3 TSX Stocks Trading Up To 27.3% Below Intrinsic Value Estimates

The Canadian market has been riding a wave of optimism, with the TSX reaching all-time highs last week, driven by factors such as the U.S. Fed's recent rate cut and ongoing AI enthusiasm. Amidst this buoyant market environment, identifying undervalued stocks becomes crucial for investors seeking opportunities that may offer potential growth at a discount.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

Name | Current Price | Fair Value (Est) | Discount (Est) |

Computer Modelling Group (TSX:CMG) | CA$11.11 | CA$22.03 | 49.6% |

Endeavour Mining (TSX:EDV) | CA$32.42 | CA$62.22 | 47.9% |

Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

Real Matters (TSX:REAL) | CA$9.34 | CA$17.50 | 46.6% |

Kinaxis (TSX:KXS) | CA$158.77 | CA$279.26 | 43.1% |

Bragg Gaming Group (TSX:BRAG) | CA$6.73 | CA$10.59 | 36.5% |

Blackline Safety (TSX:BLN) | CA$5.83 | CA$10.99 | 47% |

Lithium Royalty (TSX:LIRC) | CA$5.80 | CA$8.75 | 33.7% |

Boyd Group Services (TSX:BYD) | CA$206.00 | CA$335.76 | 38.6% |

Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

Let's explore several standout options from the results in the screener.

AtkinsRéalis Group

Overview: AtkinsRéalis Group (TSX:ATRL) operates as an integrated professional services and project management company worldwide, with a market cap of CA$9.62 billion.

Operations: AtkinsRéalis generates revenue from four main segments: Capital (CA$127.40 million), Nuclear (CA$1.20 billion), LSTK Projects (CA$318.44 million), and Segment Adjustment (CA$7.46 billion).

Estimated Discount To Fair Value: 27.3%

AtkinsRéalis Group (CA$55.72) is trading 27.3% below its estimated fair value of CA$76.66, indicating it may be undervalued based on cash flows. Despite a forecasted low Return on Equity of 13.5% in three years, the company's earnings are expected to grow significantly at 26.31% annually, outpacing the Canadian market's growth rate of 14.9%. Recent major contracts and strategic executive appointments bolster its growth prospects and financial stability amidst a robust backlog and raised earnings guidance for 2024.

Ivanhoe Mines

Overview: Ivanhoe Mines Ltd. focuses on the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$27.18 billion.

Operations: Ivanhoe Mines Ltd. generates revenue through mining, development, and exploration of minerals and precious metals primarily in Africa.

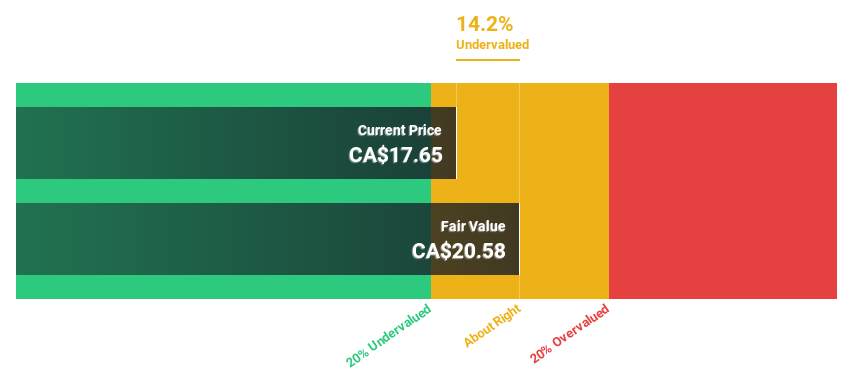

Estimated Discount To Fair Value: 13.4%

Ivanhoe Mines (CA$20.3) is trading 13.4% below its fair value estimate of CA$23.44, reflecting potential undervaluation based on cash flows. With forecasted annual revenue growth of 84% and earnings growth of 67.9%, the company significantly outpaces the Canadian market's averages. Recent developments like the MOU with Zambia’s Ministry of Mines and record production at Kamoa-Kakula bolster its growth outlook, despite past shareholder dilution and a modest return on equity forecast of 17.5%.

Paramount Resources

Overview: Paramount Resources Ltd. explores for and develops conventional and unconventional petroleum and natural gas reserves in Canada, with a market cap of CA$3.87 billion.

Operations: Paramount Resources generates revenue from the exploration and development of conventional and unconventional petroleum and natural gas reserves in Canada.

Estimated Discount To Fair Value: 20.7%

Paramount Resources (CA$27.15) trades 20.7% below its fair value estimate of CA$34.23, indicating significant undervaluation based on cash flows. Despite a dividend yield of 6.63% not being well covered by free cash flows and shareholder dilution over the past year, the company’s earnings are forecast to grow 27.48% annually, outpacing the Canadian market's average growth rate of 14.9%. Recent earnings reports show increased revenue and net income compared to last year, supporting its strong cash flow position.

Click here to discover the nuances of Paramount Resources with our detailed financial health report.

Where To Now?

Click through to start exploring the rest of the 19 Undervalued TSX Stocks Based On Cash Flows now.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:ATRL TSX:IVN and TSX:POU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]