3 US Growth Companies With High Insider Ownership Growing Earnings Up To 68%

As U.S. markets navigate a rollercoaster of volatility, with major indices experiencing both significant gains and losses, investors are increasingly seeking stable opportunities amidst the turbulence. One promising strategy is to focus on growth companies with high insider ownership, as this often indicates strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.6% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.7% |

GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.1% |

Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 31.2% |

Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.9% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 31.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

Carlyle Group (NasdaqGS:CG) | 29.5% | 22.8% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

BBB Foods (NYSE:TBBB) | 22.9% | 70.7% |

Let's uncover some gems from our specialized screener.

Iovance Biotherapeutics

Simply Wall St Growth Rating: ★★★★★☆

Overview: Iovance Biotherapeutics, Inc. is a commercial-stage biotechnology company focused on developing and commercializing cell therapies for metastatic melanoma and other solid tumor cancers, with a market cap of approximately $3.01 billion.

Operations: Iovance Biotherapeutics generates $32.77 million from innovating, developing, and commercializing therapies using autologous tumor infiltrating lymphocytes for the treatment of metastatic melanoma and other solid tumor cancers in the United States.

Insider Ownership: 9.6%

Earnings Growth Forecast: 68% p.a.

Iovance Biotherapeutics, a growth company with significant insider ownership, reported US$31.11 million in Q2 2024 revenue, a substantial increase from US$0.238 million the previous year. Despite a net loss of US$97.1 million, this marks an improvement from the prior year's loss of US$106.53 million. The company's revenue is forecast to grow at 45.5% annually, outpacing market expectations and positioning it for profitability within three years amidst high volatility and recent index reclassifications favoring growth indices over value ones.

AppLovin

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation develops a software-based platform to help advertisers improve marketing and monetization of their content globally, with a market cap of $25.86 billion.

Operations: AppLovin's revenue segments include $1.49 billion from Apps and $2.47 billion from its Software Platform.

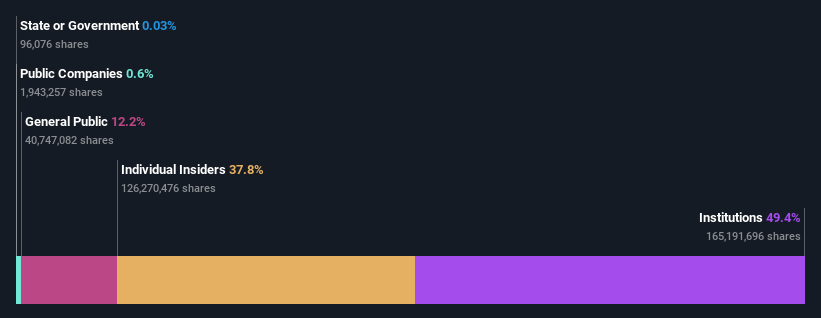

Insider Ownership: 37.8%

Earnings Growth Forecast: 22.6% p.a.

AppLovin's earnings are forecast to grow at 22.6% annually, outpacing the US market's 14.8%. Despite trading at 60.1% below its fair value estimate and having high debt levels, the company reported robust Q2 results with US$1.08 billion in sales and US$309.97 million in net income, significantly improving from last year. Insider activity shows more substantial buying than selling recently, indicating confidence amidst its removal from multiple Russell indices in July 2024.

Navigate through the intricacies of AppLovin with our comprehensive analyst estimates report here.

Our valuation report here indicates AppLovin may be undervalued.

Kanzhun

Simply Wall St Growth Rating: ★★★★☆☆

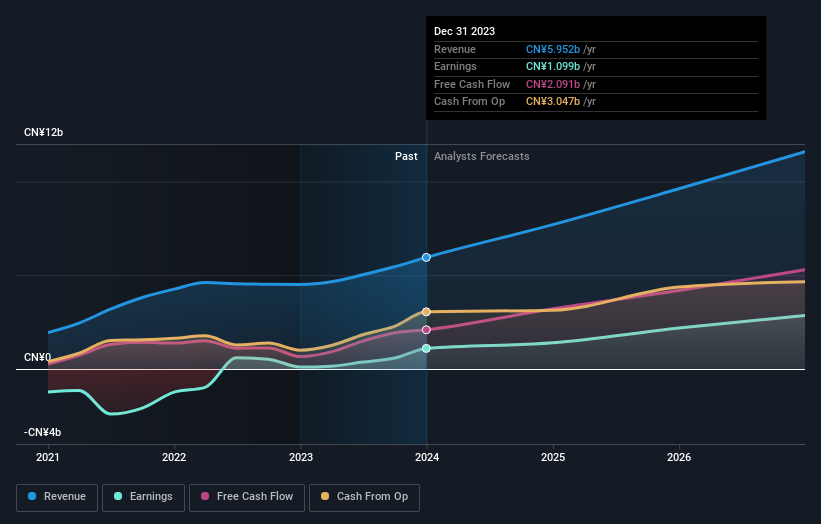

Overview: Kanzhun Limited, with a market cap of $6.14 billion, provides online recruitment services in the People's Republic of China through its subsidiaries.

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to CN¥6.38 billion.

Insider Ownership: 16.3%

Earnings Growth Forecast: 22% p.a.

Kanzhun has demonstrated significant growth, with earnings increasing by over 762% year-on-year and revenue rising to CNY 1.70 billion in Q1 2024. The company forecasts a further revenue increase of up to CNY 1.96 billion for Q2. Insider ownership remains strong, though recent board changes include the resignation of Ms. Shangyu Gao and the appointment of Ms. Mengyuan Dong, an experienced investment expert, enhancing governance and strategic oversight amidst its robust financial performance.

Key Takeaways

Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 172 more companies for you to explore.Click here to unveil our expertly curated list of 175 Fast Growing US Companies With High Insider Ownership.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGM:IOVA NasdaqGS:APP and NasdaqGS:BZ.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]