3 UK Stocks That May Be Undervalued In August 2024

The UK stock market has recently faced challenges, with the FTSE 100 index closing lower amid weak trade data from China and declining commodity prices. Despite these headwinds, there are opportunities to find undervalued stocks that may offer potential for growth as the market adjusts. Identifying such stocks often involves looking at companies with strong fundamentals that are temporarily out of favor due to broader economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

TBC Bank Group (LSE:TBCG) | £30.00 | £59.69 | 49.7% |

Liontrust Asset Management (LSE:LIO) | £6.40 | £12.32 | 48.1% |

Gaming Realms (AIM:GMR) | £0.402 | £0.77 | 47.7% |

Tracsis (AIM:TRCS) | £5.95 | £11.42 | 47.9% |

GlobalData (AIM:DATA) | £2.19 | £4.11 | 46.7% |

AstraZeneca (LSE:AZN) | £129.02 | £255.54 | 49.5% |

C&C Group (LSE:CCR) | £1.516 | £2.91 | 47.9% |

Mercia Asset Management (AIM:MERC) | £0.348 | £0.68 | 48.6% |

SysGroup (AIM:SYS) | £0.335 | £0.66 | 49.4% |

Nexxen International (AIM:NEXN) | £2.835 | £5.34 | 46.9% |

Let's review some notable picks from our screened stocks.

Fevertree Drinks

Overview: Fevertree Drinks PLC develops and sells premium mixer drinks in the UK, US, Europe, and internationally, with a market cap of £1.05 billion.

Operations: The company's revenue from non-alcoholic beverages stands at £364.40 million.

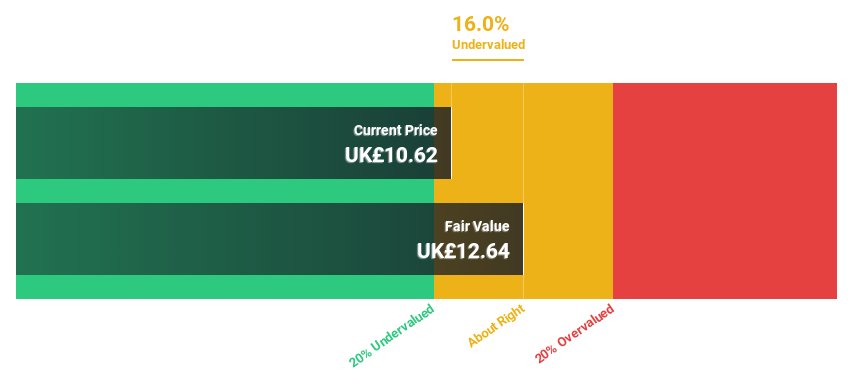

Estimated Discount To Fair Value: 43.6%

Fevertree Drinks is trading at £8.98, significantly below its estimated fair value of £15.93, making it highly undervalued based on discounted cash flow analysis. Despite a decrease in profit margins from 7.2% to 4.2%, the company's earnings are forecast to grow significantly at 34.44% per year over the next three years, outpacing the UK market's expected growth rate of 14.2%. Revenue is also expected to grow faster than the broader market at 7.3% annually.

Fintel

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £334.43 million.

Operations: Revenue segments for Fintel Plc include Research & Fintech (£22.30 million), Distribution Channels (£20.20 million), and Intermediary Services (£22.40 million).

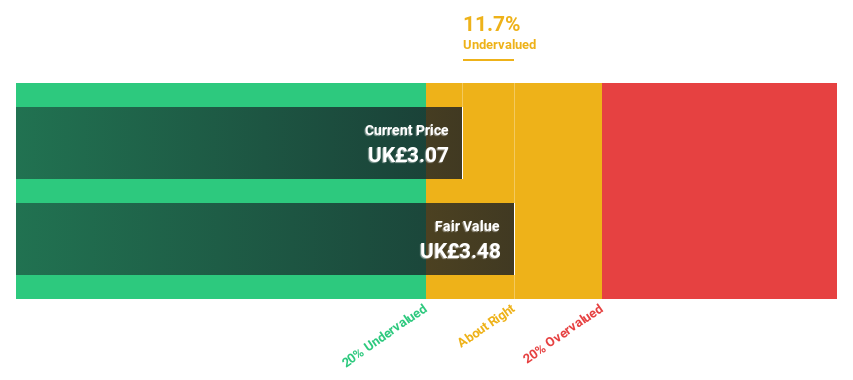

Estimated Discount To Fair Value: 19.8%

Fintel Plc, trading at £3.21, is undervalued based on discounted cash flow analysis with an estimated fair value of £4. Despite one-off items impacting its financial results, the company’s earnings are forecast to grow significantly at 23.88% annually over the next three years, outpacing the UK market's 14.2%. Revenue is expected to grow faster than the UK market at 8.6% per year. Recently, Fintel declared a final dividend of 2.35 pence per share on May 21, 2024.

TBC Bank Group

Overview: TBC Bank Group PLC, with a market cap of £1.64 billion, offers banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan through its subsidiaries.

Operations: The company's revenue segments include Uzbekistan Operations, which generated GEL 236.42 million, and Segment Adjustment, contributing GEL 2.13 billion.

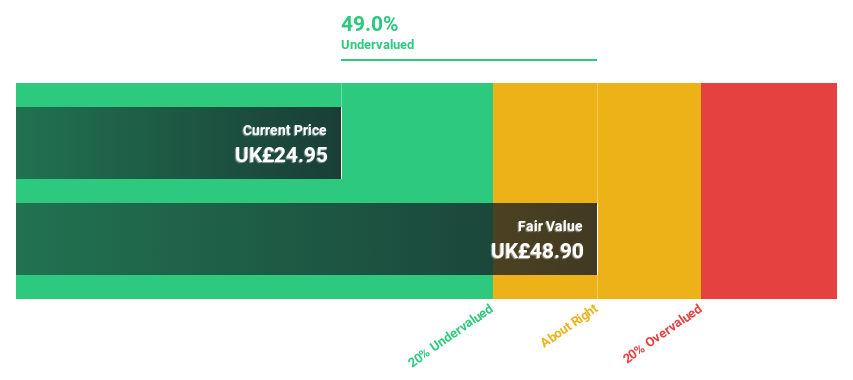

Estimated Discount To Fair Value: 49.7%

TBC Bank Group, trading at £30, appears significantly undervalued with an estimated fair value of £59.69 based on discounted cash flow analysis. The company reported strong earnings growth for H1 2024, with net income rising to GEL 617.4 million from GEL 537.46 million a year ago. Despite an unstable dividend track record, TBCG's earnings are forecast to grow at 15.3% annually, outpacing the UK market's growth rate of 14.2%.

Turning Ideas Into Actions

Explore the 57 names from our Undervalued UK Stocks Based On Cash Flows screener here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:FEVR AIM:FNTL and LSE:TBCG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]