prepared valuation report TerraVest Industries implies its share price may be too high.

Key Takeaways

Unlock more gems! Our Fast Growing TSX Companies With High Insider Ownership screener has unearthed 34 more companies for you to explore.Click here to unveil our expertly curated list of 37 Fast Growing TSX Companies With High Insider Ownership.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:PAY TSX:PRL and TSX:TVK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]