A blue wave of Democrats come November may be good for economy: Goldman Sachs

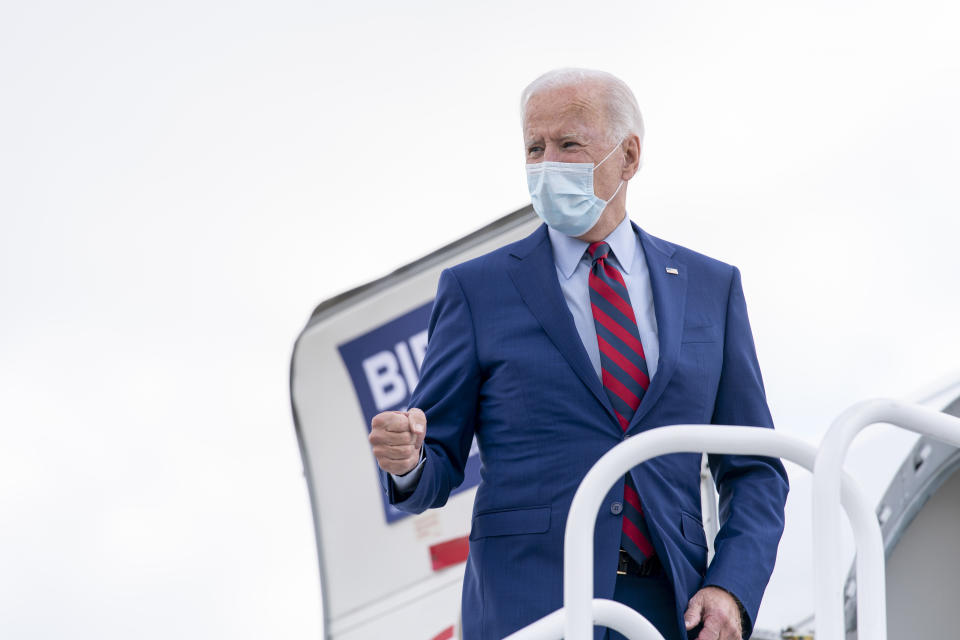

Goldman Sachs thinks a blue wave of Democrats — meaning full control of government via the presidency (Joe Biden), Senate and House — come November could be good for the U.S. economy.

“All else equal, such a blue wave would likely prompt us to upgrade our forecasts. The reason is that it would sharply raise the probability of a fiscal stimulus package of at least $2 trillion shortly after the presidential inauguration on January 20, followed by longer-term spending increases on infrastructure, climate, health care and education that would at least match the likely longer-term tax increases on corporations and upper-income earners,” wrote Goldman Sachs economist Jan Hatzius in a new note to clients on Monday.

Hatzius estimates such a fiscal stimulus package could bump up growth by two to three percentage points in 2021.

Talk of a blue wave happening have ratcheted higher as the fallout from President Trump’s COVID-19 diagnosis rages on. Not helping Trump is a debacle of a first presidential debate with Democratic nominee Joe Biden and an economy continuing to be ravaged by a pandemic the president has frequently downplayed.

A poll from Reuters conducted from Oct. 2-3 — following Trump’s COVID-19 diagnosis — found Biden leading Trump in the presidential race by a commanding 10 percentage points. Biden leads the race to be the next president 53% to 39%, according to a fresh poll of registered voters out Sunday by The Wall Street Journal/NBC News. The poll came right after the contentious first debate between Trump and Biden a week ago, but before the president was diagnosed with COVID-19.

Indeed market goers would likely cheer a stimulus quickly passed by a Democratic controlled Congress early on in 2021.

“Clearly the market seems to be focused on the potential for a fiscal stimulus, it’s definitely needed for sustaining the spending power of consumers,” said Charles Schwab Investment Management CIO of Passive Equity and Multi-Asset Strategies Omar Aguilar on Yahoo Finance’s The First Trade. “What is clear after last week’s labor report is when we see the participation rate continue to slow down and income continues to go down, the need for fiscal stimulus is right there.”

That said, Goldman’s Hatzius’ blue wave theory on the economic outlook somewhat sits counter to his colleague’s view on how stocks may react longer term.

Goldman Sachs’ equities strategist David Kostin has projected that Biden’s tax plan would lead it to reduce its 2021 earnings estimate by 12%. Biden has proposed lifting the corporate tax rate to 28% from 21%, which is currently under Trump.

“For many clients, the most important equity market implication is the potential for higher corporate tax rates,” Kostin wrote back in a June report.

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

What’s hot this week from Sozzi:

Watch Yahoo Finance’s live programming on Verizon FIOS channel 604, Apple TV, Amazon Fire TV, Roku, Samsung TV, Pluto TV, and YouTube. Online catch Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, and reddit.