3 UK Stocks Possibly Trading Below Their Intrinsic Value By Up To 46.2%

The United Kingdom's FTSE 100 index recently experienced a downturn, closing 0.4 percent lower amid weak trade data from China, which has impacted companies closely tied to its economy. In such volatile market conditions, identifying undervalued stocks trading below their intrinsic value can offer potential opportunities for investors looking to capitalize on mispriced assets.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

EnSilica (AIM:ENSI) | £0.42 | £0.82 | 48.6% |

Tracsis (AIM:TRCS) | £6.05 | £11.47 | 47.2% |

NCC Group (LSE:NCC) | £1.468 | £2.72 | 46.1% |

AstraZeneca (LSE:AZN) | £124.58 | £239.28 | 47.9% |

Mercia Asset Management (AIM:MERC) | £0.342 | £0.68 | 49.4% |

Restore (AIM:RST) | £2.535 | £4.72 | 46.2% |

Foxtons Group (LSE:FOXT) | £0.632 | £1.16 | 45.6% |

BATM Advanced Communications (LSE:BVC) | £0.195 | £0.36 | 45.9% |

accesso Technology Group (AIM:ACSO) | £6.58 | £12.34 | 46.7% |

Tortilla Mexican Grill (AIM:MEX) | £0.54 | £1.01 | 46.4% |

We're going to check out a few of the best picks from our screener tool.

Restore

Overview: Restore plc, along with its subsidiaries, offers services to offices and workplaces in both the public and private sectors primarily within the United Kingdom, with a market cap of £347.10 million.

Operations: The company generates revenue from Secure Lifecycle Services (£104.40 million) and Digital & Information Management (£172.50 million).

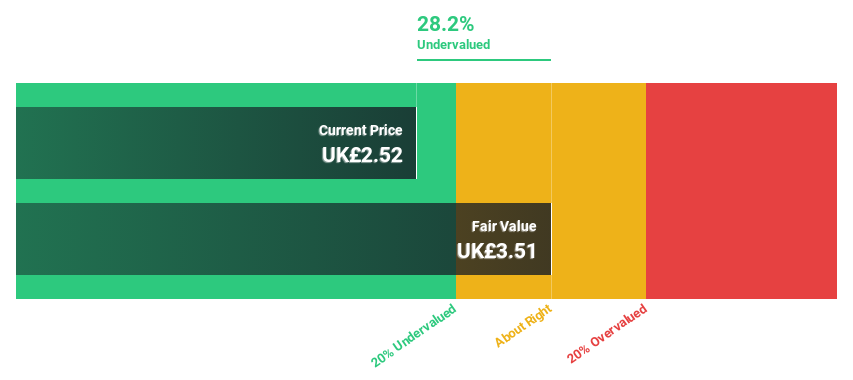

Estimated Discount To Fair Value: 46.2%

Restore plc appears undervalued based on cash flows, trading at 46.2% below fair value (£2.54 vs £4.72). Recent earnings reports show a turnaround with net income of £6.4 million compared to a net loss last year and an interim dividend increase to 2 pence per share. Despite low return on equity forecasts and interest coverage concerns, revenue is expected to grow faster than the UK market, with significant annual profit growth projected at 48.1%.

Insights from our recent growth report point to a promising forecast for Restore's business outlook.

Coats Group

Overview: Coats Group plc, with a market cap of £1.51 billion, manufactures and supplies industrial sewing threads globally through its subsidiaries.

Operations: Coats Group plc generates revenue through three primary segments: Apparel ($731 million), Footwear ($381.90 million), and Performance Materials ($327 million).

Estimated Discount To Fair Value: 10.6%

Coats Group plc is trading at £0.95, below its estimated fair value of £1.06. Recent earnings reports show a strong performance with net income rising to US$60.5 million from US$24.7 million year-over-year and revenue increasing to US$740.7 million from US$695 million. Despite a high debt level and an unstable dividend track record, the company’s earnings are forecast to grow faster than the UK market at 15.8% annually, supported by a recent 15% interim dividend increase.

Navigate through the intricacies of Coats Group with our comprehensive financial health report here.

Gym Group

Overview: The Gym Group plc, with a market cap of £251.24 million, operates a network of gym facilities under the Gym Group brand name in the United Kingdom.

Operations: The company's revenue primarily comes from the provision of high-quality health and fitness facilities, amounting to £204 million.

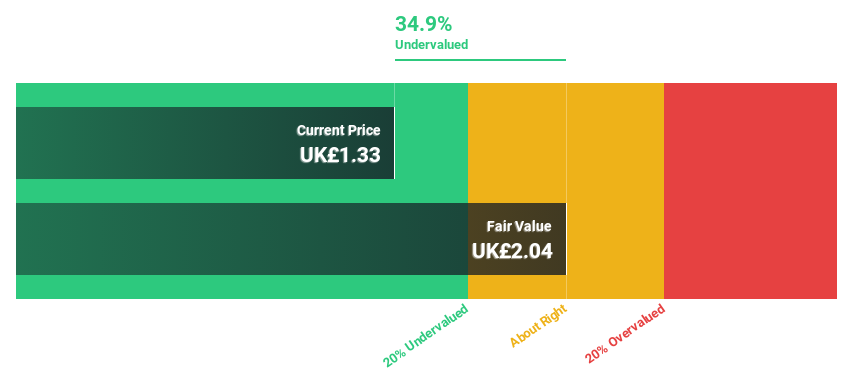

Estimated Discount To Fair Value: 12.4%

Gym Group is trading at £1.41, below its estimated fair value of £1.61, indicating it may be undervalued based on cash flows. The company is expected to grow earnings by 109.61% per year and become profitable within three years, outpacing the UK market's growth rate of 3.6%. However, its return on equity is forecasted to remain low at 1.5%, and revenue growth is projected at a modest 8.5% annually.

Turning Ideas Into Actions

Gain an insight into the universe of 49 Undervalued UK Stocks Based On Cash Flows by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:RST LSE:COA and LSE:GYM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Yahoo Finance

Yahoo Finance