'FAAMG' is powering the market — and that's not unusual

In recent weeks, the stock market has been all about one story: the dominance of big-cap tech companies.

The FANG stocks — Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Google (GOOGL) — have now been renamed the FAAMG stocks — adding Apple (AAPL) and swapping in Microsoft (MSFT) for Netflix — with investors fixated on whether these stocks’ performance is setting markets up for a crash later. According to data from Goldman Sachs, these five companies have added a combined $600 billion in market cap this year alone.

This is *not* unusual

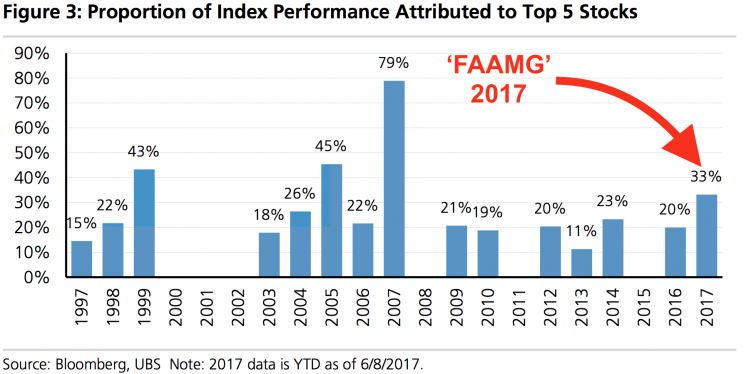

Julian Emanuel, a strategist at UBS, noted through the end of last week, 33% of the S&P 500’s return for this year was attributable to the FAAMG stocks, a proportion exceeded just three times in the past 20 years.

Something that has occurred just a fifth of the time in the last two decades may seem like an aberration.

However, consider the years in which the S&P 500 finished higher and the top 5 performers accounted for less than 20% of the gains. It’s just as infrequent.

Or as Emanuel wrote in looking at how unusual it is for gains to be this concentrated among a few stocks, “Not very.”

“Since 1993, there have been four years of comparable return ‘clustering’ in positive S&P 500 years – 1993, 1999, 2005 and 2007,” Emanuel writes.

“What is notable is that of the four previous years, MSFT (1999, 2007) and AAPL (2005, 2007) appear twice, and in 2000, MSFT declined 62.8% while in 2008 MSFT was -45.4% and AAPL was -56.9%; such declines now appear as blips on a long term chart.”

And so it isn’t just that clustering of returns among a few stocks isn’t rare, but that the stocks doing the clustering are not even new stocks. To invert the old market adage, this time is not different.

As for what could tip investors off to the end of the current bull run, Emanuel says that barring a significant jump in valuations or new money flowing into stocks, a “seminal event” like a major merger or Apple hitting a market cap of $1 trillion (versus about $750 billion today) without cash repatriation could be a sign that enthusiasm for tech stocks has peaked.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: