3 TSX Stocks Trading At Discounts Of Up To 42.7%

The Canadian stock market has recently experienced notable volatility, with significant daily swings capturing headlines and investor attention. In such an environment, identifying undervalued stocks can be a strategic move for investors looking to capitalize on potential market inefficiencies. Here are three TSX stocks currently trading at discounts of up to 42.7%.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

Name | Current Price | Fair Value (Est) | Discount (Est) |

goeasy (TSX:GSY) | CA$188.05 | CA$358.38 | 47.5% |

Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$9.15 | 45.3% |

Computer Modelling Group (TSX:CMG) | CA$13.04 | CA$22.32 | 41.6% |

Kinaxis (TSX:KXS) | CA$152.82 | CA$284.91 | 46.4% |

Exchange Income (TSX:EIF) | CA$46.60 | CA$80.52 | 42.1% |

Obsidian Energy (TSX:OBE) | CA$9.26 | CA$18.10 | 48.8% |

Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

Kraken Robotics (TSXV:PNG) | CA$1.36 | CA$2.54 | 46.4% |

Constellation Software (TSX:CSU) | CA$4097.75 | CA$7154.99 | 42.7% |

NanoXplore (TSX:GRA) | CA$2.38 | CA$4.22 | 43.6% |

Underneath we present a selection of stocks filtered out by our screen.

AtkinsRéalis Group

Overview: AtkinsRéalis Group (TSX:ATRL) operates as an integrated professional services and project management company worldwide, with a market cap of CA$9.47 billion.

Operations: The company's revenue segments include Capital (CA$127.40 million), Nuclear (CA$1.20 billion), LSTK Projects (CA$318.44 million), and Segment Adjustment (CA$7.46 billion).

Estimated Discount To Fair Value: 28.6%

AtkinsRéalis Group Inc. appears undervalued based on cash flows, trading at CA$54.37 compared to an estimated fair value of CA$76.19. Recent earnings reports show substantial growth, with Q2 revenue at CAD 2.36 billion and net income at CAD 82.19 million, reflecting improvements from the previous year. The company has also raised its earnings guidance for 2024 and secured significant contracts, including a USD 65 million Waste-to-Energy plant project in Miami-Dade County, indicating strong future cash flow potential.

Our growth report here indicates AtkinsRéalis Group may be poised for an improving outlook.

Dive into the specifics of AtkinsRéalis Group here with our thorough financial health report.

Constellation Software

Overview: Constellation Software Inc., with a market cap of CA$83.91 billion, acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally.

Operations: The company's revenue from Software & Programming is $9.27 billion.

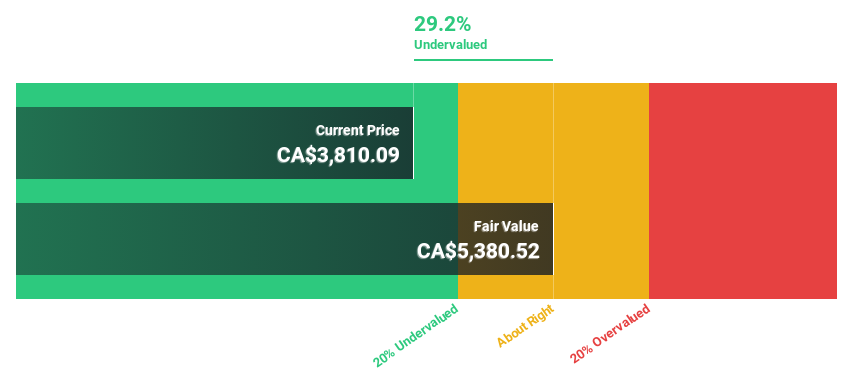

Estimated Discount To Fair Value: 42.7%

Constellation Software Inc. (CA$4097.75) is trading significantly below its estimated fair value of CA$7154.99, indicating potential undervaluation based on cash flows. Recent earnings reports show robust growth, with Q2 revenue at US$2.47 billion and net income at US$177 million, both up from the previous year. Despite high debt levels and significant insider selling in the past quarter, forecasted annual profit growth of 23.6% suggests strong future performance relative to the Canadian market's 14.8%.

MDA Space

Overview: MDA Space Ltd. designs, manufactures, and services space robotics, satellite systems and components, and intelligence systems globally, with a market cap of CA$1.71 billion.

Operations: MDA Space Ltd. generates revenue through space robotics, satellite systems and components, and intelligence systems across various global markets including Canada, the United States, Europe, Asia, and the Middle East.

Estimated Discount To Fair Value: 25.9%

MDA Space Ltd. (CA$14.45) is trading 25.9% below its estimated fair value of CA$19.51, suggesting it may be undervalued based on cash flows. Earnings are forecast to grow significantly at 50.61% annually, outpacing the Canadian market's 14.8%. Recent Q2 results show revenue growth to CA$242 million from CA$196 million a year ago, with net income rising slightly to CA$11 million from CA$9.9 million, reinforcing strong financial performance and future potential despite modest return on equity forecasts (13.2%).

Next Steps

Get an in-depth perspective on all 30 Undervalued TSX Stocks Based On Cash Flows by using our screener here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:ATRL TSX:CSU and TSX:MDA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]