3 US Growth Companies With High Insider Ownership

As the S&P 500 and Nasdaq Composite experience fluctuations, driven by movements in major tech stocks like Nvidia, investors are closely watching for opportunities that can weather market volatility. In such an environment, growth companies with high insider ownership often stand out as they reflect strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.6% |

Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.7% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.7% |

GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.1% |

Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 32.3% |

Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

On Holding (NYSE:ONON) | 28.4% | 24.4% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 60.9% |

BBB Foods (NYSE:TBBB) | 22.9% | 66.5% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 77% |

We're going to check out a few of the best picks from our screener tool.

Byrna Technologies

Simply Wall St Growth Rating: ★★★★★☆

Overview: Byrna Technologies Inc., with a market cap of $252.14 million, offers non-lethal defense technology solutions for law enforcement and private security.

Operations: Revenue Segments (in millions of $): Byrna Technologies generates $59.65 million from its Aerospace & Defense segment.

Insider Ownership: 20.8%

Revenue Growth Forecast: 21.1% p.a.

Byrna Technologies, with substantial insider ownership, is forecast to grow its revenue at 21.1% per year, significantly outpacing the US market. Recent earnings reports show a strong performance with Q2 sales reaching US$20.27 million and net income of US$2.08 million. The company announced a $10 million share repurchase program and secured a significant order from Buenos Aires for its Byrna SDs, highlighting robust operational momentum and strategic growth initiatives.

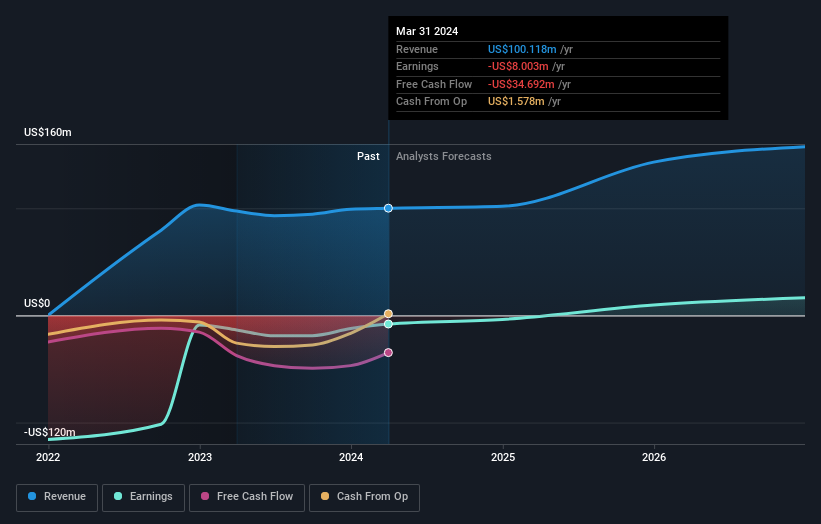

Pagaya Technologies

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pagaya Technologies Ltd. is a technology company that uses data science and AI-powered technology to serve financial institutions and investors globally, with a market cap of $937.19 million.

Operations: Pagaya Technologies generates revenue of $925.42 million from its Software & Programming segment.

Insider Ownership: 19.7%

Revenue Growth Forecast: 15.1% p.a.

Pagaya Technologies, with significant insider ownership, is forecast to achieve profitability within three years and expects revenue growth of 15.1% annually, outpacing the US market's average. Despite a net loss of US$74.79 million in Q2 2024, the company reported a revenue increase to US$250.34 million from US$195.61 million year-over-year. Recent partnerships with Castlelake and OneMain Financial enhance its funding capacity and broaden credit access through AI-driven lending technology, indicating strategic growth potential despite recent volatility and shareholder dilution concerns.

Arq

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arq, Inc. produces activated carbon products in North America and has a market cap of $255.96 million.

Operations: Revenue from specialty chemicals amounts to $105.08 million.

Insider Ownership: 20.3%

Revenue Growth Forecast: 19.8% p.a.

Arq, Inc., with high insider ownership, is forecast to achieve profitability within three years and expects annual revenue growth of 19.8%, outpacing the US market. Recent earnings showed a reduced net loss of US$1.97 million for Q2 2024, down from US$5.86 million a year ago, indicating improved financial performance. The company has secured significant contracts for its Red River facility and filed a $100 million shelf registration to support future growth initiatives despite recent shareholder dilution concerns.

Key Takeaways

Embark on your investment journey to our 177 Fast Growing US Companies With High Insider Ownership selection here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:BYRN NasdaqCM:PGY and NasdaqGM:ARQ.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]