3 Undervalued Small Caps In United Kingdom With Insider Buying

The United Kingdom's market has recently faced headwinds, with the FTSE 100 and FTSE 250 indices both experiencing declines amid weak trade data from China, highlighting the global economic challenges impacting investor sentiment. In this environment, identifying small-cap stocks that are potentially undervalued and have insider buying can be appealing to investors looking for opportunities amidst broader market volatility.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Bytes Technology Group | 26.1x | 5.9x | 6.34% | ★★★★★☆ |

NWF Group | 8.8x | 0.1x | 34.42% | ★★★★★☆ |

Headlam Group | NA | 0.2x | 24.72% | ★★★★★☆ |

C&C Group | NA | 0.5x | 3.55% | ★★★★☆☆ |

CVS Group | 28.8x | 1.2x | 37.52% | ★★★★☆☆ |

Essentra | 725.2x | 1.4x | 37.65% | ★★★★☆☆ |

Genus | 172.2x | 2.0x | -2.94% | ★★★★☆☆ |

Marlowe | NA | 0.7x | 39.97% | ★★★★☆☆ |

Optima Health | NA | 1.1x | 43.41% | ★★★★☆☆ |

Oxford Instruments | 23.3x | 2.5x | -30.30% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

Domino's Pizza Group

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Group is a leading pizza delivery and carryout chain in the UK, primarily generating revenue through sales to franchisees, corporate store income, advertising and ecommerce income, rental income from properties, and various franchise fees, with a market capitalization of approximately £1.5 billion.

Operations: Domino's Pizza Group generates revenue primarily from sales to franchisees, corporate store income, and royalties. The company's gross profit margin has shown an upward trend, reaching 47.48% in the latest period. Operating expenses are significant, with general and administrative expenses being a major component.

PE: 15.6x

Domino's Pizza Group, a smaller UK company, is navigating a mixed financial landscape. Despite an 11.4% profit margin dip from last year's 18.2%, earnings are projected to grow by 9.56% annually. The company has engaged in share repurchases, buying back over 25 million shares for £90.1 million by May 2024, signaling insider confidence in its future prospects. While sales slightly declined to £326.8 million for H1 2024, strategic initiatives aim to boost order counts and sales growth throughout the year.

Genel Energy

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Genel Energy is an oil and gas exploration and production company with operations primarily in the Kurdistan Region of Iraq, holding a market cap of approximately £0.36 billion.

Operations: Genel Energy's revenue is primarily derived from production, with recent figures showing $74.40 million. The company has experienced fluctuations in its net income margin, which was -45.03% as of the latest data point. Gross profit margin has shown variability, reaching 80.11% in the most recent period analyzed. Operating expenses and non-operating expenses have significantly impacted profitability over time, contributing to periods of negative net income margins.

PE: -8.6x

Genel Energy, a small UK-based company, has shown insider confidence with Yetik Mert purchasing 107,000 shares for approximately US$91,774 in September 2024. Despite reporting a net loss of US$21.9 million for the first half of 2024, an improvement from the previous year's US$40.7 million loss indicates potential recovery. The company's production increased to 19,510 bopd from last year's 13,440 bopd. Recent board appointments bring experienced leadership as they navigate higher-risk funding challenges and aim for projected earnings growth of over 50% annually.

Click to explore a detailed breakdown of our findings in Genel Energy's valuation report.

Assess Genel Energy's past performance with our detailed historical performance reports.

Genus

Simply Wall St Value Rating: ★★★★☆☆

Overview: Genus is a company specializing in animal genetics, focusing on bovine and porcine breeding services, with a market cap of £1.73 billion.

Operations: The company's revenue streams are primarily driven by Genus ABS and Genus PIC, contributing £314.90 million and £352.50 million respectively. Over recent periods, the gross profit margin has shown notable fluctuations, peaking at 68.02% in March 2024 and reaching an unusual 100% in June 2024 due to specific cost dynamics during that period. Operating expenses have varied significantly, with a high of £614.90 million recorded in June 2024 impacting net income margins considerably during these times.

PE: 172.2x

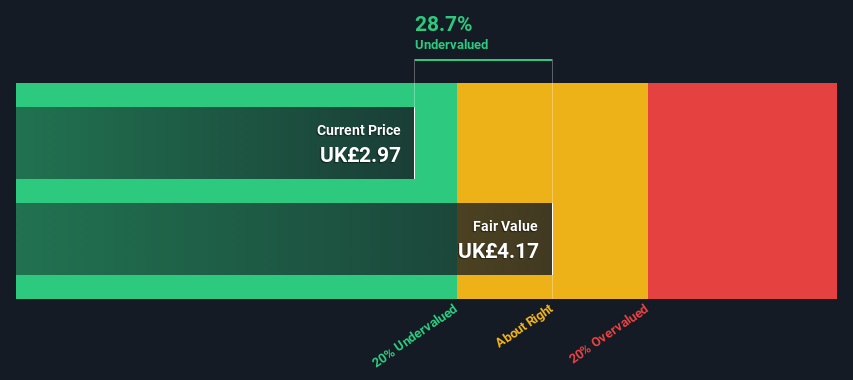

Genus, a notable player in the UK market, has seen insider confidence rise with recent share purchases. Despite a dip in sales to £668.8 million and net income falling to £7.9 million for the year ending June 2024, their earnings are projected to grow by 37% annually. The company maintains low-risk funding but faces challenges with profit margins decreasing from 4.8% to 1.2%. A consistent dividend of 21.7 pence per share reflects stability amidst these shifts, suggesting potential for future growth opportunities within their sector.

Take a closer look at Genus' potential here in our valuation report.

Examine Genus' past performance report to understand how it has performed in the past.

Next Steps

Reveal the 26 hidden gems among our Undervalued UK Small Caps With Insider Buying screener with a single click here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:DOM LSE:GENL and LSE:GNS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]